LinkedIn 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 LinkedIn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

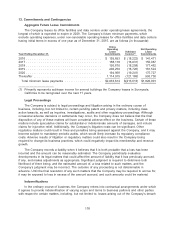

Equity Incentive Plans

The Company has two equity incentive plans: the Amended and Restated 2003 Stock Incentive

Plan (the ‘‘2003 Plan’’) and the 2011 Equity Incentive Plan (the ‘‘2011 Plan’’ and together with the 2003

Plan, the ‘‘Equity Plans’’). As of December 31, 2015, a total of 50,814,756 shares of common stock

were authorized for the issuance of equity awards under the Equity Plans. Upon the Company’s IPO in

2011, the 2003 Plan was terminated and all shares that remained available for future issuance under

the 2003 Plan at the time of its termination were transferred to the 2011 Plan. No further equity awards

can be granted under the 2003 Plan. As of December 31, 2015, 1,146,112 options to purchase

common stock granted under the 2003 Plan remain outstanding. Any of these shares that expire, are

forfeited, are repurchased by the Company or are otherwise terminated will become available under the

2011 Plan. As of December 31, 2015, the total number of shares available for future grants under the

2011 Plan was 2,131,126 shares, including shares transferred from the 2003 Plan.

Under the 2011 Plan, the Company has the ability to issue incentive stock options (‘‘ISOs’’),

nonstatutory stock options (‘‘NSOs’’), stock appreciation rights, restricted stock, RSUs, performance

units and/or performance shares. The ISOs and NSOs will be granted at a price per share not less

than the market value of the underlying stock at date of grant. Option grants are generally NSOs and

granted only to certain employees and members of the Company’s Board. Options granted to existing

employees generally vest monthly over a four-year period, while options granted to new employees

vest over a four-year period with 25% vesting at the end of one year and the remainder vesting

monthly thereafter. Options granted generally are exercisable up to ten years. RSUs generally vest

over a four-year period with 25% vesting at the end of one year and the remainder vesting quarterly

thereafter.

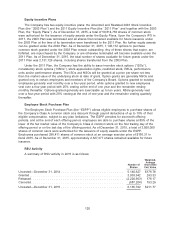

Employee Stock Purchase Plan

The Employee Stock Purchase Plan (the ‘‘ESPP’’) allows eligible employees to purchase shares of

the Company’s Class A common stock at a discount through payroll deductions of up to 10% of their

eligible compensation, subject to any plan limitations. The ESPP provides for six-month offering

periods, and at the end of each offering period, employees are able to purchase shares at 85% of the

lower of the fair market value of the Company’s Class A common stock on the first trading day of the

offering period or on the last day of the offering period. As of December 31, 2015, a total of 3,500,000

shares of common stock were authorized for the issuance of equity awards under the ESPP.

Employees purchased 296,411 shares of common stock at an average exercise price of $166.31 in

fiscal 2015. As of December 31, 2015, approximately 2,327,377 shares remained available for future

issuance.

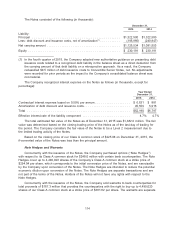

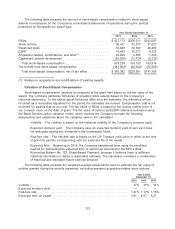

RSU Activity

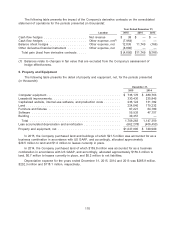

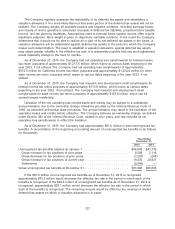

A summary of RSU activity in 2015 is as follows:

Weighted-

Average

Number of Grant Date

Shares Fair Value

Unvested—December 31, 2014 .................................. 5,140,627 $176.78

Granted ................................................... 3,903,942 243.33

Released .................................................. (2,220,663) 176.17

Canceled .................................................. (687,204) 193.29

Unvested—December 31, 2015 .................................. 6,136,702 $211.77

120