Kia 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

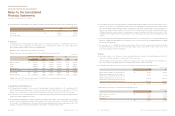

For the years ended December 31, 2013 and 2012

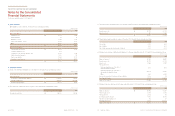

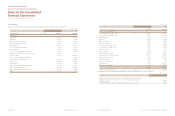

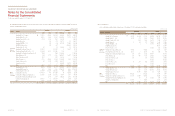

(d) Interest rate risk

Sensitivity analysis of interest expenses and interests income from changes of interests rate for the years ended December 31, 2013

and 2012 are as summarized as follows:

Interest income ₩23,110 (23,110) 19,023 (19,023)

Interest expense 10,762 (10,762) 11,756 (11,756)

(In millions of won)

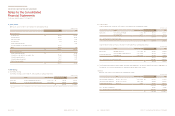

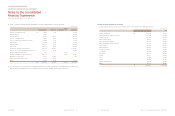

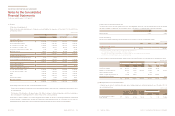

(ii) Aggregate maturities of the Company’s financial liabilities, including estimated interest, as of December 31, 2012 are summarized

as follows:

Accounts and notes payable - trade ₩4,998,445 - - 4,998,445

Accounts and notes payable - other 1,713,988 - - 1,713,988

Accrued expenses 921,097 - - 921,097

Bonds 156,263 1,628,081 - 1,784,344

Borrowings 1,345,932 927,726 343,875 2,617,533

Financial lease liabilities 6,581 17,208 - 23,789

Other current liabilities 3,137 - - 3,137

Other non-current liabilities - 108,446 - 108,446

₩9,145,443 2,681,461 343,875 12,170,779

(In millions of won)

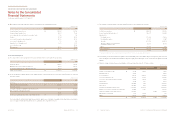

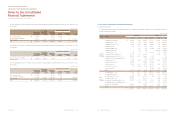

(c) Foreign exchange risk

The Company’s capital and income (loss) would have been increased or decreased, if the foreign exchange rate against USD and EUR

were higher. The Company assumes that interest rate fluctuates 10% at year ended period. Also, the Company assumes that others

variables such as interest rate are not changed by sensitive analysis. The Company analyzed by the same method as used for last period

and details for the effect on income before taxes are summarized as follows:

USD ₩(131,830) 131,830 (154,569) 154,569

EUR 16,016 (16,016) 983 (983)

(In millions of won)

(b) Liquidity risk

(i) Aggregate maturities of the Company’s financial liabilities, including estimated interest, as of December 31, 2013 are summarized as

follows:

Accounts and notes payable - trade ₩5,192,589 - - 5,192,589

Accounts and notes payable - other 1,763,692 - - 1,763,692

Accrued expenses 1,119,919 - - 1,119,919

Bonds 471,904 1,140,048 - 1,611,952

Borrowings 1,265,176 675,399 23,717 1,964,292

Financial lease liabilities 6,567 16,266 - 22,833

Other current liabilities 2,182 - - 2,182

Other non-current liabilities - 86,143 - 86,143

₩9,822,029 1,917,856 23,717 11,763,602

(In millions of won)

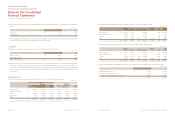

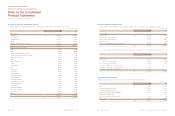

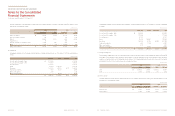

Changes in allowance for doubtful trade accounts and notes receivable and other receivables for the years ended December 31, 2013

and 2012 are summarized as follows:

Balance at January 1 ₩119,395 24,603 126,119 25,315

Collection of written-off amount 146 - 163 7,055

Write-off (18,434) (7,410) (852) (8,052)

Impairment loss 86 - 846 -

Reversal of allowance for doubtful accounts (1,178) (181) (167) (172)

Others 1,018 34 (6,714) 457

Balance at December 31 ₩101,033 17,046 119,395 24,603

(In millions of won)