Kia 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(u) Revenue

Revenue from sale of goods or the use by others of the Company assets is measured at the fair value of the consideration received or

receivable, net of trade discounts, volume rebates and cash incentives to the customers.

Revenue from sales of vehicles, service parts and other related products is recognized when the Company has transferred to the buyer

the significant risk and rewards of ownership of the goods, the Company retains neither continuing managerial involvement to the

degree usually associated with ownership nor effective control over the goods sold, the amount of revenue can be measured reliably,

it is probable that the economic benefits associated with the transaction will flow to the Company and the costs incurred or to be

incurred in respect of the transaction can be measured reliably.

The Company accounts for sales of goods and services under Q Point Program as transactions multiple revenue generation activities

or deliverables. The fair value of the consideration received or receivable in respect of the initial sale is allocated between the award

credits (“Q Points”) and the other components of the sale. The amount allocated to the Q Points is estimated by reference to the fair

value of the points for which they could be sold separately. Such amount is deferred and revenue is recognized only when the Q Points

are redeemed and the Company has fulfilled its obligations rather than the initial point of sales of goods and services.

Rental income from investment property is recognized in profit or loss on straight-line basis over the term of the lease.

(v) Finance income and finance costs

Finance income comprises interest income on funds invested (including available-for-sale financial assets), dividend income except for

dividend from investment in associates, gains on the disposal of available-for-sale financial assets, changes in the fair value of financial

assets at fair value through profit or loss, and gains on hedging instruments that are recognized in profit or loss. Interest income is

recognized as it accrues in profit or loss, using the effective interest method. Dividend income is recognized in profit or loss on the date

that the Company’s right to receive payment is established, which in the case of quoted securities is the ex-dividend date.

Finance costs comprise interest expense on borrowings, unwinding of the discount on provisions and losses on hedging instruments

that are recognized in profit or loss. Interest expense of borrowings is recognized as it accrues in profit or loss, using the effective

interest method.

(w) Income taxes

Income tax expense comprises current and deferred tax. Current tax and deferred tax are recognized in profit or loss except to the

extent that it relates to a business combination, or items recognized directly in equity or in other comprehensive income.

CURRENT TAX

Current tax is the expected tax payable or receivable on the taxable profit or loss for the year, using tax rates enacted

or substantively enacted at the end of the reporting period and any adjustment to tax payable in respect of previous years. The taxable

profit is different from the accounting profit for the period since the taxable profit is calculated excluding the temporary differences,

which will be taxable or deductible in determining taxable profit (tax loss) of future periods, and non-taxable or non-deductible items

from the accounting profit.

DEFERRED TAX

Deferred tax is recognized, using the asset-liability method, in respect of temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. A deferred tax liability

is recognized for all taxable temporary differences. A deferred tax asset is recognized for all deductible temporary differences to the

extent that it is probable that taxable profit will be available against which they can be utilized. However, deferred tax is not recognized

for the following temporary differences: taxable temporary differences arising on the initial recognition of goodwill, or the initial

recognition of assets or liabilities in a transaction that is not a business combination and that affects neither accounting profit or loss

nor taxable income.

In addition, employees of KMA are eligible to participate, upon meeting certain service requirement, in the profit sharing retirement plan

and defined benefit pension plan under the Internal Revenue Code 401(k) in the United States. KMA and employees of KMA paid each

contributions during the period in which the employees render the related service.

(r) Provisions

Provisions are recognized when the Company has a present legal or constructive obligation as a result of a past event, it is probable

that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made

of the amount of the obligation.

The risks and uncertainties that inevitably surround many events and circumstances are taken into account in reaching the best

estimate of a provision. Where the effect of the time value of money is material, provisions are determined at the present value of the

expected future cash flows.

Where some or all of the expenditures required to settle a provision are expected to be reimbursed by another party, the reimbursement

shall be recognized when, and only when, it is virtually certain that reimbursement will be received if the entity settles the obligation.

The reimbursement is treated as a separate asset.

Provisions are reviewed at the end of each reporting period and adjusted to reflect the current best estimates. If it is no longer probable

that an outflow of resources embodying economic benefits will be required to settle the obligation, the provision is reversed.

A provision for warranties is recognized when the underlying products or services are sold. The provision is based on historical

warranty data and a weighting of all possible outcomes against their associated probabilities.

A provision shall be used only for expenditures for which the provision was originally recognized.

(s) Foreign currency

Transactions in foreign currencies are translated to the respective functional currencies of the Company entities at exchange rates

at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies are retranslated to the functional

currency using the reporting date’s exchange rate. Non-monetary assets and liabilities denominated in foreign currencies that are

measured at fair value are retranslated to the functional currency at the exchange rate at the date that the fair value was determined.

Non-monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rate at the

date of the transaction.

Foreign currency differences arising on retranslation are recognized in profit or loss, except for differences arising on a financial liability

designated as a hedge of the net investment in a foreign operation, or qualifying cash flow hedges, which are recognized in other

comprehensive income. Also, foreign currency differences arising on settlement of Monetary assets and liabilities are recognized in

profit or loss.

The assets and liabilities of foreign operations are translated to presentation currency at exchange rates at the reporting date. The

income and expenses of foreign operations are translated to presentation currency at exchange rates at the dates of the transactions.

Foreign currency differences are recognized in other comprehensive income.

(t) Equity capital

Ordinary shares are classified as equity. Incremental costs directly attributable to the issuance of ordinary shares and share options are

recognized as a deduction from equity, net of any tax effects.

When the Company repurchases its share capital, the amount of the consideration paid is recognized as a deduction from equity

and classified as treasury shares. The profits or losses from the purchase, disposal, reissue, or retirement of treasury shares are not

recognized as current profit or loss. If the Company acquires and retains treasury shares, the consideration paid or received is directly

recognized in equity.

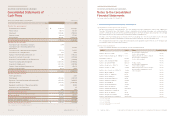

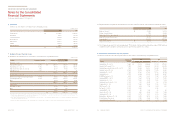

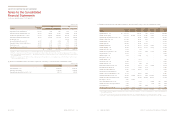

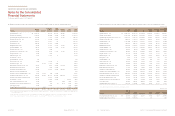

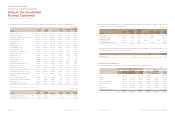

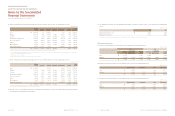

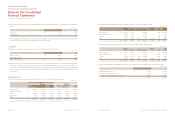

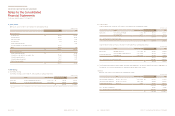

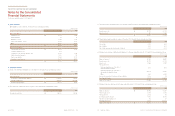

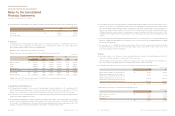

For the years ended December 31, 2013 and 2012