Kia 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

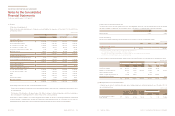

For the years ended December 31, 2013 and 2012

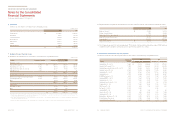

13.

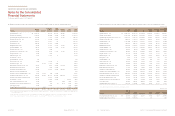

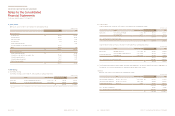

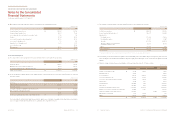

Other Assets

Other assets as of December 31, 2013 and 2012 are summarized as follows:

Other current assets:

Accrued income ₩73,758 100,636

Prepaid expenses 71,580 56,367

Deposits provided 2,163 6,275

Short-term loans 357 43,311

Held-to-maturity investments - 1,706

Short-term available-for-sale financial assets 8,000 -

Other 14,518 162

₩170,376 208,457

Other non-current assets:

Held-to-maturity investments ₩- 17,049

Long-term accounts and notes receivable - other 77,588 105,887

Long-term prepaid expenses 1,601 2,657

Long-term advanced payments 7,822 2,371

Finance lease receivables 15,566 -

₩102,577 127,964

(In millions of won)

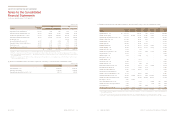

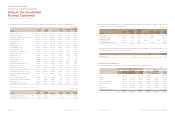

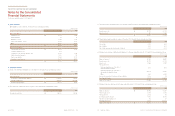

14.

Borrowings

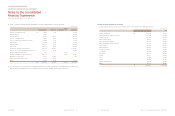

(a) Short-term borrowings

Short-term borrowings as of December 31, 2013 and 2012 are summarized as follows:

Usance bills Korea Exchange Bank and others 0.44~1.11% ₩133,941 166,900

Trade bills(*) Korea Development Bank and others 0.41~2.85% 742,435 942,925

₩876,376 1,109,825

(In millions of won)

(*) The Company did not derecognize outstanding trade accounts and notes receivable transferred to the financial institutions and recognized the transaction as borrowings from financial

institution.

(b) Long-term debt

Long-term debt in local currency as of December 31, 2013 and 2012 are summarized as follows:

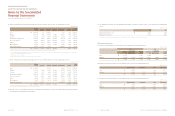

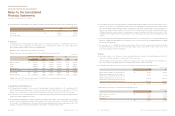

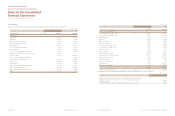

(d) Bonds

Bonds as of December 31, 2013 and 2012 are summarized as follows:

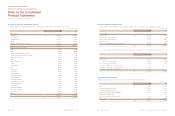

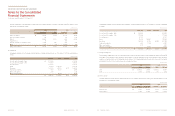

(c) The Company has pledged its land, buildings, machinery and equipments in the amount of ₩ 425,982 million in aggregate as of

December 31, 2013 as assessed by lenders as collateral for long-term debt in local currency.

Facility loans Korea Development Bank 4.09% ₩130,000 130,000

Nong Hyup Bank 4.23% 70,000 70,000

200,000 200,000

Less : current portion of long-term borrowing - -

₩200,000 200,000

(In millions of won)

Unsecured public debentures 2014.9.1~2017.11.24 4.02~6.80% ₩510,000 610,000

Unsecured foreign debentures 2014.2.25~2016.2.25 1.84~2.14% 474,885 481,995

Foreign public debentures 2016.6.14 3.63% 527,650 535,550

1,512,535 1,627,545

Less : discounts on debentures (4,351) (6,838)

Less : current portion of long-term borrowing (426,406) (99,896)

₩1,081,778 1,520,811

(In millions of won)

General loans ING Bank and others 0.93~2.75% ₩270,830 369,884

Facility loans and others Deutsche Bank Slovakia and others 0.54~3.57% 270,293 357,260

Citi Bank Korea 2.28~2.29% 196,087 196,532

737,210 923,676

Less : current portion of long-term borrowing (332,242) (189,516)

₩404,968 734,160

(In millions of won)

Long-term debt in foreign currency as of December 31, 2013 and 2012 are summarized as follows: