Kia 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For the years ended December 31, 2013 and 2012

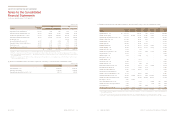

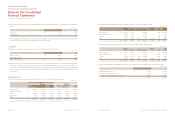

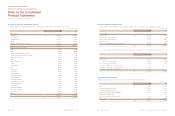

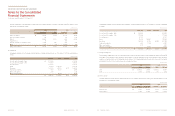

(b) Other expense for the years ended December 31, 2013 and 2012 are summarized as follows:

Foreign exchange transaction loss ₩208,381 203,764

Foreign exchange translation loss 18,491 17,666

Loss on disposal of accounts and notes receivable - trade 1,142 769

Donation 27,138 22,092

Loss on sale of property, plant and equipment 49,100 34,196

Loss on sale of intangible assets 110 303

Impairment loss of intangible assets 2,672 2,910

Loss on inventory scrap - 23,568

Other expenses 54,096 75,996

₩361,130 381,264

(In millions of won)

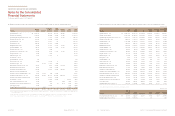

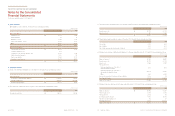

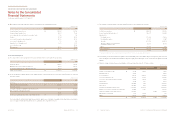

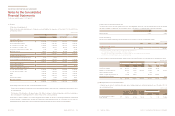

(c) Reconciliation of effective tax rate for the years ended December 31, 2013 and 2012 are as follows:

Profit before income taxes ₩4,828,576 5,164,056

Income tax using statutory tax rates (*) 1,356,277 1,208,553

Adjustment for:

Non-taxable income (170,302) (70,899)

Non-deductible expense 131,371 55,487

Tax credits (401,376) (248,451)

Tax effect for gains/losses on investment

in subsidiaries and associates 204,000 346,312

Others (78,453) 8,350

Income tax expenses ₩1,011,517 1,299,352

Effective tax rate 20.95% 25.16%

(In millions of won)

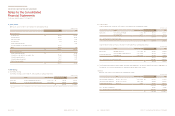

(b) Income tax benefit recognized directly in other equity and other comprehensive income for the years ended December 31, 2013 and

2012 are as follows:

Income tax related to defined benefit plan remeasurements, gains/losses on valuation of available-for-sale financial assets and gains/

losses on valuation of derivative instruments were recognized in other comprehensive income.

Current tax:

Defined benefit plan remeasurements ₩(23,715) 49,746

Deferred income tax:

Loss (gain) on valuation of available-for-sale financial assets 45,782 (40,560)

Gain on valuation of derivative instruments - (1,770)

45,782 (42,330)

Income tax recognized directly in other comprehensive income ₩22,067 7,416

(In millions of won)

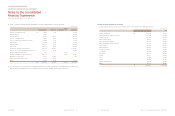

26.

Income Tax Expense

(a) The component of income tax expense for the years ended December 31, 2013 and 2012 are as follows:

Current tax expense ₩932,809 997,765

Origination and reversal of temporary differences 56,641 294,171

Income tax recognized in other comprehensive income 22,067 7,416

Total income tax expense ₩1,011,517 1,299,352

(In millions of won)

(*) Calculated by multiplying each nation’s statutory tax rate of nations and profit before income taxes on each separate financial statements.

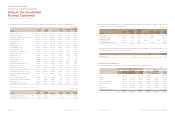

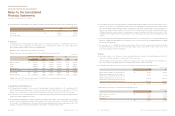

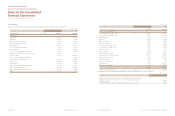

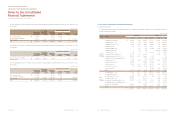

(d) The Company set off a deferred tax asset against a deferred tax liability of the same taxable entity if, and only if, they relate to income

taxes levied by the same taxation authority and the entity has a legally enforceable right to set off current tax assets against current tax

liabilities.

(e) Details of changes in deferred tax assets and liabilities for the year ended December 31, 2013 are as follows:

Allowance for doubtful accounts ₩20,185 (2,839) - 17,346

Bad debts write-off 59,880 - - 59,880

Accrued expenses 245,193 (24,712) - 220,481

Provision of warranty for sale 321,770 47,215 - 368,985

Provision of other long-term employee benefits 53,842 (2,474) - 51,368

Annual leaves 22,786 3,171 - 25,957

Revaluated land (366,868) 7,537 - (359,331)

Depreciation (271,842) 8,099 - (263,743)

Investment in subsidiaries and associates (1,196,352) (204,000) - (1,400,352)

Gains/Losses on sales of investment assets and others (76,843) 19,671 - (57,172)

Valuation of available-for-sale financial assets (176,741) - 45,782 (130,959)

Operating loss carryforward 2,390 (2,138) - 252

Others 106,059 48,047 - 154,106

₩(1,256,541) (102,423) 45,782 (1,313,182)

(In millions of won)