Honda 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

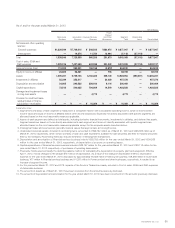

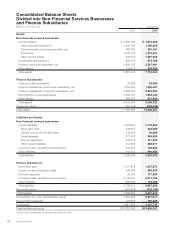

Consolidated Statements of Cash Flows

Divided into Non-Financial Services Businesses

and Finance Subsidiaries

Years ended March 31, 2012 and 2013 Yen (millions)

2012 2013

Non-financial

services

businesses

Finance

subsidiaries

Reconciling

Items Consolidated

Non-financial

services

businesses

Finance

subsidiaries

Reconciling

Items Consolidated

Cash flows from operating activities:

Net Income ¥ 109,016 ¥ 113,058 ¥ — ¥ 222,074 ¥ 295,590 ¥ 97,048 ¥ — ¥ 392,638

Adjustments to reconcile net income to

net cash provided by operating activities:

Depreciation 343,542 211,325 —554,867 334,303 256,166 —590,469

Deferred income taxes (20,191) 69,852 —49,661 32,022 21,230 —53,252

Equity in income of affiliates (100,406) — — (100,406) (82,723) — — (82,723)

Dividends from affiliates 95,106 — — 95,106 84,705 — — 84,705

Damaged and impairment loss on

long-lived assets 10,590 1,514 —12,104 —4,773 —4,773

Loss (gain) on derivative instruments, net

12,140 (13,987) —(1,847) 28,426 6,601 —35,027

Decrease (increase) in trade accounts

and notes receivable (34,607) (2,516) 1,648 (35,475) (3,881) (87,972) 1,358 (90,495)

Decrease (increase) in inventories (154,222) — — (154,222) (74,662) — — (74,662)

Increase (decrease) in trade accounts

and notes payable 240,003 —2,811 242,814 (92,277) —(2,915) (95,192)

Other, net (83,705) (14,627) (24,806) (123,138) 16,791 (43,499) 9,660 (17,048)

Net cash provided by (used in)

operating activities

417,266 364,619 (20,347) 761,538 538,294 254,347 8,103 800,744

Cash flows from investing activities:

Decrease (increase) in investments

and advances* 32,166 (9,305) (10,133) 12,728 14,836 (670) (21,218) (7,052)

Proceeds from sales of investments

in affiliates 9,957 — — 9,957 — — — —

Capital expenditures (394,490) (2,728) —(397,218) (625,128) (1,751) —(626,879)

Proceeds from sales of property,

plant and equipment 23,091 169 —23,260 44,039 143 —44,182

Proceeds from insurance recoveries for

damage property, plant and equipment 16,217 — — 16,217 9,600 — — 9,600

Collections (acquisitions) of finance

subsidiaries-receivables —(16,014) (3,502) (19,516) —(118,006) (127) (118,133)

Purchase of operating lease assets

—(683,767) —(683,767) —(793,118) —(793,118)

Proceeds from sales of operating

lease assets —365,270 —365,270 —418,086 —418,086

Other, net — — — — 3,558 — — 3,558

Net cash provided by (used in)

investing activities (313,059) (346,375) (13,635) (673,069) (553,095) (495,316) (21,345) (1,069,756)

Cash flows from financing activities:

Proceeds from (repayment of)

short-term debt, net*

38,622 (162,515) 19,297 (104,596) 65,845 72,307 15,587 153,739

Proceeds from long-term debt* 100,865 1,058,570 (7,464) 1,151,971 82,281 1,025,408 (6,220) 1,101,469

Repayment of long-term debt* (72,207) (917,530) 22,149 (967,588) (117,784) (856,793) 3,875 (970,702)

Dividends paid (108,138) — — (108,138) (129,765) — — (129,765)

Dividends paid to noncontrolling

interests (15,763) — — (15,763) (6,250) — — (6,250)

Sales (purchases) of treasury stock, net (7) — — (7) (7) — — (7)

Other, net (24,109) — — (24,109) (28,917) — — (28,917)

Net cash provided by (used in)

financing activities (80,737) (21,475) 33,982 (68,230) (134,597) 240,922 13,242 119,567

Effect of exchange rate changes on

cash and cash equivalents (51,647) (503) —(52,150) 105,242 3,218 —108,460

Net change in cash and cash equivalents

(28,177) (3,734) —(31,911) (44,156) 3,171 —(40,985)

Cash and cash equivalents at

beginning of period 1,252,362 26,662 —1,279,024 1,224,185 22,928 —1,247,113

Cash and cash equivalents at

end of period ¥1,224,185 ¥ 22,928 ¥ — ¥1,247,113 ¥1,180,029 ¥ 26,099 ¥ — ¥ 1,206,128

Notes: 1. Non-financial services businesses lend to finance subsidiaries. These cash flows are included in the decrease (increase) in investments and advances, increase

(decrease) in short-term debt, proceeds from long-term debt, and repayment of long-term debt (marked by *). The amount of the loans to finance subsidiaries is a

JPY 10,133 million decrease for the fiscal year ended March 31, 2012, and a JPY 21,218 million decrease for the fiscal year ended March 31, 2013, respectively.

2. Decrease (increase) in trade accounts and notes receivable for finance subsidiaries is due to the reclassification of finance subsidiaries-receivables which relate to

sales of inventory in the unaudited consolidated statements of cash flows presented above.

3. Regarding non-financial services businesses, the amounts of depreciation in cash flows from operating activities, and other, net in cash flows from financing

activities for the fiscal year ended March 31, 2012 have been corrected from the amounts previously disclosed.

Honda Motor Co., Ltd. 59