Honda 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

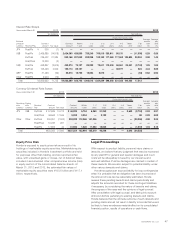

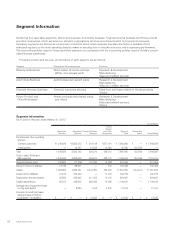

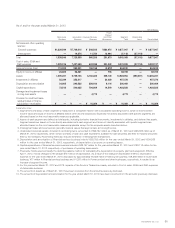

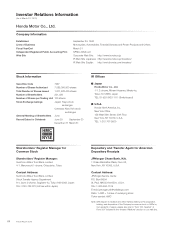

As of and for the year ended March 31, 2013

Yen (millions)

Motorcycle

Business

Automobile

Business

Financial Services

Business

Power

Product

and Other

Businesses

Segment

Total

Reconciling

Items Consolidated

Net sales and other operating

revenue:

External customers ¥1,339,549 ¥7,709,216 ¥ 548,506 ¥280,676 ¥ 9,877,947 ¥ — ¥ 9,877,947

Intersegment —14,374 11,750 10,994 37,118 (37,118) —

Total 1,339,549 7,723,590 560,256 291,670 9,915,065 (37,118) 9,877,947

Cost of sales, SG&A and

R&D expenses 1,229,316 7,437,599 402,098 301,242 9,370,255 (37,118) 9,333,137

Segment income (loss) 110,233 285,991 158,158 (9,572) 544,810 —544,810

Equity in income of affiliates 25,606 56,361 —756 82,723 —82,723

Assets 1,095,357 5,759,126 6,765,322 309,149 13,928,954 (293,597) 13,635,357

Investments in affiliates 85,039 352,317 —20,020 457,376 —457,376

Depreciation and amortization 34,665 290,522 256,166 9,116 590,469 —590,469

Capital expenditures 73,513 540,625 794,869 14,519 1,423,526 —1,423,526

Damaged and impairment losses

on long-lived assets — — 4,773 —4,773 —4,773

Provision for credit and lease

residual losses on finance

subsidiaries—receivables ¥ — ¥ — ¥ 10,059 ¥ — ¥ 10,059 ¥ — ¥ 10,059

Explanatory notes:

1. Segment income (loss) of each segment is measured in a consistent manner with consolidated operating income, which is income before

income taxes and equity in income of affiliates before other income (expenses). Expenses not directly associated with specific segments are

allocated based on the most reasonable measures applicable.

2. Assets of each segment are defined as total assets, including derivative financial instruments, investments in affiliates, and deferred tax assets.

Segment assets are based on those directly associated with each segment and those not directly associated with specific segments are

allocated based on the most reasonable measures applicable except for the corporate assets described below.

3. Intersegment sales and revenues are generally made at values that approximate arm’s-length prices.

4. Unallocated corporate assets, included in reconciling items, amounted to ¥399,732 million as of March 31, 2012 and ¥293,583 million as of

March 31, 2013, respectively, which consist primarily of cash and cash equivalents, available-for-sale securities and held-to-maturity securities

held by the Company. Reconciling items also include elimination of intersegment transactions.

5. Depreciation and amortization of Financial services business include ¥209,762 million for the year ended March 31, 2012 and ¥254,933

million for the year ended March 31, 2013, respectively, of depreciation of property on operating leases.

6. Capital expenditures of Financial services business includes ¥683,767 million for the year ended March 31, 2012 and ¥793,118 million for the

year ended March 31, 2013, respectively, of purchases of operating lease assets.

7. Previously, Honda used principally the declining-balance method for calculating the depreciation of property, plant and equipment. Effective

April 1, 2012, Honda changed to the straight line method of depreciation. As a result of the change in depreciation method, depreciation

expense for the year ended March 31, 2013 decreased by approximately ¥6,358 million in Motorcycle business, ¥48,568 million in Automobile

business, ¥77 million in Financial services business and ¥1,297 million in Power product and other businesses, respectively. It resulted in an

increase of segment income.

8. For the year ended March 31, 2012 and 2013, impacts of the floods in Thailand are mainly included in Cost of sales, SG&A and R&D expenses

of Automobile business.

9. The amounts of Assets as of March 31, 2012 have been corrected from the amounts previously disclosed.

10. The amounts of Depreciation and amortization for the year ended March 31, 2012 have been corrected from the amounts previously disclosed.

Honda Motor Co., Ltd. 55