Honda 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

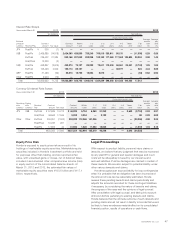

Yen (billions)

For the year ended March 31, 2013 Retail

Direct

financing lease Wholesale Total

Allowance for credit losses

Balance at beginning of year ¥ 20.4 ¥ 1.1 ¥ 1.4 ¥ 23.0

Provision 8.7 0.3 0.0 9.1

Charge-offs (20.8) (0.9) (0.2) (22.0)

Recoveries 8.1 0.1 0.0 8.2

Adjustments from foreign currency translation 1.1 0.0 0.0 1.3

Balance at end of year ¥ 17.6 ¥ 0.7 ¥ 1.2 ¥ 19.7

Ending receivable balance ¥3,865.4 ¥448.6 ¥431.9 ¥4,746.0

Average receivable balance, net ¥3,429.8 ¥394.5 ¥334.1 ¥4,158.4

Net charge-offs as a % of average receivable balance 0.37% 0.21% 0.08% 0.33%

Allowance as a % of ending receivable balance 0.46% 0.18% 0.30% 0.42%

The following table provides information related to losses on operating leases due to customer defaults:

Yen (billions)

Fiscal years ended March 31 2012 2013

Provision for credit losses on past due rental payments ¥1.1 ¥1.1

Impairment losses on operating leases due to early termination ¥1.5 ¥4.7

Fiscal Year 2013 Compared with Fiscal Year 2012

The provision for credit losses on finance receivables

decreased by ¥1.6 billion, or 15%, and net charge-offs

decreased by ¥1.3 billion, or 9%. The decline in net charge-

offs is due mainly to the improved credit quality of our North

American portfolio. Impairment losses on operating leases

due to early termination increased by ¥3.2 billion, or 213%.

The increase was primarily attributable to the increase in the

volume of operating lease assets in North America.

Losses on Lease Residual Values

Our finance subsidiaries in North America establish contract

residual values of lease vehicles at lease inception based on

expectations of future used vehicle values, taking into consid-

eration external industry data. End-customers of leased vehi-

cles typically have an option to buy the leased vehicle for the

contractual residual value of the vehicle or to return the vehi-

cle to our finance subsidiaries through the dealer at the end

of the lease term. Likewise, dealers have the option to buy

the vehicle returned by the customer or to return the vehicle

to our finance subsidiaries. The likelihood that the leased

vehicle will be purchased varies depending on the difference

between the contractual residual value and the actual market

value of the vehicle at the end of the lease term. We are

exposed to risk of loss on the disposition of returned lease

vehicles when the proceeds from the sale of the vehicles are

less than the contractual residual values at the end of the

lease term. For direct financing leases, our finance subsidiar-

ies in North America purchase insurance to cover a portion of

the estimated residual value.

We periodically review the estimate of residual values.

For vehicle leases accounted for as operating leases, the

adjustments to estimated residual values result in changes

to the remaining depreciation expense to be recognized

prospectively on a straight-line basis over the remaining

term of the lease.

For vehicle leases accounted for as direct financing leases,

downward adjustments are made for declines in estimated

residual values that are deemed to be other-than-temporary.

The adjustments on the uninsured portion of the vehicle’s

residual value are recognized as a loss in the period in which

the estimate changed.

The primary components in estimating losses on lease

residual values are the expected frequency of returns, or the

percentage of leased vehicles we expect to be returned by

customers at the end of the lease term, and the expected

loss severity, or the expected difference between the residual

value and the amount we receive through sales of returned

vehicles plus proceeds from insurance, if any. We estimate

losses on lease residual values by evaluating several different

factors, including trends in historical and projected used

vehicle values and general economic measures.

We also test our operating leases for impairment whenever

events or changes in circumstances indicate that their carry-

ing values may not be recoverable.

Recoverability of operating leases to be held is mea-

sured by a comparison of the carrying amount of operating

leases to future net cash flows (undiscounted and without

interest charges) expected to be generated by the operat-

ing leases. If such operating leases are considered to be

Annual Report 201342