Honda 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

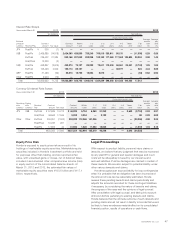

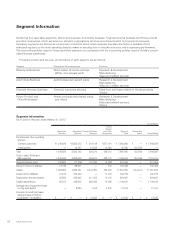

Interest Rate Swaps

Years ended March 31 2012 2013

Yen (millions) Yen (millions)

Average

receive

rate

(%)

Average

pay

rate

(%)

Expected maturity date

Fair

value

Notional

principal

currency Receive/Pay

Contract

amount Fair value

Contract

amount

Within

1 year

1–2

years

2–3

years

3–4

years

4–5

years

There-

after

JP¥ Float/Fix ¥ 300 (7) ¥ — — — — — — — — — —

US$ Float/Fix 2,465,885 (14,818) 2,424,360 426,859 788,240 769,519 359,611 80,131 —(11,508) 0.29 0.86

Fix/Float 736,422 27,384 993,168 207,849 202,208 188,100 117,563 117,563 159,885 30,934 3.08 1.45

Float/Float 12,329 (3) — — — — — — — — — —

CA$ Float/Fix 448,897 (3,679) 493,374 75,137 89,280 73,611 119,434 96,361 39,551 (2,743) 1.29 1.84

Fix/Float 123,446 2,929 120,174 83,197 — — — 36,977 —924 4.44 2.85

GBP Float/Fix 31,456 (59) 32,213 15,750 12,884 3,579 — — — (94) 0.52 0.90

Other Float/Fix 4,904 (12) — — — — — — — — — —

Total ¥3,823,639 11,735 ¥4,063,289 808,792 1,092,612 1,034,809 596,608 331,032 199,436 17,513

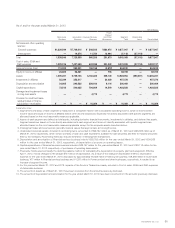

Currency & Interest Rate Swaps

Years ended March 31 2012 2013

Yen (millions) Yen (millions)

Average

receive

rate

(%)

Average

pay

rate

(%)

Expected maturity date

Fair

value

Receiving

side

currency

Paying

side

currency

Receive/

Pay

Contract

amount Fair value

Contract

amount

Within

1 year

1–2

years

2–3

years

3–4

years

4–5

years

There-

after

JP¥ US$ Fix/Float ¥ 57,585 10,773 ¥ 46,029 5,754 6,263 31,369 — — 2,643 (2,704) 0.93 0.97

Float/Float 46,563 17,045 5,383 3,254 —2,129 — — — 88 0.38 0.82

Other Other Fix/Float 309,357 (7,023) 253,922 112,066 141,856 — — — — (20,306) 4.98 2.05

Float/Float 19,033 961 — — — — — — — — — —

Float/Fix 17,555 44 31,920 1,920 17,200 12,800 — — — (1,610) 1.18 3.13

Total ¥450,093 21,800 ¥337,254 122,994 165,319 46,298 — — 2,643 (24,532)

Equity Price Risk

Honda is exposed to equity price risk as a result of its

holdings of marketable equity securities. Marketable equity

securities included in Honda’s investment portfolio are held

for purposes other than trading, and are reported at fair

value, with unrealized gains or losses, net of deferred taxes,

included in accumulated other comprehensive income (loss)

in equity section of the consolidated balance sheets. At

March 31, 2012 and 2013, the estimated fair values of

marketable equity securities were ¥100.8 billion and ¥117.1

billion, respectively.

Legal Proceedings

With respect to product liability, personal injury claims or

lawsuits, we believe that any judgment that may be recovered

by any plaintiff for general and special damages and court

costs will be adequately covered by our insurance and

accrued liabilities. Punitive damages are claimed in certain of

these lawsuits. We are also subject to potential liability under

other various lawsuits and claims.

Honda recognizes an accrued liability for loss contingencies

when it is probable that an obligation has been incurred and

the amount of loss can be reasonably estimated. Honda

reviews these pending lawsuits and claims periodically and

adjusts the amounts recorded for these contingent liabilities,

if necessary, by considering the nature of lawsuits and claims,

the progress of the case and the opinions of legal counsel.

After consultation with legal counsel, and taking into account

all known factors pertaining to existing lawsuits and claims,

Honda believes that the ultimate outcome of such lawsuits and

pending claims should not result in liability to Honda that would

be likely to have an adverse material effect on its consolidated

financial position, results of operations or cash flows.

Honda Motor Co., Ltd. 47