Honda 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.impaired, impairment losses to be recognized is measured

by the amount by which the carrying amount of the operat-

ing leases exceeds the estimated fair value of the operat-

ing leases.

We believe that our estimated losses on lease residual

values and impairment losses is a “critical accounting esti-

mate” because it is highly susceptible to market volatility and

requires us to make assumptions about future economic

trends and lease residual values, which are inherently uncer-

tain. We believe that the assumptions used are appropriate.

However actual losses incurred may differ from original esti-

mates as a result of actual results varying from those

assumed in our estimates.

If future auction values for all Honda and Acura vehicles in

our North American operating lease portfolio as of March 31,

2013, were to decrease by approximately ¥10,000 per unit

from our present estimates, holding all other assumption

constant, the total impact would be an increase in deprecia-

tion expense by approximately ¥3.8 billion, which would be

recognized over the remaining lease terms. Similarly, if future

return rates for our existing portfolio of all Honda and Acura

vehicles were to increase by one percentage point from our

present estimates, the total impact would be an increase in

depreciation expense by approximately ¥0.2 billion, which

would be recognized over the remaining lease terms. With

the same prerequisites shown above, if future auction values

in our North American direct financing lease portfolio were to

decrease by approximately ¥10,000 per unit from our present

estimates, the total impact would be an increase in losses on

lease residual values by approximately ¥0.2 billion. And if

future return rates were to increase by one percentage point

from our present estimates, the total impact would be slight.

Note that this sensitivity analysis may be asymmetric, and are

specific to the base conditions in fiscal 2013. Also, declines

in auction values are likely to have a negative effect on return

rates which could affect the sensitivities.

Fiscal Year 2013 Compared with Fiscal Year 2012

Losses on lease residual values on direct financing leases

declined by ¥0.6 billion, or 47%. Incremental deprecation on

operating leases increased by ¥6.7 billion, due mainly to

declines in used vehicle prices in North America compared

with fiscal year 2012 which showed near historical high.

No impairment losses as a result of declines in estimated

residual values were recognized during fiscal year 2013.

Pension and Other Postretirement Benefits

We have various pension plans covering substantially all of

our employees in Japan and certain employees in foreign

countries. Benefit obligations and pension costs are based

on assumptions of many factors, including the discount rate,

the rate of salary increase and the expected long-term rate of

return on plan assets. The discount rate is determined mainly

based on the rates of high quality corporate bonds currently

available and expected to be available during the period to

maturity of the defined benefit pension plans. The salary

increase assumptions reflect our actual experience as well as

near-term outlook. Honda determines the expected long-term

rate of return based on the investment policies. Honda con-

siders the eligible investment assets under investment poli-

cies, historical experience, expected long-term rate of return

under the investing environment, and the long-term target

allocations of the various asset categories. Our assumed

discount rate and rate of salary increase as of March 31,

2013 were 1.5% and 2.2%, respectively, and our assumed

expected long-term rate of return for the year ended March

31, 2013 was 3.0% for Japanese plans. Our assumed dis-

count rate and rate of salary increase as of March 31, 2013

were 4.5~4.7% and 2.5~4.1%, respectively, and our

assumed expected long-term rate of return for fiscal 2013

was 6.2~7.7% for foreign plans.

We believe that the accounting estimates related to our

pension plans is “critical accounting estimate” because

changes in these estimates can materially affect our financial

condition and results of operations.

Actual results may differ from our assumptions, and the

difference is accumulated and amortized over future periods.

Therefore, the difference generally will be reflected as our

recognized expenses in future periods. We believe that the

assumptions currently used are appropriate, however, differ-

ences in actual expenses or changes in assumptions could

affect our pension costs and obligations, including our cash

requirements to fund such obligations.

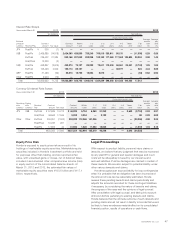

The following table shows the effect of a 0.5% change in

the assumed discount rate and the expected long-term rate

of return on our funded status, equity, and pension expense.

Honda Motor Co., Ltd. 43