Honda 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net cash provided by financing activities amounted to

¥119.5 billion of cash inflows. Cash inflows from financing

activities increased by ¥187.7 billion, compared with the

previous fiscal year, due mainly to an increase in proceeds

from debt, which was partially offset by an increase in

dividends paid.

Liquidity

The ¥1,206.1 billion in cash and cash equivalents at the

end of the fiscal year 2013 corresponds to approximately 1.5

months of net sales, and Honda believes it has sufficient

liquidity for its business operations.

At the same time, Honda is aware of the possibility that

various factors, such as recession-induced market contrac-

tion and financial and foreign exchange market volatility, may

adversely affect liquidity. For this reason, finance subsidiaries

that carry total short-term borrowings of ¥1,397.8 billion have

committed lines of credit equivalent to ¥805.6 billion that

serve as alternative liquidity for the commercial paper issued

regularly to replace debt. Honda believes it currently has

sufficient credit limits, extended by prominent international

banks, as of the date of the filing of Honda’s Form 20-F.

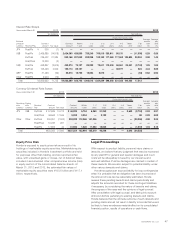

Honda’s short- and long-term debt securities are rated by

credit rating agencies, such as Moody’s Investors Service,

Inc., Standard& Poor’s Rating Services, and Rating and

Investment Information, Inc. The following table shows the

ratings of Honda’s unsecured debt securities by Moody’s,

Standard& Poor’s and Rating and Investment Information as

of March 31, 2013.

Credit ratings for

Short-term

unsecured

debt securities

Long-term

unsecured

debt securities

Moody’s Investors Service P-1 A1

Standard & Poor’s Rating

Services A-1 A+

Rating and Investment

Information a-1+ AA

The above ratings are based on information provided by

Honda and other information deemed credible by the rating

agencies. They are also based on the agencies’ assessment

of credit risk associated with designated securities issued by

Honda. Each rating agency may use different standards for

calculating Honda’s credit rating, and also makes its own

assessment. Ratings can be revised or nullified by agencies

at any time. These ratings are not meant to serve as a rec-

ommendation for trading in or holding Honda’s unsecured

debt securities.

Off-Balance Sheet Arrangements

Guarantee

At March 31, 2013, we guaranteed ¥26.4 billion of employee

bank loans for their housing costs. If an employee defaults on

his/her loan payments, we are required to perform under the

guarantee. The undiscounted maximum amount of our

obligation to make future payments in the event of defaults is

¥26.4 billion. As of March 31, 2013, no amount was accrued

for any estimated losses under the obligations, as it was

probable that the employees would be able to make all

scheduled payments.

Tabular Disclosure of Contractual Obligations

The following table shows our contractual obligations at March 31, 2013:

Yen (millions)

Payments due by period

At March 31, 2013 Total Less than 1 year 1–3 years 3–5 years After 5 years

Long-term debt ¥3,655,891 ¥ 945,046 ¥1,646,877 ¥865,725 ¥198,243

Operating leases 105,050 19,020 24,951 19,854 41,225

Purchase and other commitments*1105,285 69,905 9,919 14,152 11,309

Interest payments*2183,261 75,619 78,426 26,676 2,540

Contributions to defined benefit pension plans*394,944 94,944 — — —

Total ¥4,144,431 ¥1,204,534 ¥1,760,173 ¥926,407 ¥253,317

*1 Honda had commitments for purchases of property, plant and equipment at March 31, 2013.

*2 To estimate the schedule of interest payments, the company utilized the balances and average interest rates of borrowings and debts and derivative instruments as of

March 31, 2013.

*3 Since contributions beyond the next fiscal year are not currently determinable, contributions to defined benefit pension plans reflect only contributions expected for the

next fiscal year.

Honda Motor Co., Ltd. 39