Honda 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In Motorcycle business, we made capital expenditures of

¥73,513 million in the fiscal year ended March 31, 2013. Funds

were allocated to the introduction of new models, as well as

the improvement, streamlining and modernization of produc-

tion facilities, and improvement of sales and R&D facilities.

In Automobile business, we made capital expenditures of

¥505,045 million in the fiscal year ended March 31, 2013.

Funds were allocated to the introduction of new models, as well

as the improvement, streamlining and modernization of produc-

tion facilities, and improvement of sales and R&D facilities.

In Financial services business, capital expenditures

excluding property on operating leases amounted to ¥551

million in the fiscal year ended March 31, 2013, while capital

expenditures for property on operating leases were ¥793,118

million. Capital expenditures in Power products and other

businesses in the fiscal year ended March 31, 2013, totaling

¥14,519 million, were deployed to upgrade, streamline, and

modernize manufacturing facilities for power products, and to

improve R&D facilities for power products.

Plans after Fiscal 2013

During the fiscal year ended March 31, 2013, we modified

our capital expenditure plans which were originally set out in

the prior fiscal year. The modified plans are as follows:

The second auto plant in Rajasthan, India, constructed by

Honda Cars India Limited, which is one of the Company’s con-

solidated subsidiaries, is planned to start operations from 2014.

Managements mainly consider economic trends of each

region, demand trends, situation of competitors and our

business strategy such as introduction plans of new models

in determining the future of projects.

The estimated amounts of capital expenditures for fiscal

year ending March 31, 2014 are shown below.

Yen (millions)

Fiscal year ending March 31, 2014 2014

Motorcycle Business ¥ 64,000

Automobile Business 623,000

Financial Services Business 700

Power Product and Other Businesses 12,300

Total ¥700,000

Note: The estimated amount of capital expenditures for Financial services business

in the above table does not include property on operating leases.

Intangible assets are not included in the table above.

Liquidity and Capital Resources

Overview of Capital Requirements,

Sources and Uses

The policy of Honda is to support its business activities by

maintaining sufficient capital resources, a sufficient level of

liquidity and a sound balance sheet.

Honda’s main business is the manufacturing and sale of

motorcycles, automobiles and power products. To support

this business, it also provides retail financing and automobile

leasing services for customers, as well as wholesale financing

services for dealers.

Honda requires working capital mainly to purchase parts

and raw materials required for production, as well as to

maintain inventory of finished products and cover receiv-

ables from dealers and for providing financial services.

Honda also requires funds for capital expenditures, mainly

to introduce new models, upgrade, rationalize and renew

production facilities, as well as to expand and reinforce

sales and R&D facilities.

Honda meets its working capital requirements primarily

through cash generated by operations, bank loans and the

issuance of commercial paper. Honda believes that its work-

ing capital is sufficient for the Company’s present require-

ments. The year-end balance of liabilities associated with the

Company and its subsidiaries’ funding for non-Financial ser-

vices businesses was ¥540.2 billion as of March 31, 2013. In

addition, the Company’s finance subsidiaries fund financial

programs for customers and dealers primarily from medium-

term notes, bank loans, securitization of finance receivables,

commercial paper, corporate bonds, and intercompany loans.

The year-end balance of liabilities associated with these

finance subsidiaries’ funding for Financial services business

was ¥4,863.5 billion as of March 31, 2013.

Cash Flows

Consolidated cash and cash equivalents on March 31, 2013

decreased by ¥40.9 billion from March 31, 2012, to ¥1,206.1

billion. The reasons for the increases or decreases for each

cash flow activity, when compared with the previous fiscal

year, are as follows:

Net cash provided by operating activities amounted to

¥800.7 billion of cash inflows. Cash inflows from operating

activities increased by ¥39.2 billion compared with the previ-

ous fiscal year due mainly to an increase in cash received due

to increased unit sales in Automobile business, which was

partially offset by increased payments for parts and raw mate-

rials primarily caused by an increase in automobile production.

Net cash used in investing activities amounted to ¥1,069.7

billion of cash outflows. Cash outflows from investing activi-

ties increased by ¥396.6 billion compared with the previous

fiscal year, due mainly to an increase in capital expenditure,

acquisitions of finance subsidiaries-receivables and purchase

of operating lease assets.

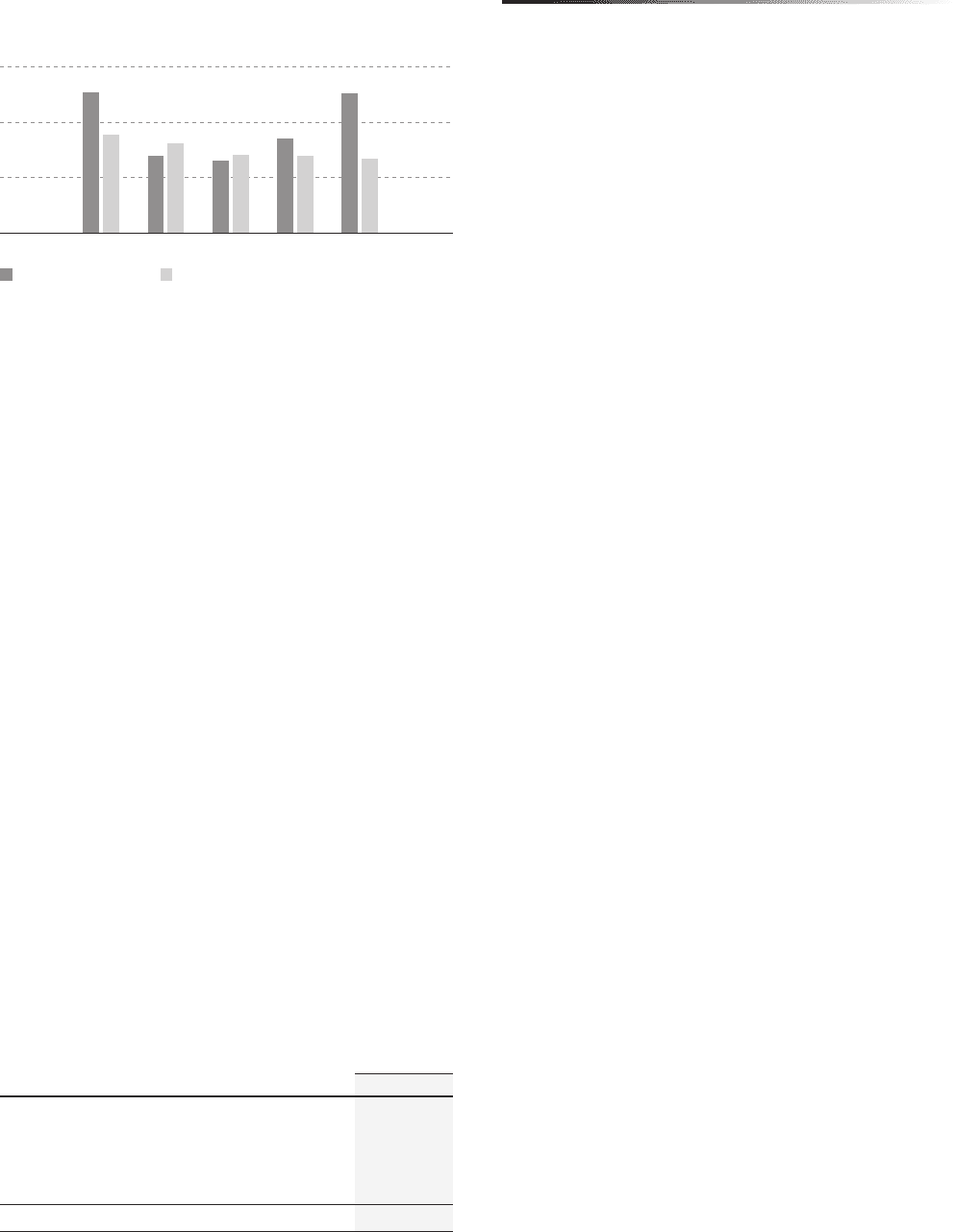

Capital Expenditures and Depreciation

Years ended March 31

Yen (billions)

Capital Expenditures Depreciation

Note: Capital Expenditure and Depreciation aforementioned exclude Capital

Expenditure and Depreciation in operating lease assets and intangible assets.

250

500

750

009 10 11 12 13

Annual Report 201338