Home Depot 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

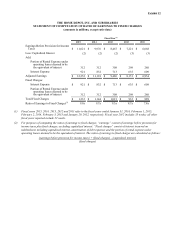

Exhibit 12

THE HOME DEPOT, INC. AND SUBSIDIARIES

STATEMENT OF COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES

(amounts in millions, except ratio data)

Fiscal Year (1)

2015 2014 2013 2012 2011

Earnings Before Provision for Income

Taxes $ 11,021 $ 9,976 $ 8,467 $ 7,221 $ 6,068

Less: Capitalized Interest (2) (2)(2)(3)(3)

Add:

Portion of Rental Expense under

operating leases deemed to be

the equivalent of interest 312 312 308 298 280

Interest Expense 921 832 713 635 609

Adjusted Earnings $ 12,252 $ 11,118 $ 9,486 $ 8,151 $ 6,954

Fixed Charges:

Interest Expense $ 921 $ 832 $ 713 $ 635 $ 609

Portion of Rental Expense under

operating leases deemed to be

the equivalent of interest 312 312 308 298 280

Total Fixed Charges $ 1,233 $ 1,144 $ 1,021 $ 933 $ 889

Ratio of Earnings to Fixed Charges(2) 9.9x 9.7x 9.3x 8.7x 7.8x

(1) Fiscal years 2015, 2014, 2013, 2012 and 2011 refer to the fiscal years ended January 31, 2016, February 1, 2015,

February 2, 2014, February 3, 2013 and January 29, 2012, respectively. Fiscal year 2012 includes 53 weeks; all other

fiscal years reported include 52 weeks.

(2) For purposes of computing the ratios of earnings to fixed charges, “earnings” consist of earnings before provision for

income taxes plus fixed charges, excluding capitalized interest. “Fixed charges” consist of interest incurred on

indebtedness including capitalized interest, amortization of debt expenses and the portion of rental expense under

operating leases deemed to be the equivalent of interest. The ratios of earnings to fixed charges are calculated as follows:

(earnings before provision for income taxes) + (fixed charges) - (capitalized interest)

(fixed charges)