Home Depot 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

18

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Executive Summary and Selected Consolidated Statements of Earnings Data

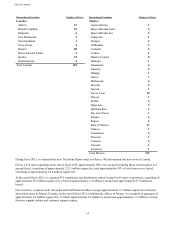

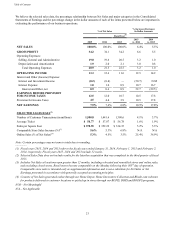

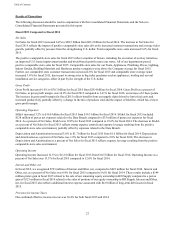

Net Sales increased 6.4% to $88.5 billion for the fiscal year ended January 31, 2016 ("fiscal 2015") from $83.2 billion for the

fiscal year ended February 1, 2015 ("fiscal 2014"). Our total comparable store sales increased 5.6% in fiscal 2015, driven by

a 4.0% increase in our comparable store customer transactions and a 1.6% increase in our comparable store average ticket.

Comparable store sales for our U.S. stores increased 7.1% in fiscal 2015.

For fiscal 2015, we reported Net Earnings of $7.0 billion and Diluted Earnings per Share of $5.46 compared to Net Earnings

of $6.3 billion and Diluted Earnings per Share of $4.71 for fiscal 2014.

The results for fiscal 2015 and 2014 included $128 million and $33 million, respectively, of pretax net expenses related to the

Data Breach that we discovered in the third quarter of fiscal 2014. These charges resulted in decreases of $0.06 and $0.02 to

Diluted Earnings per Share for fiscal 2015 and 2014, respectively.

The results for fiscal 2015 and 2014 also included a $144 million and a $323 million pretax gain, respectively, related to the

sales of our remaining equity ownership in HD Supply Holdings, Inc. ("HD Supply"). These gains contributed $0.07 and

$0.15 to Diluted Earnings per Share for fiscal 2015 and 2014, respectively.

During the first quarter of fiscal 2015, we changed our accounting policy for shipping and handling costs from our stores,

locations or distribution centers to customers and for online fulfillment center costs. Under the new accounting policy, these

costs are included in Cost of Sales, whereas they were previously included in Operating Expenses. The Consolidated

Statements of Earnings for fiscal 2014 and 2013 have been reclassified to reflect this change in accounting policy. The impact

of this reclassification was an increase of $565 million and $475 million to Cost of Sales for fiscal 2014 and 2013,

respectively, and a corresponding decrease to Operating Expenses in the same periods. This reclassification had no impact on

Net Sales, Operating Income, Net Earnings or Earnings per Share.

Data Breach

As previously reported, in the third quarter of fiscal 2014, we confirmed that our payment data systems were breached, which

potentially impacted customers who used payment cards at self-checkout systems in our U.S. and Canadian stores. Since the

breach, we completed a major payment security project that provides enhanced encryption of payment card data at the point

of sale in all of our U.S. and Canadian stores. We have also rolled out EMV chip card technology in our U.S. stores, which

adds extra layers of payment card protection for customers who use EMV enabled chip cards. Our Canadian stores were

already enabled with EMV chip card technology.

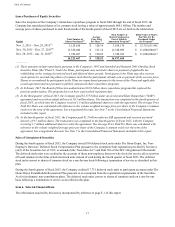

Litigation, Claims and Government Investigations

In the second quarter of fiscal 2015, the payment card networks made claims against us for costs that they assert they or their

issuing banks incurred in connection with the Data Breach, including incremental counterfeit fraud losses and non-ordinary

course operating expenses (such as card reissuance costs), and we recorded an accrual for estimated probable losses we

expected to incur in connection with those claims. In the third and fourth quarters of fiscal 2015, we entered into settlement

agreements with American Express, Discover, MasterCard and Visa with respect to their claims.

In addition, at least 57 putative class actions have been filed in courts in the U.S. and Canada allegedly arising from the Data

Breach. The U.S. class actions have been consolidated for pre-trial proceedings in the United States District Court for the

Northern District of Georgia (the "District Court"). That court ordered that the individual class actions be administratively

closed in favor of the filing of consolidated class action complaints on behalf of customers and financial institutions allegedly

harmed by the Data Breach. In the third quarter of fiscal 2015, we recorded an accrual for estimated probable losses that we

expect to incur in connection with the U.S. customer class actions. In the fourth quarter of fiscal 2015, we agreed in principle

to settlement terms that, upon the approval of the District Court, will resolve and dismiss the claims asserted in the U.S.

customer class actions.

The accruals for estimated probable losses in connection with the payment card networks’ claims and the U.S. customer class

actions are based on currently available information associated with those matters. These estimates may change as new

information becomes available or circumstances change.

Other claims have been and may be asserted against us on behalf of customers, payment card issuing banks, shareholders or

others seeking damages or other related relief allegedly arising from the Data Breach. In the third quarter of fiscal 2015, two

purported shareholder derivative actions were filed in the District Court against certain present and former members of our