Home Depot 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

24

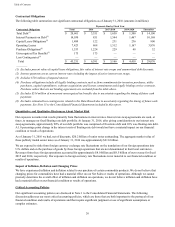

Liquidity and Capital Resources

Cash flow generated from operations provides us with a significant source of liquidity. For fiscal 2015, Net Cash Provided by

Operating Activities was $9.4 billion compared to $8.2 billion for fiscal 2014. This increase was primarily due to a $664

million increase in Net Earnings resulting from higher comparable store sales and expense leverage and a $644 million

increase in cash flows from Accounts Payable and Accrued Expenses related to increased purchases and the timing of

payments, partially offset by a $422 million increase in Merchandise Inventories as a result of increased inventory purchases

in support of increased sales.

Net Cash Used in Investing Activities for fiscal 2015 was $3.0 billion compared to $1.3 billion for fiscal 2014. This change

was primarily due to $1.5 billion more in Payments for Businesses Acquired, net, related to the acquisition of Interline, and

$179 million less in Proceeds from Sales of Investments in fiscal 2015 compared to fiscal 2014. The aggregate purchase price

of Interline was $1.7 billion, of which a portion was used for the repayment of substantially all of Interline’s existing

indebtedness. See Note 3 to the Consolidated Financial Statements included in this report.

Net Cash Used in Financing Activities for fiscal 2015 was $5.8 billion compared to $7.1 billion for fiscal 2014. This change

was primarily the result of $2.0 billion more of net Proceeds from Long-Term Borrowings, partially offset by $501 million

more in Cash Dividends Paid to Stockholders and $230 million less in Proceeds from Short-Term Borrowings, net, in fiscal

2015 compared to fiscal 2014.

In February 2015, our Board of Directors authorized an $18.0 billion share repurchase program that replaced the previous

authorization. In fiscal 2015, we entered into ASR agreements with third-party financial institutions to repurchase $5.2 billion

of our common stock. Under the agreements, we paid $5.2 billion to the financial institutions and received a total of 44

million shares in fiscal 2015. Also in fiscal 2015, we repurchased 15 million additional shares of our common stock for $1.8

billion through the open market. At January 31, 2016, $11.0 billion remained under our share repurchase authorization. See

Note 7 to our Consolidated Financial Statements for further discussion of our ASR agreements.

Subsequent to the end of fiscal 2015, in February 2016 we issued $1.35 billion of 2.00% senior notes due April 1, 2021 (the

"2021 notes") at a discount of $5 million, $1.3 billion of 3.00% senior notes due April 1, 2026 (the "2026 notes") at a

discount of $8 million, and $350 million of 4.25% senior notes due April 1, 2046 (the "2046 notes") at a premium of $2

million (together, the "February 2016 issuance"). The 2046 notes form a single series with our $1.25 billion of 4.25% senior

notes due April 1, 2046 that were issued in May 2015, and have the same terms. The aggregate principal amount outstanding

of our senior notes due April 1, 2046 is $1.6 billion. Interest on the 2021 and 2026 notes is due semi-annually on April 1 and

October 1 of each year, beginning October 1, 2016. Interest on the 2046 notes is due semi-annually on April 1 and October 1

of each year, beginning April 1, 2016, with interest accruing from October 1, 2015.

The net proceeds of the February 2016 issuance were used to repay our 5.40% senior notes due March 1, 2016 (the "2016

notes"). As a result, the 2016 notes are classified as Long-Term Debt in our accompanying Consolidated Balance Sheets. See

Note 6 to our Consolidated Financial Statements included in this report.

In September 2015, we issued $500 million of floating rate senior notes due September 15, 2017 (the "2017 notes") and $1.0

billion of 3.35% senior notes due September 15, 2025 (the "2025 notes") at a discount of $1 million (together, the "September

2015 issuance"). The 2017 notes bear interest at a variable rate determined quarterly equal to the three-month LIBOR rate

plus 37 basis points. Interest on the 2017 notes is due quarterly on March 15, June 15, September 15 and December 15 of

each year, beginning December 15, 2015. Interest on the 2025 notes is due semi-annually on March 15 and September 15 of

each year, beginning March 15, 2016. The net proceeds of the September 2015 issuance were used to fund the acquisition of

Interline.

In May 2015, we issued $1.25 billion of 2.625% senior notes due June 1, 2022 (the "2022 notes") at a discount of $5

million and $1.25 billion of 4.25% senior notes due April 1, 2046 (the "existing 2046 notes") at a discount of $3

million (together, the "May 2015 issuance"). Interest on the 2022 notes is due semi-annually on June 1 and December 1 of

each year, beginning December 1, 2015. Interest on the existing 2046 notes is due semi-annually on April 1 and October 1 of

each year, beginning October 1, 2015. The net proceeds of the May 2015 issuance were used for general corporate purposes,

including repurchases of shares of our common stock.

In June 2014, we issued $1.0 billion of 2.00% senior notes due June 15, 2019 (the "2019 notes") at a discount of $4 million

and $1.0 billion of 4.40% senior notes due March 15, 2045 (the "2045 notes") at a discount of $15 million (together, the

"June 2014 issuance"). Interest on the 2019 notes is due semi-annually on June 15 and December 15 of each year, beginning

December 15, 2014. Interest on the 2045 notes is due semi-annually on March 15 and September 15 of each year, beginning