Home Depot 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

55

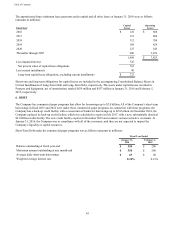

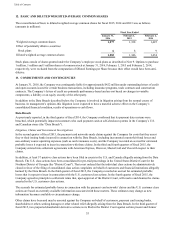

12. BASIC AND DILUTED WEIGHTED AVERAGE COMMON SHARES

The reconciliation of basic to diluted weighted average common shares for fiscal 2015, 2014 and 2013 was as follows

(amounts in millions):

Fiscal Year Ended

January 31,

2016 February 1,

2015 February 2,

2014

Weighted average common shares 1,277 1,338 1,425

Effect of potentially dilutive securities:

Stock plans 68 9

Diluted weighted average common shares 1,283 1,346 1,434

Stock plans consist of shares granted under the Company’s employee stock plans as described in Note 9. Options to purchase

1 million, 1 million and 1 million shares of common stock at January 31, 2016, February 1, 2015 and February 2, 2014,

respectively, were excluded from the computation of Diluted Earnings per Share because their effect would have been anti-

dilutive.

13. COMMITMENTS AND CONTINGENCIES

At January 31, 2016, the Company was contingently liable for approximately $422 million under outstanding letters of credit

and open accounts issued for certain business transactions, including insurance programs, trade contracts and construction

contracts. The Company’s letters of credit are primarily performance-based and are not based on changes in variable

components, a liability or an equity security of the other party.

In addition to the Data Breach described below, the Company is involved in litigation arising from the normal course of

business. In management’s opinion, this litigation is not expected to have a material adverse effect on the Company’s

consolidated financial condition, results of operations or cash flows.

Data Breach

As previously reported, in the third quarter of fiscal 2014, the Company confirmed that its payment data systems were

breached, which potentially impacted customers who used payment cards at self-checkout systems in the Company’s U.S.

and Canadian stores (the "Data Breach").

Litigation, Claims and Government Investigations

In the second quarter of fiscal 2015, the payment card networks made claims against the Company for costs that they assert

they or their issuing banks incurred in connection with the Data Breach, including incremental counterfeit fraud losses and

non-ordinary course operating expenses (such as card reissuance costs), and the Company recorded an accrual for estimated

probable losses it expected to incur in connection with those claims. In the third and fourth quarters of fiscal 2015, the

Company entered into settlement agreements with American Express, Discover, MasterCard and Visa with respect to their

claims.

In addition, at least 57 putative class actions have been filed in courts in the U.S. and Canada allegedly arising from the Data

Breach. The U.S. class actions have been consolidated for pre-trial proceedings in the United States District Court for the

Northern District of Georgia (the "District Court"). That court ordered that the individual class actions be administratively

closed in favor of the filing of consolidated class action complaints on behalf of customers and financial institutions allegedly

harmed by the Data Breach. In the third quarter of fiscal 2015, the Company recorded an accrual for estimated probable

losses that it expects to incur in connection with the U.S. customer class actions. In the fourth quarter of fiscal 2015, the

Company agreed in principle to settlement terms that, upon approval of the District Court, will resolve and dismiss the claims

asserted in the U.S. customer class actions.

The accruals for estimated probable losses in connection with the payment card networks’ claims and the U.S. customer class

actions are based on currently available information associated with those matters. These estimates may change as new

information becomes available or circumstances change.

Other claims have been and may be asserted against the Company on behalf of customers, payment card issuing banks,

shareholders or others seeking damages or other related relief allegedly arising from the Data Breach. In the third quarter of

fiscal 2015, two purported shareholder derivative actions were filed in the District Court against certain present and former