Home Depot 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of Contents

42

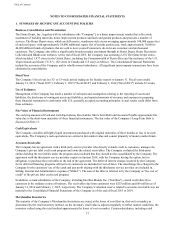

consistent with debt discounts. The recognition and measurement guidance for debt issuance costs are not affected by this

ASU. This guidance is effective for annual reporting periods beginning after December 15, 2015 and for interim and annual

reporting periods thereafter, and retrospective application is required. Early adoption is permitted for financial statements that

have not been previously issued. The Company does not believe that ASU No. 2015-03 will have a material impact on its

Consolidated Financial Statements and related disclosures.

In August 2015, the FASB issued Accounting Standards Update No. 2015-15, "Interest – Imputation of Interest (Subtopic

835-30): Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit

Arrangements" ("ASU No. 2015-15"), which states that ASU No. 2015-03 does not address debt issuance costs for line-of-

credit arrangements, and therefore the SEC staff would not object to an entity deferring and presenting these related debt

issuance costs as an asset and subsequently amortizing the deferred issuance costs ratably over the term of the line-of-credit

arrangement, regardless of whether there are any outstanding borrowings on the line-of-credit arrangement. The Company

does not believe that ASU No. 2015-15 will have a material impact on its Consolidated Financial Statements and related

disclosures.

In November 2015, the FASB issued Accounting Standards Update No. 2015-17, "Income Taxes (Topic 740): Balance Sheet

Classification of Deferred Taxes" ("ASU No. 2015-17"), which requires an entity to present deferred tax assets and liabilities

as noncurrent in a classified balance sheet. This guidance is effective for annual reporting periods beginning after December

15, 2016, and interim periods within those annual periods. Early adoption is permitted as of the beginning of an interim or

annual reporting period. The guidance in this ASU may be applied either prospectively to all deferred tax assets and liabilities

or retrospectively to all periods presented. The Company does not believe that ASU No. 2015-17 will have a material impact

on its Consolidated Financial Statements and related disclosures.

In May 2014, the FASB issued Accounting Standards Update No. 2014-09, "Revenue from Contracts with Customers (Topic

606)" ("ASU No. 2014-09"), which requires an entity to recognize revenue to depict the transfer of promised goods or

services to customers in an amount that reflects the consideration to which it expects to be entitled in exchange for those

goods or services. ASU No. 2014-09 supersedes most existing revenue recognition guidance in U.S. GAAP, and it permits the

use of either the retrospective or cumulative effect transition method. In August 2015, the FASB issued Accounting Standards

Update No. 2015-14, "Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date" ("ASU No.

2015-14"), which delayed the effective date of ASU No. 2014-09 by one year. As a result, ASU No. 2014-09 is effective for

annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. Early

adoption is permitted for annual reporting periods beginning after December 15, 2016, including interim periods within that

reporting period. The Company is evaluating the effect that ASU No. 2014-09 will have on its Consolidated Financial

Statements and related disclosures.

Reclassifications

Certain amounts in prior fiscal years have been reclassified to conform with the presentation adopted in the current fiscal

year. See Note 2 to the Consolidated Financial Statements included in this report.