Home Depot 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of Contents

47

will be amortized over the term of the notes using the effective interest rate method. Issuance costs associated with the

February 2016 issuance were $17 million and will be amortized over the term of the notes.

The net proceeds of the February 2016 issuance were used to repay the Company’s 5.40% senior notes due March 1, 2016

(the "2016 notes"). As a result, the 2016 notes are classified as Long-Term Debt in the accompanying Consolidated Balance

Sheets.

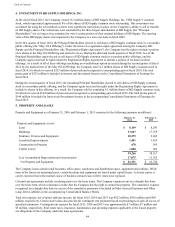

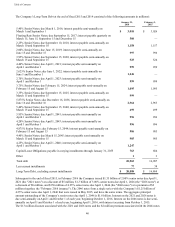

In September 2015, the Company issued $500 million of floating rate senior notes due September 15, 2017 (the "2017 notes")

and $1.0 billion of 3.35% senior notes due September 15, 2025 (the "2025 notes") at a discount of $1 million (together, the

"September 2015 issuance"). The 2017 notes bear interest at a variable rate determined quarterly equal to the three-month

LIBOR rate plus 37 basis points. Interest on the 2017 notes is due quarterly on March 15, June 15, September 15 and

December 15 of each year, beginning December 15, 2015. Interest on the 2025 notes is due semi-annually on March 15 and

September 15 of each year, beginning March 15, 2016. The net proceeds of the September 2015 issuance were used to fund

the Company’s acquisition of Interline. The $1 million discount associated with the 2025 notes is being amortized over the

term of the notes using the effective interest rate method. Issuance costs associated with the September 2015 issuance

were $7 million and are being amortized over the term of the notes.

In May 2015, the Company issued $1.25 billion of 2.625% senior notes due June 1, 2022 (the "2022 notes") at a discount

of $5 million and $1.25 billion of 4.25% senior notes due April 1, 2046 (the "existing 2046 notes") at a discount of $3

million (together, the "May 2015 issuance"). Interest on the 2022 notes is due semi-annually on June 1 and December 1 of

each year, beginning December 1, 2015. Interest on the existing 2046 notes is due semi-annually on April 1 and October 1 of

each year, beginning October 1, 2015. The net proceeds of the May 2015 issuance were used for general corporate purposes,

including repurchases of shares of the Company’s common stock. The $8 million discount associated with the May 2015

issuance is being amortized over the term of the notes using the effective interest rate method. Issuance costs associated with

the May 2015 issuance were $19 million and are being amortized over the term of the notes.

In June 2014, the Company issued $1.0 billion of 2.00% senior notes due June 15, 2019 (the "2019 notes") at a discount of $4

million and $1.0 billion of 4.40% senior notes due March 15, 2045 (the "2045 notes") at a discount of $15 million (together,

the "June 2014 issuance"). Interest on the 2019 notes is due semi-annually on June 15 and December 15 of each year,

beginning December 15, 2014. Interest on the 2045 notes is due semi-annually on March 15 and September 15 of each year,

beginning September 15, 2014. The net proceeds of the June 2014 issuance were used for general corporate purposes,

including repurchases of shares of the Company’s common stock. The $19 million discount associated with the June 2014

issuance is being amortized over the term of the notes using the effective interest rate method. Issuance costs associated with

the June 2014 issuance were approximately $14 million and are being amortized over the term of the notes.

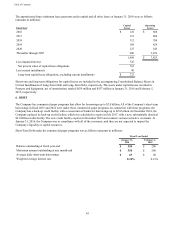

The Company’s senior notes, other than the 2017 notes, may be redeemed by the Company at any time, in whole or in part, at

the redemption price plus accrued interest up to the redemption date. The redemption price is equal to the greater of (1) 100%

of the principal amount of the notes to be redeemed, and (2) the sum of the present values of the remaining scheduled

payments of principal and interest to the Par Call Date, as defined in the respective notes. Additionally, if a Change in Control

Triggering Event occurs, as defined in each of the outstanding notes except for the 2016 notes, holders of all notes other than

the 2016 notes have the right to require the Company to redeem those notes at 101% of the aggregate principal amount of the

notes plus accrued interest up to the redemption date. The Company is generally not limited under the indentures governing

the notes in its ability to incur additional indebtedness or required to maintain financial ratios or specified levels of net worth

or liquidity. Further, while the indentures governing the notes contain various restrictive covenants, none are expected to

impact the Company’s liquidity or capital resources.

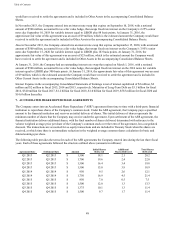

In fiscal 2015, the Company entered into forward starting interest rate swap agreements with a combined notional amount of

$1.0 billion, accounted for as cash flow hedges, to hedge interest rate fluctuations in anticipation of issuing long-term debt to

refinance the 2016 notes. At January 31, 2016, the approximate fair value of these agreements was a liability of $82 million,

which is the estimated amount the Company would have paid to settle the agreements and is included in Other Long-Term

Liabilities in the accompanying Consolidated Balance Sheets. In connection with the February 2016 issuance, the Company

paid $89 million in February 2016 to settle the forward starting interest rate swap agreements it entered into in fiscal 2015.

This amount, net of income taxes, will be included in Accumulated Other Comprehensive Income and will be amortized to

Interest Expense over the lives of the 2026 notes.

At January 31, 2016, the Company had outstanding cross currency swap agreements with a notional amount of $676 million,

accounted for as cash flow hedges, to hedge foreign currency fluctuations on certain intercompany debt. At January 31, 2016,

the approximate fair value of these agreements was an asset of $170 million, which is the estimated amount the Company