Home Depot 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

28

allowances that are reimbursements of specific, incremental and identifiable costs incurred to promote vendors’ products are

recorded as an offset against advertising expense in SG&A.

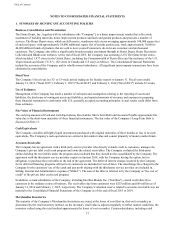

Impairment of Long-Lived Assets

We evaluate our long-lived assets each quarter for indicators of potential impairment. Indicators of impairment include

current period losses combined with a history of losses, management’s decision to relocate or close a store or other location

before the end of its previously estimated useful life or when changes in other circumstances indicate the carrying amount of

an asset may not be recoverable. The evaluation for long-lived assets is performed at the lowest level of identifiable cash

flows, which is generally the individual store level.

The assets of a store with indicators of impairment are evaluated by comparing its undiscounted cash flows with its carrying

value. The estimate of cash flows includes management’s assumptions of cash inflows and outflows directly resulting from

the use of those assets in operations, including gross margin on Net Sales, payroll and related items, occupancy costs,

insurance allocations and other costs to operate a store. If the carrying value is greater than the undiscounted cash flows, an

impairment loss is recognized for the difference between the carrying value and the estimated fair market value. Impairment

losses are recorded as a component of SG&A in the accompanying Consolidated Statements of Earnings. When a leased

location closes, we also recognize in SG&A the net present value of future lease obligations less estimated sublease income.

We make critical assumptions and estimates in completing impairment assessments of long-lived assets. Our cash flow

projections look several years into the future and include assumptions on variables such as future sales and operating margin

growth rates, economic conditions, market competition and inflation. A 10% decrease in the estimated undiscounted cash

flows for the stores with indicators of impairment would not have a material impact on our results of operations. Our

estimates of fair market value are generally based on market appraisals of owned locations and estimates on the amount of

potential sublease income and the time required to sublease for leased locations. A 10% decrease in estimated sublease

income and a 10% increase in the time required to sublease would not have a material impact on our results of operations. We

recorded impairments and lease obligation costs on closings and relocations in the ordinary course of business, which were

not material to the Consolidated Financial Statements in fiscal 2015, 2014 or 2013.

Goodwill and Other Intangible Assets

Goodwill represents the excess of purchase price over the fair value of net assets acquired. We do not amortize goodwill but

do assess the recoverability of goodwill in the third quarter of each fiscal year, or more often if indicators warrant, by

determining whether the fair value of each reporting unit supports its carrying value. Each year we may assess qualitative

factors to determine whether it is more likely than not that the fair value of each reporting unit is less than its carrying amount

as a basis for determining whether it is necessary to complete quantitative impairment assessments, with a quantitative

assessment completed at least once every three years. Our most recent quantitative assessment was completed in fiscal 2013.

In fiscal 2015, we completed our annual assessment of the recoverability of goodwill for our U.S., Canada and Mexico

reporting units. We performed qualitative assessments, concluding that the fair value of our reporting units was not more

likely than not less than the carrying value. There were no impairment charges related to goodwill for fiscal 2015, 2014 or

2013.

We amortize the cost of other intangible assets over their estimated useful lives, which range up to 12 years, unless such lives

are deemed indefinite. Intangible assets with indefinite lives are tested in the third quarter of each fiscal year for impairment,

or more often if indicators warrant. There were no impairment charges related to our other intangible assets for fiscal 2015,

2014 or 2013.

Recent Accounting Pronouncements

For a summary of recently issued accounting pronouncements which may be applicable to us, see Note 1 to the Consolidated

Financial Statements included in this report.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

The information required by this item is incorporated by reference to Item 7, "Management’s Discussion and Analysis of

Financial Condition and Results of Operations" of this report.