Home Depot 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

48

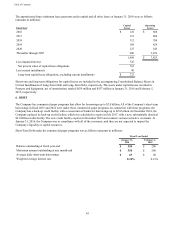

would have received to settle the agreements and is included in Other Assets in the accompanying Consolidated Balance

Sheets.

In November 2013, the Company entered into an interest rate swap that expires on September 10, 2018, with a notional

amount of $500 million, accounted for as a fair value hedge, that swaps fixed rate interest on the Company’s 2.25% senior

notes due September 10, 2018 for variable interest equal to LIBOR plus 88 basis points. At January 31, 2016, the

approximate fair value of this agreement was an asset of $9 million, which is the estimated amount the Company would have

received to settle the agreement and is included in Other Assets in the accompanying Consolidated Balance Sheets.

Also in November 2013, the Company entered into an interest rate swap that expires on September 15, 2020, with a notional

amount of $500 million, accounted for as a fair value hedge, that swaps fixed rate interest on the Company’s 3.95% senior

notes due September 15, 2020 for variable interest equal to LIBOR plus 183 basis points. At January 31, 2016, the

approximate fair value of this agreement was an asset of $25 million, which is the estimated amount the Company would

have received to settle the agreement and is included in Other Assets in the accompanying Consolidated Balance Sheets.

At January 31, 2016, the Company had an outstanding interest rate swap that expired on March 1, 2016, with a notional

amount of $500 million, accounted for as a fair value hedge, that swapped fixed rate interest on the 2016 notes for variable

interest equal to LIBOR plus 300 basis points. At January 31, 2016, the approximate fair value of this agreement was an asset

of $9 million, which is the estimated amount the Company would have received to settle the agreement and is included in

Other Current Assets in the accompanying Consolidated Balance Sheets.

Interest Expense in the accompanying Consolidated Statements of Earnings is net of interest capitalized of $2 million, $2

million and $2 million in fiscal 2015, 2014 and 2013, respectively. Maturities of Long-Term Debt are $3.1 billion for fiscal

2016, $540 million for fiscal 2017, $1.2 billion for fiscal 2018, $1.0 billion for fiscal 2019, $583 million for fiscal 2020 and

$14.6 billion thereafter.

7. ACCELERATED SHARE REPURCHASE AGREEMENTS

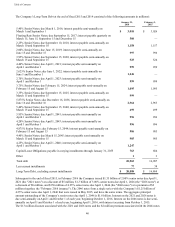

The Company enters into an Accelerated Share Repurchase ("ASR") agreement from time to time with a third-party financial

institution to repurchase shares of the Company’s common stock. Under the ASR agreement, the Company pays a specified

amount to the financial institution and receives an initial delivery of shares. This initial delivery of shares represents the

minimum number of shares that the Company may receive under the agreement. Upon settlement of the ASR agreement, the

financial institution delivers additional shares, with the final number of shares delivered determined with reference to the

volume weighted average price per share of the Company’s common stock over the term of the agreement, less a negotiated

discount. The transactions are accounted for as equity transactions and are included in Treasury Stock when the shares are

received, at which time there is an immediate reduction in the weighted average common shares calculation for basic and

diluted earnings per share.

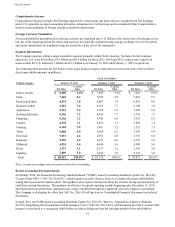

The following table provides the terms for each of the ASR agreements the Company entered into during the last three fiscal

years. Each of these agreements followed the structure outlined above (amounts in millions):

Agreement Date Settlement Date Amount Initial Shares

Delivered Additional

Shares Delivered Total Shares

Delivered

Q1 2013 Q2 2013 $ 1,500 18.1 2.1 20.2

Q2 2013 Q3 2013 $ 1,700 19.6 2.4 22.0

Q3 2013 Q4 2013 $ 1,500 16.4 3.4 19.8

Q4 2013 Q4 2013 $ 1,500 15.0 3.9 18.9

Q1 2014 Q1 2014 $ 950 9.5 2.6 12.1

Q2 2014 Q3 2014 $ 1,750 16.9 4.5 21.4

Q1 2015 Q1 2015 $ 850 7.0 0.5 7.5

Q2 2015 Q3 2015 $ 1,500 12.0 1.3 13.3

Q3 2015 Q4 2015 $ 1,375 10.1 1.3 11.4

Q4 2015 Q4 2015 $ 1,500 9.7 1.7 11.4