Home Depot 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

46

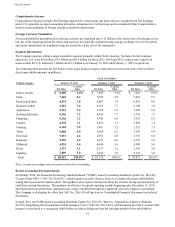

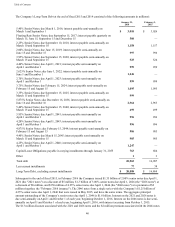

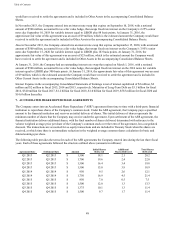

The Company’s Long-Term Debt at the end of fiscal 2015 and 2014 consisted of the following (amounts in millions):

January 31,

2016 February 1,

2015

5.40% Senior Notes; due March 1, 2016; interest payable semi-annually on

March 1 and September 1 $ 3,010 $ 3,026

Floating Rate Senior Notes; due September 15, 2017; interest payable quarterly on

March 15, June 15, September 15 and December 15 500 —

2.25% Senior Notes; due September 10, 2018; interest payable semi-annually on

March 10 and September 10 1,158 1,157

2.00% Senior Notes; due June 15, 2019; interest payable semi-annually on

June 15 and December 15 997 996

3.95% Senior Notes; due September 15, 2020; interest payable semi-annually on

March 15 and September 15 525 524

4.40% Senior Notes; due April 1, 2021; interest payable semi-annually on

April 1 and October 1 999 999

2.625% Senior Notes; due June 1, 2022; interest payable semi-annually on

June 1 and December 1 1,246 —

2.70% Senior Notes; due April 1, 2023; interest payable semi-annually on

April 1 and October 1 999 999

3.75% Senior Notes; due February 15, 2024; interest payable semi-annually on

February 15 and August 15 1,095 1,095

3.35% Senior Notes; due September 15, 2025; interest payable semi-annually on

March 15 and September 15 999 —

5.875% Senior Notes; due December 16, 2036; interest payable semi-annually on

June 16 and December 16 2,964 2,963

5.40% Senior Notes; due September 15, 2040; interest payable semi-annually on

March 15 and September 15 499 499

5.95% Senior Notes; due April 1, 2041; interest payable semi-annually on

April 1 and October 1 996 996

4.20% Senior Notes; due April 1, 2043; interest payable semi-annually on

April 1 and October 1 996 996

4.875% Senior Notes; due February 15, 2044; interest payable semi-annually on

February 15 and August 15 986 985

4.40% Senior Notes; due March 15, 2045; interest payable semi-annually on

March 15 and September 15 985 985

4.25% Senior Notes; due April 1, 2046; interest payable semi-annually on

April 1 and October 1 1,247 —

Capital Lease Obligations; payable in varying installments through January 31, 2055 763 684

Other 13

Total debt 20,965 16,907

Less current installments 77 38

Long-Term Debt, excluding current installments $ 20,888 $ 16,869

Subsequent to the end of fiscal 2015, in February 2016 the Company issued $1.35 billion of 2.00% senior notes due April 1,

2021 (the "2021 notes") at a discount of $5 million, $1.3 billion of 3.00% senior notes due April 1, 2026 (the "2026 notes") at

a discount of $8 million, and $350 million of 4.25% senior notes due April 1, 2046 (the "2046 notes") at a premium of $2

million (together, the "February 2016 issuance"). The 2046 notes form a single series with the Company’s $1.25 billion of

4.25% senior notes due April 1, 2046 that were issued in May 2015, and have the same terms. The aggregate principal

amount outstanding of the Company’s senior notes due April 1, 2046 is $1.6 billion. Interest on the 2021 and 2026 notes is

due semi-annually on April 1 and October 1 of each year, beginning October 1, 2016. Interest on the 2046 notes is due semi-

annually on April 1 and October 1 of each year, beginning April 1, 2016, with interest accruing from October 1, 2015.

The $13 million discount associated with the 2021 and 2026 notes and the $2 million premium associated with the 2046 notes