Home Depot 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of Contents

20

Product Authority – Our product authority initiative is facilitated by our merchandising transformation and portfolio strategy,

which is focused on delivering product innovation, assortment and value. In fiscal 2015, we continued to introduce a wide

range of innovative new products to our do-it-yourself, do-it-for-me and professional customers, while remaining focused on

offering everyday values in our stores and online. We also continued to utilize our merchandising assortment planning and

pricing tools to better understand customer preferences and to refine our product assortment in particular stores or geographic

areas.

Productivity and Efficiency Driven by Capital Allocation – Our approach to driving productivity and efficiency is advanced

through continuous operational improvement in the stores and our supply chain, disciplined capital allocation and building

shareholder value through higher returns on invested capital and total value returned to shareholders in the form of dividends

and share repurchases. One of our principal initiatives in fiscal 2015 has been to further optimize and efficiently operate our

supply chain by beginning initial work on a multi-year program called Project Sync. Through Project Sync, which is being

rolled out gradually to suppliers in several U.S. RDCs, we can significantly reduce our average lead time from supplier to

shelf, reduce transportation expenses and improve inventory turns. As we continue to roll out Project Sync throughout our

supply chain over the next several years, we plan to create an end-to-end solution that benefits all participants in our supply

chain, from our suppliers to our transportation providers to our RDC and store associates to our customers.

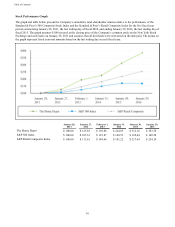

We repurchased a total of 59 million shares of our common stock for $7.0 billion through ASR agreements and the open

market during fiscal 2015. In addition, in February 2016, we announced a 17% increase in our quarterly cash dividend to

$0.69 per share.

In fiscal 2015, we opened four new stores in Mexico and one new store in Canada, for a total store count of 2,274 at the end

of fiscal 2015. As of the end of fiscal 2015, a total of 297 of our stores, or 13.1%, were located in Canada and Mexico.

In August 2015, we completed the acquisition of Interline for $1.7 billion. Interline is a leading national distributor and direct

marketer of broad-line MRO products. We intend to leverage Interline’s capabilities and expertise in MRO products to

expand our share of the MRO product market with our current customers as well as gain new customers currently served by

Interline.

We generated $9.4 billion of cash flow from operations in fiscal 2015. This cash flow, along with $4.0 billion of long-term

debt issued in fiscal 2015, was used to fund $7.0 billion of share repurchases, pay $3.0 billion of dividends, purchase

Interline for $1.7 billion and fund $1.5 billion in capital expenditures.

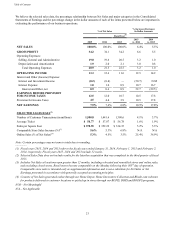

Our inventory turnover ratio was 4.9 times at the end of fiscal 2015 compared to 4.7 times at the end of fiscal 2014. Our

return on invested capital (computed on net operating profit after tax for the trailing twelve months and the average of

beginning and ending long-term debt and equity) was 28.0% for fiscal 2015 compared to 24.9% for fiscal 2014.

Interconnecting Retail – Our focus on interconnecting retail is based on building a competitive and seamless platform across

all commerce channels. In fiscal 2015, we continued the pilot of our new COM platform, which we expect to roll out to all

U.S. stores by the end of fiscal 2016. We opened and began shipping products from our third new DFC located in Troy

Township, Ohio in fiscal 2015. We expect this facility, along with our other two new DFCs in California and Georgia, to

enable us to reach 90% of our U.S. customers in two business days or less with parcel shipping. We also began further

interconnecting our distribution networks. For non-parcel orders originating from our DFCs, we have fully implemented

BOSS via RDC delivery. In fiscal 2015, we began to roll out BODFS, which complements our existing interconnecting retail

programs. We plan to complete the roll out of BODFS by the end of fiscal 2016.

Additionally, we improved our mobile experience, invested in our digital content and made other site improvements to

enhance and simplify the online experience. As a result of these efforts, we increased traffic to our websites, improved our

online sales conversion rates, and saw a larger percentage of orders being picked up in our stores. In fiscal 2015, over 40% of

our online orders were picked up in our stores through our BOPIS and BOSS offerings. Sales from our online channels

increased 25.4% for fiscal 2015 compared to fiscal 2014, and represented 5.3% of our total Net Sales for fiscal 2015.