Home Depot 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

41

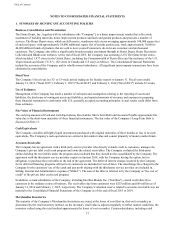

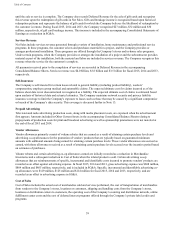

Comprehensive Income

Comprehensive Income includes Net Earnings adjusted for certain gains and losses that are excluded from Net Earnings

under U.S. generally accepted accounting principles. Adjustments to Net Earnings and Accumulated Other Comprehensive

Income consist primarily of foreign currency translation adjustments.

Foreign Currency Translation

Assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the current rate of exchange on the

last day of the reporting period. Revenues and expenses are generally translated using average exchange rates for the period

and equity transactions are translated using the actual rate on the day of the transaction.

Segment Information

The Company operates within a single reportable segment primarily within North America. Net Sales for the Company

outside the U.S. were $8.0 billion, $8.5 billion and $8.5 billion for fiscal 2015, 2014 and 2013, respectively. Long-lived

assets outside the U.S. totaled $2.3 billion and $2.5 billion as of January 31, 2016 and February 1, 2015, respectively.

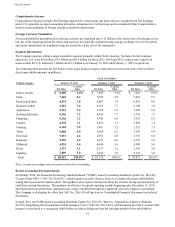

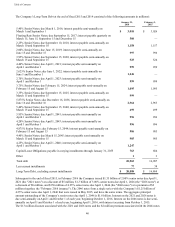

The following table presents the Net Sales of each major product category (and related services) for each of the last three

fiscal years (dollar amounts in millions):

Product Category

Fiscal Year Ended

January 31, 2016 February 1, 2015 February 2, 2014

Net Sales % of Net

Sales Net Sales % of Net

Sales Net Sales % of Net

Sales

Indoor Garden $ 8,298 9.4% $ 7,560 9.1% $ 7,022 8.9%

Paint 7,465 8.4 7,299 8.8 7,018 8.9

Kitchen and Bath 6,874 7.8 6,607 7.9 6,301 8.0

Outdoor Garden 6,565 7.4 6,385 7.7 6,140 7.8

Appliances 6,534 7.4 5,708 6.9 5,382 6.8

Building Materials 6,396 7.2 6,054 7.3 5,728 7.3

Plumbing 6,346 7.2 5,740 6.9 5,435 6.9

Lumber 6,278 7.1 6,050 7.3 5,820 7.4

Flooring 6,194 7.0 5,987 7.2 5,721 7.3

Tools 6,060 6.8 5,388 6.5 5,038 6.4

Electrical 5,833 6.6 5,653 6.8 5,378 6.8

Hardware 5,296 6.0 4,975 6.0 4,718 6.0

Millwork 4,924 5.6 4,694 5.6 4,389 5.6

Décor 2,757 3.1 2,577 3.1 2,343 3.0

Lighting 2,699 3.0 2,499 3.0 2,379 3.0

Total $ 88,519 100.0% $ 83,176 100.0% $ 78,812 100.0%

Note: Certain percentages may not sum to totals due to rounding.

Recent Accounting Pronouncements

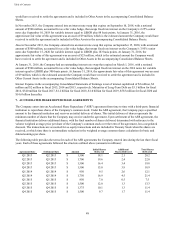

In February 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update No. 2016-02,

"Leases (Topic 842)" ("ASU No. 2016-02"), which requires an entity that is a lessee to recognize the assets and liabilities

arising from leases on the balance sheet. This guidance also requires disclosures about the amount, timing and uncertainty of

cash flows arising from leases. This guidance is effective for annual reporting periods beginning after December 15, 2018,

and interim periods within those annual periods, using a modified retrospective approach, and early adoption is permitted.

The Company is evaluating the effect that ASU No. 2016-02 will have on its Consolidated Financial Statements and related

disclosures.

In April 2015, the FASB issued Accounting Standards Update No. 2015-03, "Interest – Imputation of Interest (Subtopic

835-30): Simplifying the Presentation of Debt Issuance Costs" ("ASU No. 2015-03"), which requires an entity to present debt

issuance costs related to a recognized debt liability as a direct deduction from the carrying amount of that debt liability,