Home Depot 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

26

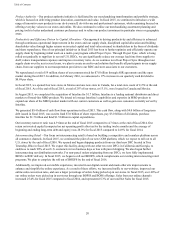

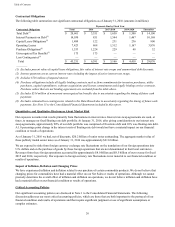

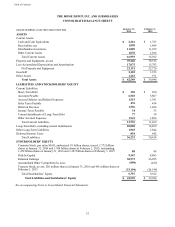

Contractual Obligations

The following table summarizes our significant contractual obligations as of January 31, 2016 (amounts in millions):

Payments Due by Fiscal Year

Contractual Obligations Total 2016 2017-2018 2019-2020 Thereafter

Total Debt(1) $ 20,601 $ 3,351 $ 1,650 $ 1,500 $ 14,100

Interest Payments on Debt(2) 14,030 851 1,544 1,467 10,168

Capital Lease Obligations(3) 1,489 122 231 236 900

Operating Leases 7,423 868 1,512 1,167 3,876

Purchase Obligations(4) 1,533 1,224 229 48 32

Unrecognized Tax Benefits(5) 175 175 — — —

Loss Contingencies(6) —————

Total $ 45,251 $ 6,591 $ 5,166 $ 4,418 $ 29,076

—————

(1) Excludes present value of capital lease obligations, fair value of interest rate swaps and unamortized debt discounts.

(2) Interest payments are at current interest rates including the impact of active interest rate swaps.

(3) Includes $726 million of imputed interest.

(4) Purchase obligations include all legally binding contracts such as firm commitments for inventory purchases, utility

purchases, capital expenditures, software acquisitions and license commitments and legally binding service contracts.

Purchase orders that are not binding agreements are excluded from the table above.

(5) Excludes $514 million of noncurrent unrecognized tax benefits due to uncertainty regarding the timing of future cash

payments.

(6) Excludes estimated loss contingencies related to the Data Breach due to uncertainty regarding the timing of future cash

payments. See Note 13 to the Consolidated Financial Statements included in this report.

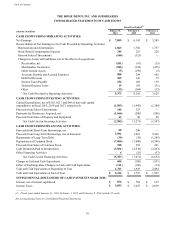

Quantitative and Qualitative Disclosures About Market Risk

Our exposure to market risk results primarily from fluctuations in interest rates. Interest rate swap agreements are used, at

times, to manage our fixed/floating rate debt portfolio. At January 31, 2016, after giving consideration to our interest rate

swap agreements, approximately 90% of our debt portfolio was comprised of fixed-rate debt and 10% was floating-rate debt.

A 1.0 percentage point change in the interest costs of floating-rate debt would not have a material impact on our financial

condition or results of operations.

As of January 31, 2016 we had, net of discounts, $20.2 billion of senior notes outstanding. The aggregate market value of

these publicly traded senior notes as of January 31, 2016 was approximately $21.8 billion.

We are exposed to risks from foreign currency exchange rate fluctuations on the translation of our foreign operations into

U.S. dollars and on the purchase of goods by these foreign operations that are not denominated in their local currencies.

Revenues from these foreign operations accounted for approximately $8.0 billion and $8.5 billion of our revenue for fiscal

2015 and 2014, respectively. Our exposure to foreign currency rate fluctuations is not material to our financial condition or

results of operations.

Impact of Inflation, Deflation and Changing Prices

We have experienced inflation and deflation related to our purchase of certain commodity products. We do not believe that

changing prices for commodities have had a material effect on our Net Sales or results of operations. Although we cannot

precisely determine the overall effect of inflation and deflation on operations, we do not believe inflation and deflation have

had a material effect on our financial condition or results of operations.

Critical Accounting Policies

Our significant accounting policies are disclosed in Note 1 to the Consolidated Financial Statements. The following

discussion addresses our most critical accounting policies, which are those that are both important to the portrayal of our

financial condition and results of operations and that require significant judgment or use of significant assumptions or

complex estimates.