Home Depot 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

56

members of the Company’s Board of Directors and executive officers. The Company was also named as a nominal defendant

in both suits, which together assert claims for breaches of fiduciary duty, waste of corporate assets and violations of the

Securities Exchange Act of 1934. In the first quarter of fiscal 2016, the two actions were consolidated into a single derivative

complaint. The complaint seeks unspecified damages, equitable relief to reform the Company’s corporate governance

structure, restitution, disgorgement of profits, benefits and other compensation obtained by the defendants, and reasonable

costs and expenses. In addition, several state and federal agencies, including State Attorneys General, are investigating events

related to the Data Breach, including how it occurred, its consequences and the Company’s responses. The Company is

cooperating in the governmental investigations, and the Company may be subject to fines or other obligations. While a loss

from these matters, including the Canadian class actions and the U.S. financial institution class actions, is reasonably

possible, the Company is not able to estimate the costs, or range of costs, related to these matters because the proceedings

remain in the early stages, alleged damages have not been specified, there is uncertainty as to the likelihood of a class or

classes being certified or the ultimate size of any class if certified, and there are significant factual and legal issues to be

resolved. The Company has not concluded that a loss from these matters is probable; therefore, the Company has not

recorded an accrual for litigation, claims and governmental investigations related to these matters in fiscal 2015. The

Company will continue to evaluate information as it becomes known and will record an estimate for losses at the time or

times when it is both probable that a loss has been incurred and the amount of the loss is reasonably estimable. The Company

believes that the ultimate amount paid on these actions, claims and investigations could have an adverse effect on the

Company’s consolidated financial condition, results of operations or cash flows in future periods.

Expenses Incurred and Amounts Accrued

In fiscal 2015, the Company recorded $198 million of pretax gross expenses related to the Data Breach, partially offset by

$70 million of expected insurance proceeds, for pretax net expenses of $128 million. Since the Data Breach occurred, the

Company has recorded $261 million of pretax gross expenses related to the Data Breach, partially offset by $100 million of

expected insurance proceeds, for pretax net expenses of $161 million. These expenses include costs to investigate the Data

Breach; provide identity protection services, including credit monitoring, to impacted customers; increase call center staffing;

and pay legal and other professional services, all of which were expensed as incurred. Expenses also include the accruals for

estimated probable losses that the Company has incurred or expects to incur in connection with the claims made by the

payment card networks and the U.S. customer class actions. These expenses are included in SG&A expenses in the

accompanying Consolidated Statements of Earnings.

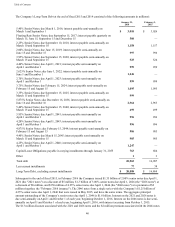

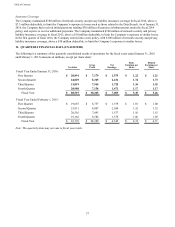

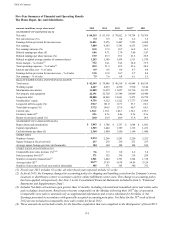

At January 31, 2016, accrued liabilities and insurance receivable related to the Data Breach consisted of the following

(amounts in millions):

Accrued

Liabilities Insurance

Receivable

(Expenses incurred) insurance receivable recorded in fiscal 2014 $ (63) $ 30

Payments made (received) in fiscal 2014 51 (10)

Balance at February 1, 2015 (12) 20

(Expenses incurred) insurance receivable recorded in fiscal 2015 (198) 70

Payments made (received) in fiscal 2015 176 (20)

Balance at January 31, 2016 $(34) $ 70

Future Costs

The Company expects to incur additional legal and other professional services expenses associated with the Data Breach in

future periods and will recognize these expenses as services are received. Costs related to the Data Breach that may be

incurred in future periods may include additional liabilities to payment card networks and impacted customers; liabilities

from current and future civil litigation, governmental investigations and enforcement proceedings; future expenses for legal,

investigative and consulting fees; and incremental expenses and capital investments for remediation activities. The Company

believes that the ultimate amount paid on these services and claims could have an adverse effect on the Company’s

consolidated financial condition, results of operations or cash flows in future periods.