Home Depot 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

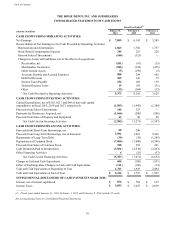

Table of Contents

43

2. CHANGE IN ACCOUNTING POLICY

During the first quarter of fiscal 2015, the Company changed its accounting policy for shipping and handling costs from the

Company’s stores, locations or distribution centers to customers and for online fulfillment center costs. Under the new

accounting policy, these costs are included in Cost of Sales, whereas they were previously included in Operating Expenses.

Including these expenses in Cost of Sales better aligns these costs with the related revenue in the gross profit calculation. This

change in accounting policy has been applied retrospectively.

The Consolidated Statements of Earnings for fiscal 2014 and 2013 have been reclassified to reflect this change in accounting

policy. The impact of this reclassification was an increase of $565 million and $475 million to Cost of Sales for fiscal 2014

and 2013, respectively, and a corresponding decrease to Operating Expenses in the same periods. This reclassification had no

impact on Net Sales, Operating Income, Net Earnings or Earnings per Share.

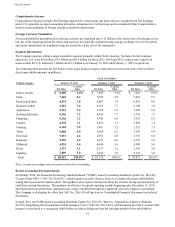

3. INTERLINE ACQUISITION

On August 24, 2015, the Company completed its acquisition of Interline. Interline is a leading national distributor and direct

marketer of broad-line maintenance, repair and operations ("MRO") products. The Company intends to leverage Interline’s

capabilities and expertise in MRO products to expand the Company’s share of the MRO product market with its current

customers as well as gain new customers currently served by Interline.

The aggregate purchase price of this acquisition was $1.7 billion. A portion of the purchase price was used for the repayment

of substantially all of Interline’s existing indebtedness. The acquisition was accounted for in accordance with FASB ASC 805

"Business Combinations" and, accordingly, Interline’s results of operations have been consolidated in the Company’s

financial statements since the date of acquisition. Acquisition-related costs were expensed as incurred and were not material.

Pro forma results of operations would not be materially different as a result of the acquisition and therefore are not presented.

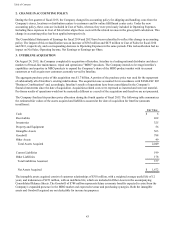

The Company finalized its purchase price allocation during the fourth quarter of fiscal 2015. The following table summarizes

the estimated fair values of the assets acquired and liabilities assumed at the date of acquisition for Interline (amounts

in millions):

Fair Value

Cash $ 6

Receivables 262

Inventories 325

Property and Equipment 56

Intangible Assets 563

Goodwill 788

Other Assets 49

Total Assets Acquired 2,049

Current Liabilities 199

Other Liabilities 178

Total Liabilities Assumed 377

Net Assets Acquired $ 1,672

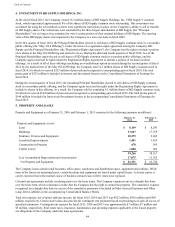

The intangible assets acquired consist of customer relationships of $310 million, with a weighted average useful life of 12

years, and tradenames of $253 million, with an indefinite life, which are included in Other Assets in the accompanying

Consolidated Balance Sheets. The Goodwill of $788 million represents future economic benefits expected to arise from the

Company’s expanded presence in the MRO market and expected revenue and purchasing synergies. Both the intangible

assets and Goodwill acquired are not deductible for income tax purposes.