Home Depot 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

50

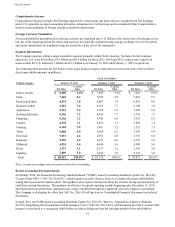

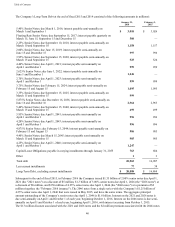

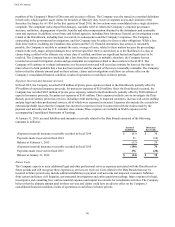

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax

liabilities as of January 31, 2016 and February 1, 2015 were as follows (amounts in millions):

January 31,

2016 February 1,

2015

Assets:

Deferred compensation $ 269 $ 272

Accrued self-insurance liabilities 433 440

State income taxes 140 121

Non-deductible reserves 315 283

Net operating losses 58 45

Impairment of investment —30

Other 267 279

Total Deferred Tax Assets 1,482 1,470

Valuation Allowance (3)(6)

Total Deferred Tax Assets after Valuation Allowance 1,479 1,464

Liabilities:

Inventory (129)(61)

Property and equipment (1,165)(1,156)

Goodwill and other intangibles (368)(161)

Other (116)(234)

Total Deferred Tax Liabilities (1,778)(1,612)

Net Deferred Tax Liabilities $(299)$(148)

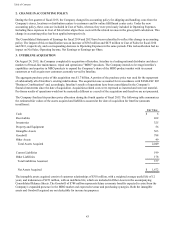

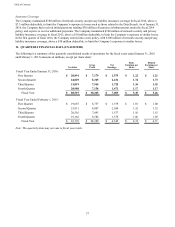

Current deferred tax assets and current deferred tax liabilities are netted by tax jurisdiction and noncurrent deferred tax assets

and noncurrent deferred tax liabilities are netted by tax jurisdiction, and are included in the accompanying Consolidated

Balance Sheets as follows (amounts in millions):

January 31,

2016 February 1,

2015

Other Current Assets $ 509 $ 444

Other Assets 48 51

Other Accrued Expenses (2)(1)

Deferred Income Taxes (854)(642)

Net Deferred Tax Liabilities $(299)$(148)

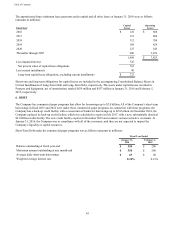

The Company believes that the realization of the deferred tax assets is more likely than not, based upon the expectation that it

will generate the necessary taxable income in future periods, and except for certain net operating losses discussed below, no

valuation reserves have been provided.

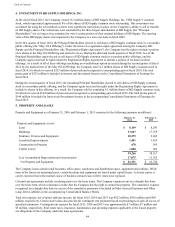

At January 31, 2016, the Company had federal, state and foreign net operating loss carryforwards available to reduce future

taxable income, expiring at various dates beginning in 2016 to 2035. Management has concluded that it is more likely than

not that the tax benefits related to the federal and state net operating losses will be realized. However, it is unlikely that the

Company will be able to utilize certain foreign net operating losses. Therefore, a valuation allowance has been provided to

reduce the deferred tax asset related to foreign net operating losses to an amount that is more likely than not to be realized.

Total valuation allowances related to foreign net operating losses at January 31, 2016 and February 1, 2015 were $3 million

and $6 million, respectively.