GE 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2010 ANNUAL REPORT 81

OTHER

In 2010, we committed to sell GE Capital Consumer businesses in

Argentina, Brazil, and Canada, a CLL business in South Korea, and

our Interpark business in Real Estate. Assets and liabilities of

these businesses of $3,127 million and $592 million, respectively,

were classified as held for sale at December 31, 2010.

On November 12, 2009, we committed to sell our Security

business (within Corporate Items and Eliminations). On

February 28, 2010, we completed the sale of our Security busi-

ness for $1,787 million. Assets and liabilities of $1,780 million

and $282 million, respectively, were classified as held for sale at

December 31, 2009.

On January 7, 2009, we exchanged our Consumer businesses

in Austria and Finland, the credit card and auto businesses in the

U.K., and the credit card business in Ireland for a 100% ownership

interest in Interbanca S.p.A., an Italian corporate bank. We recog-

nized a $184 million loss, net of tax, related to the classification of

the assets held for sale at the lower of carrying amount or esti-

mated fair value less costs to sell.

On December 24, 2008, we committed to sell a portion of our

Australian residential mortgage business, including certain

underlying mortgage receivables, and completed this sale during

the first quarter of 2009. We recognized a $38 million loss, net of

tax, related to the classifications of the assets held for sale at the

lower of carrying amount or estimated fair value less costs to sell.

Summarized financial information for businesses held for sale

is shown below.

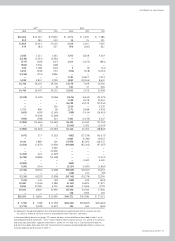

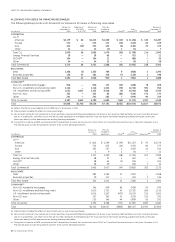

December 31 (In millions) 2010 2009

ASSETS

Cash and equivalents $ 63 $ —

Current receivables 2,572 2,188

Financing receivables—net 1,917 —

Property, plant and equipment—net 2,185 1,978

Goodwill 19,606 20,086

Other intangible assets—net 2,844 2,866

All other assets 7,560 6,621

Other 140 372

Assets of businesses held for sale $36,887 $34,111

LIABILITIES

Accounts payable $ 538 $ 451

Other GE current liabilities 3,994 4,139

Long-term borrowings 10,134 2

All other liabilities 1,378 1,447

Other 3 53

Liabilities of businesses held for sale $16,047 $ 6,092

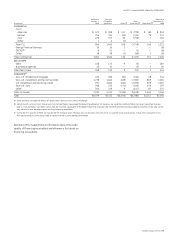

Discontinued Operations

Discontinued operations primarily comprised BAC Credomatic

GECF Inc. (BAC) (our Central American bank and card business),

GE Money Japan (our Japanese personal loan business, Lake,

and our Japanese mortgage and card businesses, excluding our

investment in GE Nissen Credit Co., Ltd.), our U.S. mortgage busi-

ness (WMC), our U.S. recreational vehicle and marine equipment

financing business (Consumer RV Marine), Consumer Mexico

and Plastics. Associated results of operations, financial position

and cash flows are separately reported as discontinued opera-

tions for all periods presented.

With respect to our 49% interest in NBCU LLC, we hold

redemption rights, which, if exercised, cause NBCU LLC or

Comcast to purchase half of our ownership interest after three

and a half years and the remaining half after seven years (either

directly or through the transfer of common stock of the corporate

owner of NBCU LLC) subject to certain exceptions, conditions and

limitations. Our interest in NBCU LLC is also subject to call provi-

sions, which, if exercised, allow Comcast to purchase our interest

(either directly or through the transfer of common stock of the

corporate owner of NBCU LLC) at specified times subject to cer-

tain exceptions. The redemption prices for such transactions are

determined pursuant to a contractually specified formula.

In connection with the transaction, we also entered into a

number of agreements with Comcast governing the operation of

the venture and transitional services, employee, tax and other

matters. Under the operating agreement, excess cash generated

by the operations of NBCU LLC will be used to reduce borrowings

rather than to pay distributions to us, except for distributions

under a formula to enable us to pay taxes on NBCU LLC’s profits.

In addition, Comcast is obligated to make payments to us for a

share of tax savings associated with Comcast’s purchase of its

NBCU LLC member interest.

As part of the transfer, we provided guarantees and indemnifi-

cations related to certain pre-existing contractual arrangements

entered into by NBCU. We have provided guarantees, on behalf

of NBCU LLC, for the acquisition of sports programming in the

amount of $3,258 million, triggered only in the event NBCU LLC

fails to meet its payment commitments. We also have agreed to

indemnify Comcast against any loss (after giving consideration

to underlying collateral) related to a pre-existing credit support

agreement covering $815 million of debt plus accrued interest

owed by a joint venture of NBCU LLC.

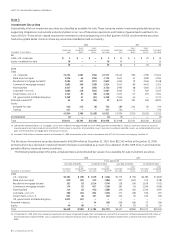

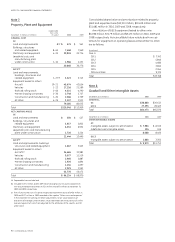

At December 31, 2010, we classified the NBCU assets and

liabilities of $33,758 million and $15,455 million, respectively, as

held for sale. The major classes of assets at December 31, 2010

were current receivables ($2,572 million), property, plant and

equipment—net ($2,082 million), goodwill and other intangible

assets—net ($22,263 million) and all other assets ($6,841 million),

including film and television production costs of $4,423 million.

The major classes of liabilities at December 31, 2010 were

accounts payable ($492 million), other GE current liabilities

($3,983 million), long-term debt ($9,906 million) and all other

liabilities ($1,073 million).

At December 31, 2009, we classified the NBCU assets and

liabilities of $32,150 million and $5,751 million, respectively, as

held for sale. The major classes of assets at December 31, 2009

were current receivables ($2,136 million), property, plant and

equipment—net ($1,805 million), goodwill and other intangible

assets—net ($21, 574 million) and all other assets ($6,514 million),

including film and television production costs of $4,507 million.

The major classes of liabilities at December 31, 2009 were

accounts payable ($398 million), other GE current liabilities

($4,051 million) and all other liabilities ($1,300 million).