GE 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 GE 2010 ANNUAL REPORT

non-recurring basis. This guidance establishes a new framework

for measuring fair value and expands related disclosures. See

Note 21.

Effective January 1, 2008, we adopted ASC 825, Financial

Instruments. Upon adoption, we elected to report $172 million of

commercial mortgage loans at fair value in order to recognize

them on the same accounting basis (measured at fair value

through earnings) as the derivatives economically hedging

these loans.

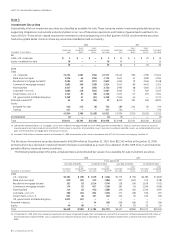

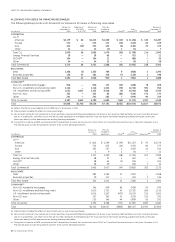

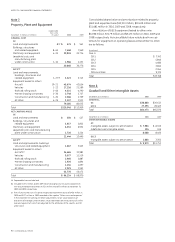

Note 2.

Assets and Liabilities of Businesses Held for Sale and

Discontinued Operations

Assets and Liabilities of Businesses Held for Sale

NBC UNIVERSAL

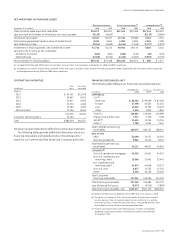

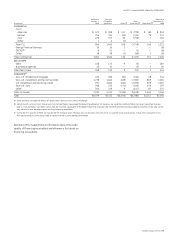

In December 2009, we entered into an agreement with Comcast

Corporation (Comcast) to transfer the assets of the NBCU busi-

ness to a newly formed entity, comprising our NBCU business and

Comcast’s cable networks, regional sports networks, certain

digital properties and certain unconsolidated investments, in

exchange for cash and a 49% interest in the newly formed entity.

On March 19, 2010, NBCU entered into a three-year credit

agreement and a 364-day bridge loan agreement. On April 30,

2010, NBCU issued $4,000 million of senior, unsecured notes with

maturities ranging from 2015 to 2040 (interest rates ranging from

3.65% to 6.40%). On October 4, 2010, NBCU issued $5,100 million

of senior, unsecured notes with maturities ranging from 2014 to

2041 (interest rates ranging from 2.10% to 5.95%). Subsequent to

these issuances, the credit agreement and bridge loan agree-

ments were terminated, with a $750 million revolving credit

agreement remaining in effect. Proceeds from these issuances

were used to repay $1,678 million of existing debt and pay a

dividend to GE.

On September 26, 2010, we acquired approximately 38% of

Vivendi S.A.’s (Vivendi) 20% interest in NBCU (7.7% of NBCU’s

outstanding shares) for $2,000 million.

Prior to and in connection with the transaction with Comcast,

we acquired the remaining Vivendi interest in NBCU (12.3% of

NBCU’s outstanding shares) for $3,578 million and made an

additional payment of $222 million related to the previously

purchased shares.

On January 28, 2011, we transferred the assets of the NBCU

business and Comcast transferred certain of its assets to a newly

formed entity, NBC Universal LLC (NBCU LLC). In connection with the

transaction, we received $6,197 million in cash from Comcast and a

49% interest in NBCU LLC. Comcast holds the remaining 51% inter-

est in NBCU LLC. We will account for our investment in NBCU LLC

under the equity method. As a result of the transaction, we expect

to recognize a small after-tax gain in the first quarter of 2011.

requires pre-acquisition contingencies to be recognized at fair

value, if fair value can be determined or reasonably estimated

during the measurement period. If fair value cannot be

deter mined or reasonably estimated, the standard requires mea-

surement based on the recognition and measurement criteria of

ASC 450, Contingencies.

On January 1, 2009, we adopted an amendment to ASC 810,

that requires us to make certain changes to the presentation of

our financial statements. This amendment requires us to classify

earnings attributable to noncontrolling interests (previously

referred to as “minority interest”) as part of consolidated net

earnings ($535 million and $200 million for 2010 and 2009, respec-

tively) and to include the accumulated amount of noncontrolling

interests as part of shareowners’ equity ($5,262 million and

$7,845 million at December 31, 2010 and 2009, respectively). The

net earnings amounts we have previously reported are now

presented as “Net earnings attributable to the Company” and, as

required, earnings per share continues to reflect amounts attrib-

utable only to the Company. Similarly, in our presentation of

shareowners’ equity, we distinguish between equity amounts

attributable to GE shareowners and amounts attributable to the

noncontrolling interests—previously classified as minority inter-

est outside of shareowners’ equity. Beginning January 1, 2009,

dividends to noncontrolling interests ($317 million and $548 mil-

lion in 2010 and 2009, respectively) are classified as financing

cash flows. In addition to these financial reporting changes, this

guidance provides for significant changes in accounting related to

noncontrolling interests; specifically, increases and decreases in

our controlling financial interests in consolidated subsidiaries will

be reported in equity similar to treasury stock transactions. If a

change in ownership of a consolidated subsidiary results in loss of

control and deconsolidation, any retained ownership interests are

remeasured with the gain or loss reported in net earnings.

Effective January 1, 2009, we adopted ASC 808, Collaborative

Arrangements, that requires gross basis presentation of revenues

and expenses for principal participants in collaborative arrange-

ments. Our Technology Infrastructure and Energy Infrastructure

segments enter into collaborative arrangements with manufac-

turers and suppliers of components used to build and maintain

certain engines, aeroderivatives, and turbines, under which GE

and these participants share in risks and rewards of these prod-

uct programs. Adoption of the standard had no effect as our

historical presentation had been consistent with the new

requirements.

We adopted amendments to ASC 320, Investments—Debt

and Equity Securities, and recorded a cumulative effect adjust-

ment to increase retained earnings as of April 1, 2009, of

$62 million. See Note 3.

We adopted ASC 820, Fair Value Measurements and Disclosures,

in two steps; effective January 1, 2008, we adopted it for all finan-

cial instruments and non-financial instruments accounted for at

fair value on a recurring basis and effective January 1, 2009, for

all non-financial instruments accounted for at fair value on a