GE 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 GE 2010 ANNUAL REPORT

We measure the fair value of each stock option grant at the date

of grant using a Black-Scholes option pricing model. The weighted

average grant-date fair value of options granted during 2010,

2009 and 2008 was $4.11, $3.81 and $5.26, respectively. The

following assumptions were used in arriving at the fair value of

options granted during 2010, 2009 and 2008, respectively: risk-

free interest rates of 2.9%, 3.2% and 3.4%; dividend yields of 3.9%,

3.9% and 4.4%; expected volatility of 35%, 49% and 27%; and

expected lives of six years and eleven months, six years and ten

months, and six years and nine months. Risk-free interest rates

reflect the yield on zero-coupon U.S. Treasury securities. Expected

dividend yields presume a set dividend rate. For stock options

granted in 2010, 2009 and the fourth quarter of 2008, we used a

historical five-year average for the dividend yield. Expected vola-

tilities are based on implied volatilities from traded options and

historical volatility of our stock. The expected option lives are

based on our historical experience of employee exercise behavior.

The total intrinsic value of options exercised during 2010, 2009

and 2008 amounted to $23 million, an insignificant amount and

$45 million, respectively. As of December 31, 2010, there was

$697 million of total unrecognized compensation cost related to

nonvested options. That cost is expected to be recognized over a

weighted average period of two years, of which approximately

$236 million, pre tax, is expected to be recognized in 2011.

Stock option expense recognized in net earnings amounted to

$178 million in 2010, $120 million in 2009 and $69 million in 2008.

Cash received from option exercises during 2010, 2009 and 2008

was $37 million, an insignificant amount and $353 million, respec-

tively. The tax benefit realized from stock options exercised during

2010, 2009 and 2008 was $7 million, an insignificant amount and

$15 million, respectively.

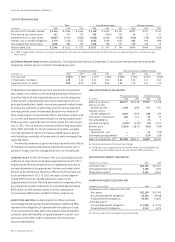

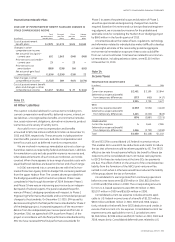

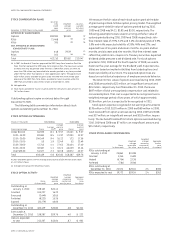

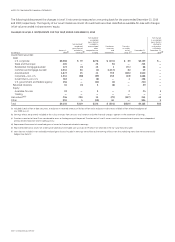

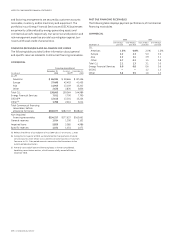

OTHER STOCK-BASED COMPENSATION

Weighted

Weighted average Aggregate

average remaining intrinsic

Shares grant date contractual value

(In thousands) fair value term (In years) (In millions)

RSUs outstanding at

January 1, 2010 25,861 $31.98

Granted 3,245 15.89

Vested (6,754) 33.38

Forfeited (781) 30.98

RSUs outstanding at

December 31, 2010 21,571 $29.16 2.5 $395

RSUs expected to vest 19,773 $29.24 2.4 $362

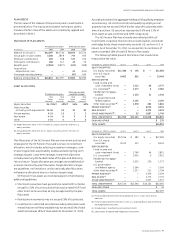

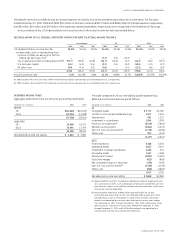

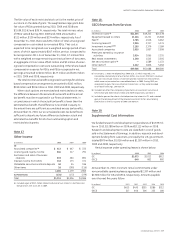

STOCK COMPENSATION PLANS

Securities

to be Weighted Securities

issued average available

upon exercise for future

December 31, 2010 (Shares in thousands) exercise price issuance

APPROVED BY SHAREOWNERS

Options 399,991 $20.81

(a)

RSUs 21,468 (b)

(a)

PSUs 700

(b)

(a)

NOT APPROVED BY SHAREOWNERS

(CONSULTANTS’ PLAN)

Options 448 29.39

(c)

RSUs 103 (b)

(c)

Total 422,710 $20.82 213,047

(a) In 2007, the Board of Directors approved the 2007 Long-Term Incentive Plan (the

Plan). The Plan replaced the 1990 Long-Term Incentive Plan. The maximum number

of shares that may be granted under the Plan is 500 million shares, of which no

more than 250 million may be available for awards granted in any form provided

under the Plan other than options or stock appreciation rights. The approximate

105.9 million shares available for grant under the 1990 Plan were retired upon

approval of the 2007 Plan. Total shares available for future issuance under the

2007 Plan amounted to 184.8 million shares at December 31, 2010.

(b) Not applicable.

(c) Total shares available for future issuance under the consultants’ plan amount to

28.2 million shares.

Outstanding options expire on various dates through

December 9, 2020.

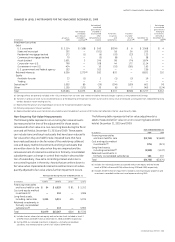

The following table summarizes information about stock

options outstanding at December 31, 2010.

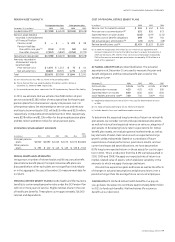

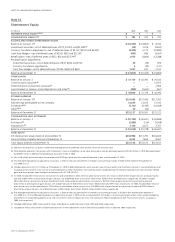

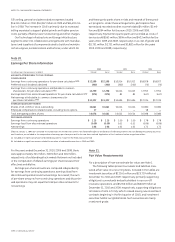

STOCK OPTIONS OUTSTANDING

(Shares in thousands) Outstanding

Exercisable

Average Average

Average exercise exercise

Exercise price range Shares life

(a) price Shares price

Under $10.00 64,595 8.1 $ 9.57 13,061 $ 9.57

10.01–15.00 83,081 8.5 11.97 17,093 11.97

15.01–20.00 104,149 9.4 16.22 173 17.56

20.01–25.00 55 1.9 22.49 55 22.49

25.01–30.00 47,745 4.4 27.62 35,404 27.40

30.01–35.00 49,487 4.1 33.21 46,629 33.16

Over $35.00 51,327 2.3 40.38 45,872 40.57

Total 400,439 6.8 $20.82 158,287 $29.76

At year-end 2009, options with an average exercise price of $36.94 were exercisable

on 147 million shares.

(a) Average contractual life remaining in years.

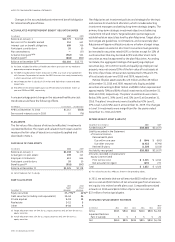

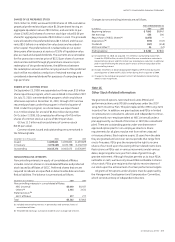

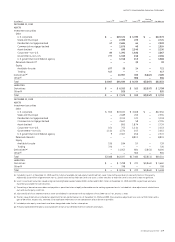

STOCK OPTION ACTIVITY

Weighted

Weighted average Aggregate

average remaining intrinsic

Shares exercise contractual value

(In thousands) price term (In years) (In millions)

Outstanding at

January 1, 2010 338,163 $24.41

Granted 105,227 16.22

Exercised (3,449) 10.65

Forfeited (8,223) 15.26

Expired (31,279) 46.66

Outstanding at

December 31, 2010 400,439 $20.82 6.8 $1,312

Exercisable at

December 31, 2010 158,287 $29.76 4.0 $ 222

Options expected

to vest 213,267 $15.04 8.7 $ 962