GE 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 GE 2010 ANNUAL REPORT

such, these loans are not necessarily classified as nonearning

or impaired.

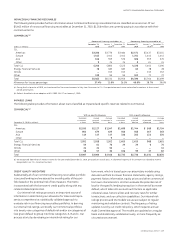

At December 31, 2010, our unsecured Commercial financing

receivables portfolio of $208 million, $964 million and $783 million

was rated A, B and C, respectively. Substantially all of these financ-

ing receivables are attributable to our Interbanca S.p.A. and

GE Sanyo Credit acquisitions in Europe and Asia, respectively.

Real Estate

Our real estate portfolio primarily comprises fixed and floating

loans secured by commercial real estate. Our Debt portfolio is

underwritten based on the cash flows generated by underlying

income-producing commercial properties and secured by first

mortgages. Our Business properties portfolio is underwritten

primarily by the credit quality of the borrower and secured by

tenant and owner-occupied commercial properties.

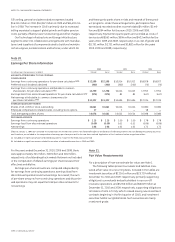

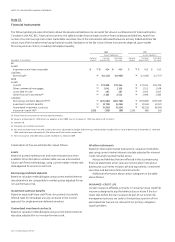

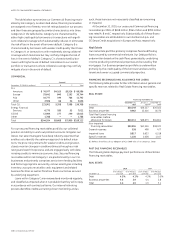

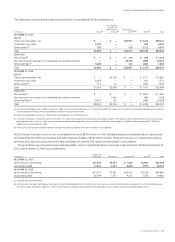

FINANCING RECEIVABLES AND ALLOWANCE FOR LOSSES

The following table provides further information about general and

specific reserves related to Real Estate financing receivables.

REAL ESTATE

Financing receivables at

December 31, January 1, December 31,

(In millions) 2010 2010

(a) 2009

Debt $30,249 $36,257 $36,565

Business properties 9,962 12,416 8,276

Total Real Estate financing

receivables, before

allowance for losses $40,211 $48,673 $44,841

Non-impaired

financing receivables $30,394 $42,050 $38,323

General reserves 338 498 477

Impaired loans 9,817 6,623 6,518

Specific reserves 1,150 1,038 1,017

(a) Reflects the effects of our adoption of ASU 2009-16 & 17 on January 1, 2010.

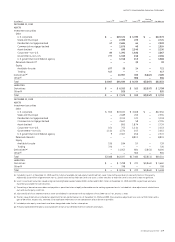

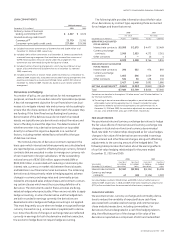

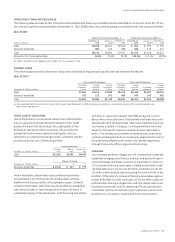

PAST DUE FINANCING RECEIVABLES

The following table displays payment performance of Real Estate

financing receivables.

REAL ESTATE

2010

2009

Over 30 days Over 90 days Over 30 days Over 90 days

December 31 past due past due past due past due

Debt 4.3 % 4.1 % 4.3 % 3.0 %

Business properties 4.6 3.9 4.4 3.8

Total 4.4 4.0 4.3 3.1

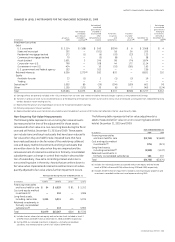

The table below summarizes our Commercial financing receiv-

ables by risk category. As described above, financing receivables

are assigned one of twenty-one risk ratings based on our process

and then these are grouped by similar characteristics into three

categories in the table below. Category A is characterized by

either high credit quality borrowers or transactions with signifi-

cant collateral coverage which substantially reduces or eliminates

the risk of loss in the event of borrower default. Category B is

characterized by borrowers with weaker credit quality than those

in Category A, or transactions with moderately strong collateral

coverage which minimizes but may not fully mitigate the risk of

loss in the event of default. Category C is characterized by bor-

rowers with higher levels of default risk relative to our overall

portfolio or transactions where collateral coverage may not fully

mitigate a loss in the event of default.

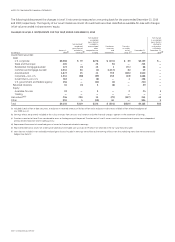

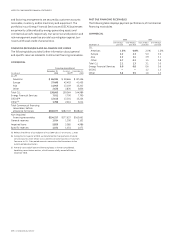

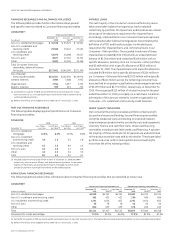

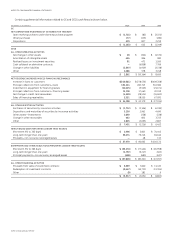

COMMERCIAL

Secured

December 31, 2010 (In millions) A B C Total

CLL

Americas $ 76,977 $4,103 $5,516 $ 86,596

Europe 33,642 840 1,262 35,744

Asia 10,777 199 766 11,742

Other 2,506 66 54 2,626

Total CLL 123,902 5,208 7,598 136,708

Energy Financial

Services 6,775 183 53 7,011

GECAS 12,089 277 249 12,615

Other 1,788 — — 1,788

Total $144,554 $5,668 $7,900 $158,122

For our secured financing receivables portfolio, our collateral

position and ability to work out problem accounts mitigates our

losses. Our asset managers have deep industry expertise that

enables us to identify the optimum approach to default situa-

tions. We price risk premiums for weaker credits at origination,

closely monitor changes in creditworthiness through our risk

ratings and watch list process, and are engaged early with dete-

riorating credits to minimize economic loss. Secured financing

receivables within risk Category C are predominantly in our CLL

businesses and primarily comprises senior term lending facilities

and factoring programs secured by various asset types including

inventory, accounts receivable, cash, equipment and related

business facilities as well as franchise finance activities secured

by underlying equipment.

Loans within Category C are reviewed and monitored regularly,

and classified as impaired when it is probable that they will not pay

in accordance with contractual terms. Our internal risk rating

process identifies credits warranting closer monitoring; and as