GE 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

32 GE 2010 ANNUAL REPORT

Operations

Our consolidated financial statements combine the

industrial manufacturing, services and media businesses of

General Electric Company (GE) with the financial services

businesses of General Electric Capital Services, Inc. (GECS or

financial services).

In the accompanying analysis of financial information, we

sometimes use information derived from consolidated financial

information but not presented in our financial statements pre-

pared in accordance with U.S. generally accepted accounting

principles (GAAP). Certain of these data are considered

“non-GAAP financial measures” under the U.S. Securities and

Exchange Commission (SEC) rules. For such measures, we have

provided supplemental explanations and reconciliations in the

Supplemental Information section.

We present Management’s Discussion of Operations in

five parts: Overview of Our Earnings from 2008 through 2010,

Global Risk Management, Segment Operations, Geographic

Operations and Environmental Matters. Unless otherwise indi-

cated, we refer to captions such as revenues and earnings from

continuing operations attributable to the company simply as

“revenues” and “earnings” throughout this Management’s

Discussion and Analysis. Similarly, discussion of other matters

in our consolidated financial statements relates to continuing

operations unless otherwise indicated.

Effective January 1, 2010, we reorganized our segments to

better align our Consumer & Industrial and Energy businesses

for growth. As a result of this reorganization, we created a

new segment called Home & Business Solutions that includes

the Appliances and Lighting businesses from our previous

Consumer & Industrial segment and the retained portion of the

GE Fanuc Intelligent Platforms business of our previous Enterprise

Solutions business (formerly within our Technology Infrastructure

segment). In addition, the Industrial business of our previous

Consumer & Industrial segment and the Sensing & Inspection

Technologies and Digital Energy businesses of our previous

Enterprise Solutions business are now part of the Energy busi-

ness within the Energy Infrastructure segment. The Security

business of Enterprise Solutions was reported in Corporate Items

and Eliminations until its sale in February 2010. Also, effective

January 1, 2010, the Capital Finance segment was renamed

GE Capital and includes all of the continuing operations of

General Electric Capital Corporation (GECC). In addition, the

Transportation Financial Services business, previously reported

in GE Capital Aviation Services (GECAS), is included in Commercial

Lending and Leasing (CLL) and our Consumer business in Italy,

previously reported in Consumer, is included in CLL.

Effective January 1, 2011, we reorganized the Technology

Infrastructure segment into three segments—Aviation, Healthcare

and Transportation. The results of the Aviation, Healthcare and

Transportation businesses are unaffected by this reorganization

and we will begin reporting these as separate segments beginning

with our quarterly report on Form 10-Q for the period ended

March 31, 2011. Results for 2010 and prior periods are reported on

the basis under which we managed our businesses in 2010 and do

not reflect the January 2011 reorganization.

Beginning in 2011, we will supplement our GAAP net earnings

and earnings per share (EPS) reporting by also reporting an oper-

ating earnings and EPS measure (non-GAAP). Operating earnings

and EPS will include service cost and plan amendment amortiza-

tion for our principal pension plans as these costs represent

expenses associated with employee benefits earned. Operating

earnings and EPS will exclude non-operating pension cost/

income such as interest cost, expected return on plans assets and

non-cash amortization of actuarial gains and losses. We believe

that this reporting will provide better transparency to the

employee benefit costs of our principal pension plans and

Company operating results.

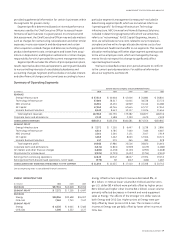

Overview of Our Earnings from 2008 through 2010

Earnings from continuing operations attributable to the

Company increased 15% in 2010 after decreasing 39% in 2009,

reflecting the stabilization of overall economic conditions during

2010, following the challenging conditions of the last two years

and the effect on both our industrial and financial services

businesses. We believe that we are seeing signs of stabilization

in the global economy, including in financial services, as GECS

earnings from continuing operations attributable to the

Company increased 138% in 2010 compared with a decrease

of 83% in 2009. Net earnings attributable to the Company

increased 6% in 2010 after decreasing 37% in 2009, as losses

from discontinued operations in 2010 partially offset the 15%

increase in earnings from continuing operations. We have a

strong backlog entering 2011 and expect global economic

conditions to continue to improve through 2012.

Energy Infrastructure (25% and 33% of consolidated three-

year revenues and total segment profit, respectively) revenues

decreased 8% in 2010 and 6% in 2009 as the worldwide demand

for new sources of power, such as wind and thermal, declined with

the overall economic conditions. Segment profit increased 2% in

2010 and 9% in 2009 primarily on higher prices and lower material

and other costs. We continue to invest in market-leading technol-

ogy and services at Energy and Oil & Gas.

Technology Infrastructure (24% and 33% of consolidated

three-year revenues and total segment profit, respectively) rev-

enues and segment profit fell 2% and 7%, respectively, in 2010

and 7% and 9%, respectively, in 2009. We continue to invest in

market-leading technologies and services at Aviation, Healthcare

and Transportation. Aviation revenues and earnings trended

down over this period on lower equipment sales and services and

the costs of investment in new product launches, coupled with

the effects of the challenging global economic environment.

Healthcare revenues and earnings improved in 2010 on higher

equipment sales and services after trending down in 2009 due

to generally weak global economic conditions and uncertainty in

the healthcare markets. Transportation revenues and earnings

declined 12% and 33%, respectively, in 2010, and 24% and 51%,

respectively, in 2009 as the weakened economy has driven

overall reductions in U.S. freight traffic and we updated our esti-

mates of long-term product service costs in our maintenance

service agreements.