GE 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2010 ANNUAL REPORT 105

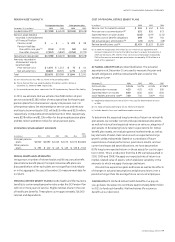

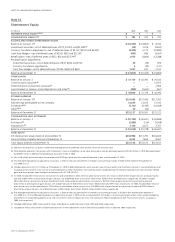

SHARES OF GE PREFERRED STOCK

On October 16, 2008, we issued 30,000 shares of 10% cumulative

perpetual preferred stock (par value $1.00 per share) having an

aggregate liquidation value of $3.0 billion, and warrants to pur-

chase 134,831,460 shares of common stock (par value $0.06 per

share) for aggregate proceeds of $3.0 billion in cash. The proceeds

were allocated to the preferred shares ($2.5 billion) and the war-

rants ($0.5 billion) on a relative fair value basis and recorded in

other capital. The preferred stock is redeemable at our option

three years after issuance at a price of 110% of liquidation value

plus accrued and unpaid dividends. The warrants are exercisable

for five years at an exercise price of $22.25 per share of common

stock and are settled through physical share issuance. Upon

redemption of the preferred shares, the difference between

the redemption amount and the carrying amount of the preferred

stock will be recorded as a reduction of retained earnings and

considered a deemed dividend for purposes of computing earn-

ings per share.

SHARES OF GE COMMON STOCK

On September 25, 2008, we suspended our three-year, $15 billion

share repurchase program, which was initiated in December 2007.

On July 23, 2010, we extended the program, which would have

otherwise expired on December 31, 2010, through 2013 and we

resumed purchases under the program in the third quarter of

2010. Under this program, on a book basis, we repurchased

111.2 million shares for a total of $1,814 million during 2010.

On October 7, 2008, GE completed an offering of 547.8 million

shares of common stock at a price of $22.25 per share.

GE has 13.2 billion authorized shares of common stock

($0.06 par value).

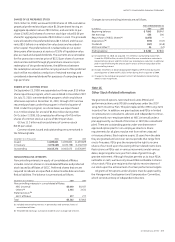

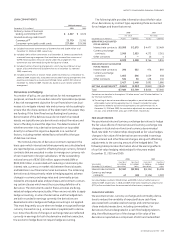

Common shares issued and outstanding are summarized in

the following table.

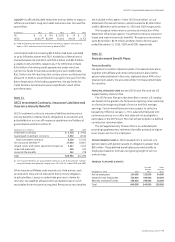

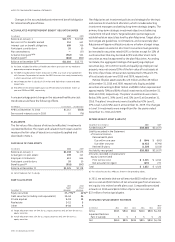

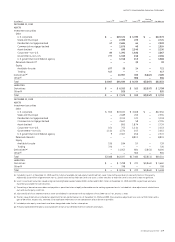

December 31 (In thousands) 2010 2009 2008

Issued 11,693,841 11,693,833 11,693,829

In treasury (1,078,465) (1,030,758) (1,156,932)

Outstanding 10,615,376 10,663,075 10,536,897

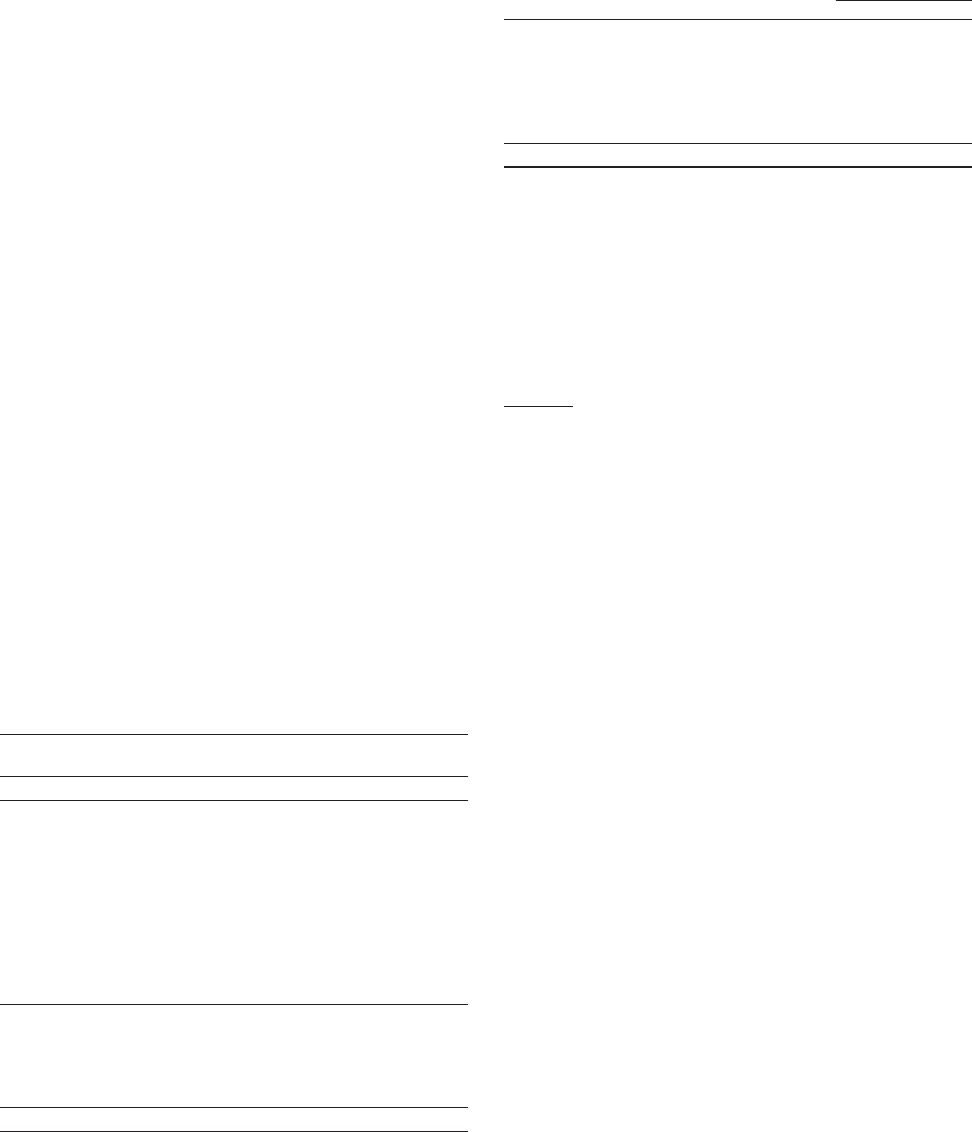

NONCONTROLLING INTERESTS

Noncontrolling interests in equity of consolidated affiliates

includes common shares in consolidated affiliates and preferred

stock issued by affiliates of GECC. Preferred shares that we are

required to redeem at a specified or determinable date are classi-

fied as liabilities. The balance is summarized as follows:

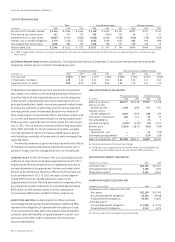

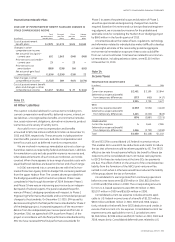

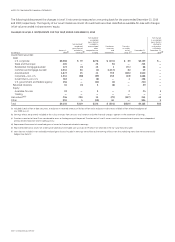

December 31 (In millions) 2010 2009

Noncontrolling interests in consolidated affiliates

NBC Universal $3,040 $4,937

Others

(a)

1,945 2,631

Preferred stock

(b)

GECC affiliates 277 277

Total $5,262 $7,845

(a) Included noncontrolling interests in partnerships and common shares of

consolidated affiliates.

(b) The preferred stock pays cumulative dividends at an average rate of 6.81%.

Changes to noncontrolling interests are as follows.

Years ended December 31

(In millions) 2010 2009

Beginning balance $ 7,845 $8,947

Net earnings 535 200

Repurchase of NBCU shares

(a) (1,878) —

Dispositions (b) (979) (707)

Dividends (317) (548)

AOCI and other

(c) 56 (47)

Ending balance $ 5,262 $7,845

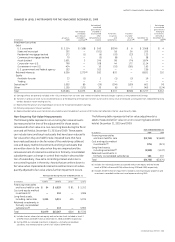

(a) On September 26, 2010, we acquired 7.7% of NBCU’s outstanding shares from

Vivendi for $2,000 million, of which $1,878 million was recorded as a reduction in

noncontrolling interests and $151 million was recorded as a reduction in additional

paid-in capital reflecting the amount paid in excess of the carrying value of the

noncontrolling interest.

(b) Includes the effects of deconsolidating both Regency $(979) million during the

second quarter of 2010 and PTL $(331) million during the first quarter of 2009.

(c) Changes to the individual components of AOCI attributable to noncontrolling

interests were insignificant.

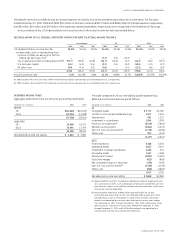

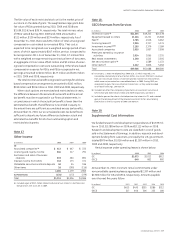

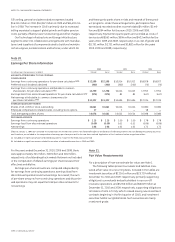

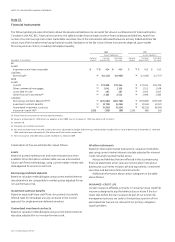

Note 16.

Other Stock-Related Information

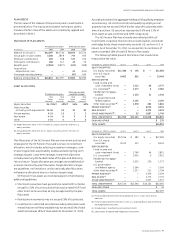

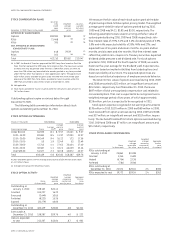

We grant stock options, restricted stock units (RSUs) and

performance share units (PSUs) to employees under the 2007

Long-Term Incentive Plan. This plan replaced the 1990 Long-Term

Incentive Plan. In addition, we grant options and RSUs in limited

circumstances to consultants, advisors and independent contrac-

tors (primarily non-employee talent at NBC Universal) under a

plan approved by our Board of Directors in 1997 (the consultants’

plan). There are outstanding grants under one shareowner-

approved option plan for non-employee directors. Share

requirements for all plans may be met from either unissued

or treasury shares. Stock options expire 10 years from the date

they are granted and vest over service periods that range from

one to five years. RSUs give the recipients the right to receive

shares of our stock upon the vesting of their related restrictions.

Restrictions on RSUs vest in various increments and at various

dates, beginning after one year from date of grant through

grantee retirement. Although the plan permits us to issue RSUs

settleable in cash, we have only issued RSUs settleable in shares

of our stock. PSUs give recipients the right to receive shares of

our stock upon the achievement of certain performance targets.

All grants of GE options under all plans must be approved by

the Management Development and Compensation Committee,

which consists entirely of independent directors.