GE 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2010 ANNUAL REPORT 119

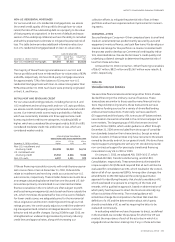

with loan-to-value ratios greater than 95% are paying in accor-

dance with contractual terms. Substantially all of these loans and

substantially all of the Real Estate—Business properties financing

receivables included in Category C are impaired loans which are

subject to the specific reserve evaluation process described in

Note 1. The ultimate recoverability of impaired loans is driven by

collection strategies that do not necessarily depend on the sale of

the underlying collateral and include full or partial repayments

through third-party refinancing and restructurings.

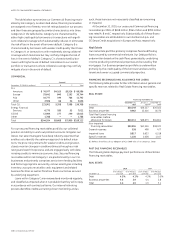

Consumer

Our Consumer portfolio is largely non-U.S. and primarily comprises

residential mortgage, sales finance, and auto and personal loans in

various European and Asian countries. At December 31, 2010, our

U.S. consumer financing receivables included private-label credit

card and sales financing for over 51 million customers across the

U.S. with no metropolitan area accounting for more than 6% of the

portfolio. Of the total U.S. consumer financing receivables, approxi-

mately 63% relate to credit card loans, which are often subject to

profit and loss sharing arrangements with the retailer (which are

recorded in revenues), and the remaining 37% are sales finance

receivables, which provide financing to customers in areas such

as electronics, recreation, medical and home improvement.

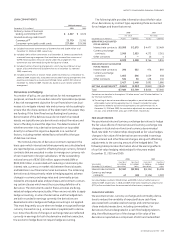

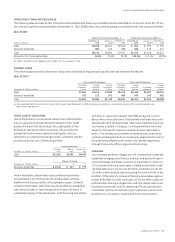

CREDIT QUALITY INDICATORS

Due to the primarily non-recourse nature of our Debt portfolio,

loan-to-value ratios provide the best indicators of the credit

quality of the portfolio. By contrast, the credit quality of the

Business properties portfolio is primarily influenced by the

strength of the borrower’s general credit quality, which is

reflected in our internal risk rating process, consistent with the

process we use for our Commercial portfolio.

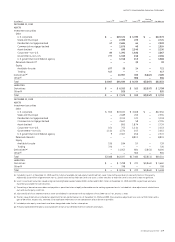

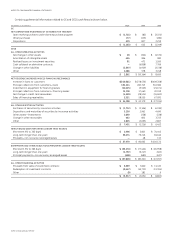

Loan-to-value ratio

Less than 80% to Greater than

December 31, 2010 (In millions) 80% 95% 95%

Debt $12,362 $9,392 $8,495

Internal risk rating

December 31, 2010 (In millions) A B C

Business properties $ 8,746 $ 437 $ 779

Within Real Estate, these financing receivables are primarily

concentrated in our North American and European Lending

platforms and are secured by various property types. Collateral

values for Real Estate—Debt financing receivables are updated at

least semi-annually, or more frequently for higher risk loans. A

substantial majority of the Real Estate—Debt financing receivables

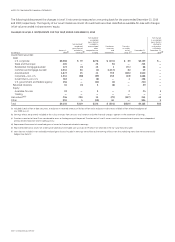

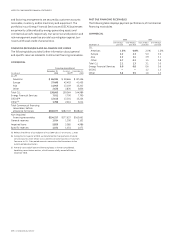

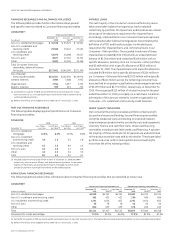

NONACCRUAL FINANCING RECEIVABLES

The following table provides further information about Real Estate financing receivables that are classified as nonaccrual. Of our $9,719 mil-

lion of nonaccrual financing receivables at December 31, 2010, $7,888 million are currently paying in accordance with their contractual terms.

REAL ESTATE

Nonaccrual financing receivables at Nonearning financing receivables at

December 31, January 1, December 31, December 31, January 1, December 31,

(Dollars in millions) 2010 2010

(a) 2009 2010 2010

(a) 2009

Debt $9,039 $6,342 $6,649 $ 961 $ 939 $ 939

Business properties 680 493 388 386 419 313

Total $9,719 $6,835 $7,037 $1,347 $1,358 $1,252

Allowance for losses percentage 15.3% 22.5% 21.2% 110.5% 113.1% 119.3%

(a) Reflects the effects of our adoption of ASU 2009-16 & 17 on January 1, 2010.

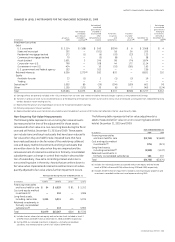

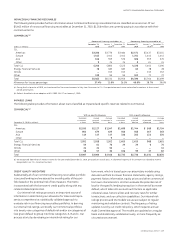

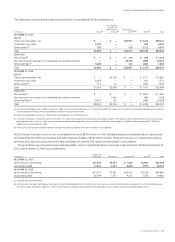

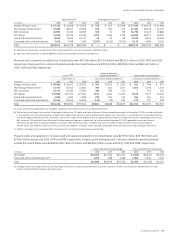

IMPAIRED LOANS

The following table provides information about loans classified as impaired and specific reserves related to Real Estate.

REAL ESTATE

(a)

With no specific allowance With a specific allowance

Recorded Unpaid Average Recorded Unpaid Average

investment principal investment investment principal Associated investment

December 31, 2010 (In millions) in loans balance in loans in loans balance allowance in loans

Debt $2,814 $2,873 $1,598 $6,323 $6,498 $1,007 $6,116

Business properties 191 213 141 489 476 143 382

Total $3,005 $3,086 $1,739 $6,812 $6,974 $1,150 $6,498

(a) We recognized $189 million of interest income for the year ended December 31, 2010, principally on a cash basis. A substantial majority of this amount related to our

Real Estate—Debt business.