GE 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.122 GE 2010 ANNUAL REPORT

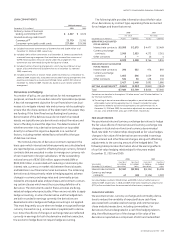

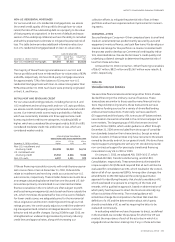

If the long-term credit rating of GECC were to fall below AA-/

Aa3 or its short-term credit rating were to fall below A-1+/P-1,

GECC would be required to provide approximately $1,508 mil-

lion to such entities as of December 31, 2010 pursuant to

letters of credit issued by GECC. To the extent that the entities’

liabilities exceed the ultimate value of the proceeds from the

sale of their assets and the amount drawn under the letters of

credit, GECC is required to provide such excess amount. As the

borrowings of these entities are already reflected in our con-

solidated Statement of Financial Position, there would be no

change in our debt if this were to occur. As of December 31,

2010, the carrying value of the liabilities of these entities’ was

$5,690 million and the fair value of their assets was $5,989 mil-

lion (which included net unrealized losses on investment

securities of $690 million). With respect to these investment

securities, we intend to hold them at least until such time as

their individual fair values exceed their amortized cost. We

have the ability to hold all such debt securities until maturity.

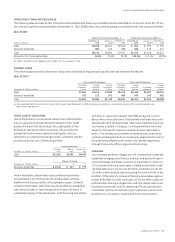

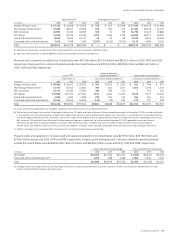

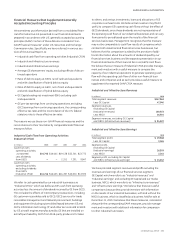

• Securitization QSPEs comprise previously off-book QSPEs that

were consolidated on January 1, 2010 in connection with our

adoption of ASU 2009-16 & 17. These entities were created to

facilitate securitization of financial assets and other forms of

asset-backed financing which serve as an alternative funding

source by providing access to the commercial paper and term

markets. The securitization transactions executed with these

entities are similar to those used by many financial institutions

and substantially all are non-recourse. We provide servicing

for substantially all of the assets in these entities.

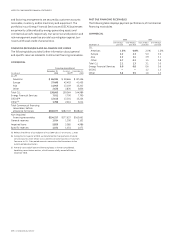

The financing receivables in these entities have similar risks

and characteristics to our other financing receivables and

were underwritten to the same standard. Accordingly, the

performance of these assets has been similar to our other

financing receivables; however, the blended performance of

the pools of receivables in these entities reflects the eligibility

criteria that we apply to determine which receivables are

selected for transfer. Contractually the cash flows from these

financing receivables must first be used to pay third-party

debt holders as well as other expenses of the entity. Excess

cash flows are available to GE. The creditors of these entities

have no claim on other assets of GE.

• Other remaining assets and liabilities of consolidated VIEs

relate primarily to five categories of entities: (1) enterprises we

acquired that had previously created asset-backed financing

entities to fund commercial real estate, middle-market and

equipment loans; we are the collateral manager for these

entities; (2) joint ventures that lease light industrial equipment

and that hold a limited partnership interest in certain media

properties; (3) entities that have executed on-balance sheet

securitizations of financial assets and of third-party trade

receivables; (4) insurance entities that, among other lines of

business, provide property and casualty and workers’ compen-

sation coverage for GE; and (5) other entities that are involved

in power generating, leasing and real estate activities.

that significantly determine the entity’s economic performance

as compared to other economic interest holders. This evaluation

requires consideration of all facts and circumstances relevant to

decision-making that affects the entity’s future performance and

the exercise of professional judgment in deciding which decision-

making rights are most important.

In determining whether we have the right to receive benefits

or the obligation to absorb losses that could potentially be signifi-

cant to the VIE, we evaluate all of our economic interests in the

entity, regardless of form (debt, equity, management and servic-

ing fees, and other contractual arrangements). This evaluation

considers all relevant factors of the entity’s design, including: the

entity’s capital structure, contractual rights to earnings (losses),

subordination of our interests relative to those of other investors,

contingent payments, as well as other contractual arrangements

that have potential to be economically significant. The evaluation

of each of these factors in reaching a conclusion about the poten-

tial significance of our economic interests is a matter that

requires the exercise of professional judgment.

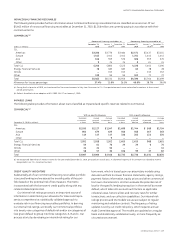

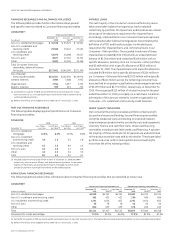

As of January 1, 2010 and subsequently, we evaluated all

entities that fall within the scope of the amended ASC 810 to

determine whether we were required to consolidate or deconsoli-

date them based on the approach described above. In addition to

the securitization QSPEs described above, we were required to

consolidate assets of VIEs related to direct investments in entities

that hold loans and fixed income securities, a media joint venture

and a small number of companies to which we have extended

loans in the ordinary course of business and have subsequently

been subject to a TDR. The incremental effect of these entities on

our total assets and liabilities, net of our investment in them, was

an increase of approximately $31,097 million and $33,042 million,

respectively, at January 1, 2010. There also was a net reduction of

total equity (including noncontrolling interests) of approximately

$1,945 million at January 1, 2010, principally related to the rever-

sal of previously recognized securitization gains as a cumulative

effect adjustment to retained earnings.

The assets of QSPEs that we consolidated were $29,792 mil-

lion, net of our existing retained interests of $8,782 million, and

liabilities were $31,616 million at January 1, 2010. Significant

assets of the QSPEs included net financing receivables and trade

receivables of $39,463 million and investment securities of

$1,015 million at January 1, 2010. Significant liabilities included

non-recourse borrowings of $36,112 million. The assets and

liabilities of other VIEs we consolidated were $1,305 million

and $1,426 million, respectively.

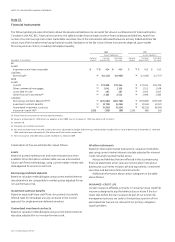

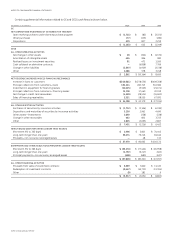

Consolidated Variable Interest Entities

We consolidate VIEs because we have the power to direct the

activities that significantly affect the VIEs’ economic performance,

typically because of our role as either servicer or manager for the

VIE. Our consolidated VIEs fall into three main groups, which are

further described below:

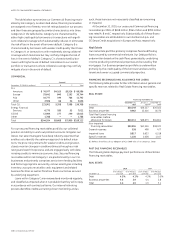

• Trinity is a group of sponsored special purpose entities that

holds investment securities, the majority of which are invest-

ment grade, and are funded by the issuance of GICs. These

entities were consolidated in 2003, and ceased issuing new

investment contracts beginning in the first quarter of 2010.