GE 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

62 GE 2010 ANNUAL REPORT

valuations, we used cash flows that reflected management’s

forecasts and discount rates that included risk adjustments con-

sistent with the current market conditions. Based on the results of

our step one testing, the fair values of each of the GE Industrial

reporting units and the CLL, Consumer, Energy Financial Services

and GECAS reporting units exceeded their carrying values; there-

fore, the second step of the impairment test was not required to

be performed and no goodwill impairment was recognized.

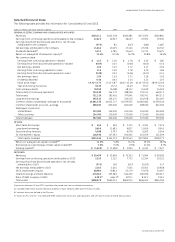

Our Real Estate reporting unit had a goodwill balance of

$1.1 billion at December 31, 2010. As of July 1, 2010, the carrying

amount exceeded the estimated fair value of our Real Estate

reporting unit by approximately $3.2 billion. The estimated fair

value of the Real Estate reporting unit is based on a number of

assumptions about future business performance and investment,

including loss estimates for the existing finance receivable and

investment portfolio, new debt origination volume and margins,

and anticipated stabilization of the real estate market allowing

for sales of real estate investments at normalized margins. Our

assumed discount rate was 12% and was derived by applying a

capital asset pricing model and corroborated using equity analyst

research reports and implied cost of equity based on forecasted

price to earnings per share multiples for similar companies. Given

the volatility and uncertainty in the current commercial real estate

environment, there is uncertainty about a number of assump-

tions upon which the estimated fair value is based. Different loss

estimates for the existing portfolio, changes in the new debt

origination volume and margin assumptions, changes in the

expected pace of the commercial real estate market recovery, or

changes in the equity return expectation of market participants

may result in changes in the estimated fair value of the Real Estate

reporting unit.

Based on the results of the step one testing, we performed the

second step of the impairment test described above. Based on

the results of the second step analysis for the Real Estate report-

ing unit, the estimated implied fair value of goodwill exceeded

the carrying value of goodwill by approximately $3.5 billion.

Accordingly, no goodwill impairment was required. In the sec-

ond step, unrealized losses in an entity’s assets have the effect of

increasing the estimated implied fair value of goodwill. The results

of the second step analysis were attributable to several factors.

The primary driver was the excess of the carrying value over the

estimated fair value of our Real Estate equity investments, which

approximated $6.3 billion at that time. Further information about

the Real Estate investment portfolio is provided in the Financial

Resources and Liquidity—Statement of Financial Position—All

Other Assets section. Other drivers for the favorable outcome

include the unrealized losses in the Real Estate finance receivable

portfolio and the fair value premium on the Real Estate reporting

unit allocated debt. The results of the second step analysis are

highly sensitive to these measurements, as well as the key

assumptions used in determining the estimated fair value of

the Real Estate reporting unit.

Estimating the fair value of reporting units requires the use of

estimates and significant judgments that are based on a number

of factors including actual operating results. If current conditions

persist longer or deteriorate further than expected, it is reason-

ably possible that the judgments and estimates described above

could change in future periods.

We review identified intangible assets with defined useful lives

and subject to amortization for impairment whenever events or

changes in circumstances indicate that the related carrying

amounts may not be recoverable. Determining whether an

impairment loss occurred requires comparing the carrying

amount to the sum of undiscounted cash flows expected to be

generated by the asset. We test intangible assets with indefinite

lives annually for impairment using a fair value method such as

discounted cash flows. For our insurance activities remaining in

continuing operations, we periodically test for impairment our

deferred acquisition costs and present value of future profits.

Further information is provided in the Financial Resources and

Liquidity—Goodwill and Other Intangible Assets section and in

Notes 1 and 8.

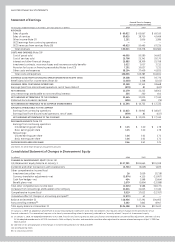

PENSION ASSUMPTIONS are significant inputs to the actuarial

models that measure pension benefit obligations and related

effects on operations. Two assumptions—discount rate

and expected return on assets—are important elements of plan

expense and asset/liability measurement. We evaluate these

critical assumptions at least annually on a plan and country-

specific basis. We periodically evaluate other assumptions

involving demographic factors, such as retirement age, mortality

and turnover, and update them to reflect our experience and

expectations for the future. Actual results in any given year will

often differ from actuarial assumptions because of economic

and other factors.

Accumulated and projected benefit obligations are measured

as the present value of future cash payments. We discount those

cash payments using the weighted average of market-observed

yields for high-quality fixed income securities with maturities that

correspond to the payment of benefits. Lower discount rates

increase present values and subsequent-year pension expense;

higher discount rates decrease present values and subsequent-

year pension expense.

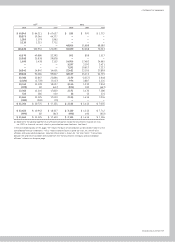

Our discount rates for principal pension plans at December 31,

2010, 2009 and 2008 were 5.28%, 5.78% and 6.11%, respectively,

reflecting market interest rates.

To determine the expected long-term rate of return on pen-

sion plan assets, we consider current and expected asset

allocations, as well as historical and expected returns on various

categories of plan assets. In developing future return expecta-

tions for our principal benefit plans’ assets, we evaluate general

market trends as well as key elements of asset class returns such

as expected earnings growth, yields and spreads. Assets in our

principal pension plans earned 13.5% in 2010, and had average

annual earnings of 4.1%, 7.9% and 9.5% per year in the 10-,

15- and 25-year periods ended December 31, 2010, respectively.

These average historical returns were significantly affected by

investment losses in 2008. Based on our analysis of future expec-

tations of asset performance, past return results, and our current

and expected asset allocations, we have assumed an 8.0%