GE 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 GE 2010 ANNUAL REPORT

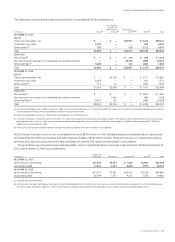

Investments in Unconsolidated Variable Interest Entities

Our involvement with unconsolidated VIEs consists of the follow-

ing activities: assisting in the formation and financing of the entity,

providing recourse and/or liquidity support, servicing the assets and

receiving variable fees for services provided. We are not required to

consolidate these entities because the nature of our involvement

with the activities of the VIEs does not give us power over decisions

that significantly affect their economic performance.

Unconsolidated VIEs at December 31, 2010 include our non-

controlling stake in PTL ($5,790 million); investments in real estate

entities ($2,071 million), which generally consist of passive limited

partnership investments in tax-advantaged, multi-family real estate

and investments in various European real estate entities; debt

investment fund ($1,877 million); and exposures to joint ventures

that purchase factored receivables ($1,596 million). Substantially all

of our other unconsolidated entities consist of passive investments

in various asset-backed financing entities.

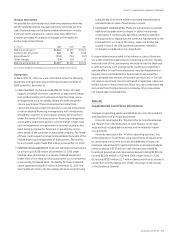

The largest unconsolidated VIE with which we are involved

is PTL, which is a truck rental and leasing joint venture. The total

consolidated assets and liabilities of PTL at December 31, 2008 were

$7,444 million and $1,339 million, respectively. As part of our strategy

to reduce our investment in the equipment management market, we

reduced our partnership interest in PTL from 79% at December 31,

2005 to 50.9% at December 31, 2008 through a series of dispositions

to Penske Truck Leasing Corporation (PTLC), the general partner of

PTL, and an entity affiliated with PTLC. In addition, in the first quarter

of 2009, we sold a 1% partnership interest in PTL, a previously con-

solidated VIE, to PTLC. The disposition of this partnership interest,

coupled with our resulting minority position on the PTL advisory

committee and related changes in our contractual rights, resulted in

the deconsolidation of PTL. We recognized a pre-tax gain on the sale

of $296 million, including a gain on the remeasurement of our

retained investment of $189 million. The transaction price was

determined on an arm’s-length basis and GE obtained a fairness

opinion from a third-party financial advisor because of the related-

party nature of the transaction. The measurement of the fair value of

our retained investment in PTL was based on a methodology that

incorporated both discounted cash flow information and market

data. In applying this methodology, we utilized different sources of

information, including actual operating results, future business plans,

economic projections and market observable pricing multiples of

similar businesses. The resulting fair value of our retained interest

reflected our position as a noncontrolling shareowner at the conclu-

sion of the transaction. At December 31, 2010, our remaining

investment in PTL of $5,790 million comprised a 49.9% partnership

interest of $935 million and loans and advances of $4,855 million.

GECC continues to provide loans under long-term revolving credit

and letter of credit facilities to PTL.

The classification of our variable interests in these entities in our

financial statements is based on the nature of the entity and the

type of investment we hold. Variable interests in partnerships and

corporate entities are classified as either equity method or cost

method investments. In the ordinary course of business, we also

make investments in entities in which we are not the primary ben-

eficiary but may hold a variable interest such as limited partner

interests or mezzanine debt investments. These investments are

classified in two captions in our financial statements: “All other

assets” for investments accounted for under the equity method,

and “Financing receivables—net” for debt financing provided to

these entities. Our investments in unconsolidated VIEs at

December 31, 2010 and 2009 follow.

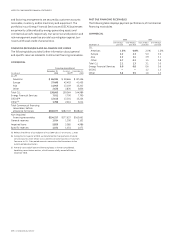

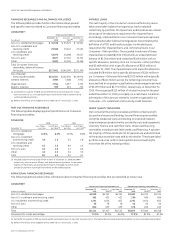

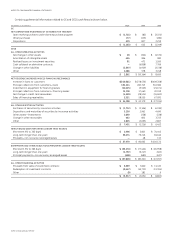

At

December 31, December 31,

(In millions) 2010 2009

Other assets and investment securities $10,375 $ 8,911

Financing receivables—net 2,240 769

Total investment 12,615 9,680

Contractual obligations to

fund new investments 1,990 1,396

Total $14,605 $11,076

In addition to the entities included in the table above, we also hold

passive investments in RMBS, CMBS and ABS issued by VIEs. Such

investments were, by design, investment grade at issuance and

held by a diverse group of investors. Further information about

such investments is provided in Note 3.

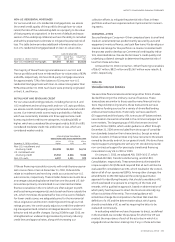

Note 25.

Commitments and Guarantees

Commitments

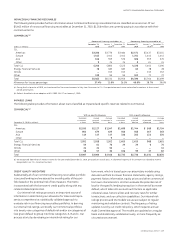

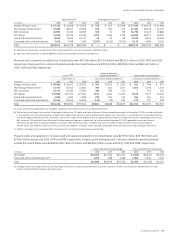

In our Aviation business of Technology Infrastructure, we had

committed to provide financing assistance on $1,128 million

of future customer acquisitions of aircraft equipped with our

engines, including commitments made to airlines in 2010 for

future sales under our GE90 and GEnx engine campaigns. The

GECAS business of GE Capital had placed multiple-year orders for

various Boeing, Airbus and other aircraft with list prices approxi-

mating $14,574 million and secondary orders with airlines for

used aircraft of approximately $790 million at December 31, 2010.

As of December 31, 2010, NBC Universal had certain commit-

ments to acquire film and television programming. On January 28,

2011, we transferred the NBCU business to a newly formed entity

and, as a result, these commitments are no longer ours. See

Note 2 for further discussion of the NBCU transaction.