GE 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 GE 2010 ANNUAL REPORT

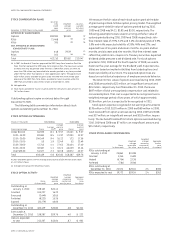

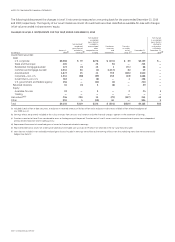

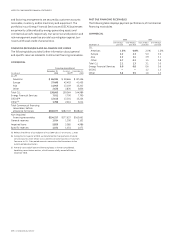

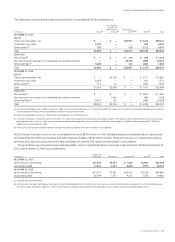

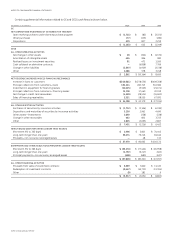

PAST DUE FINANCING RECEIVABLES

The following table displays payment performance of Commercial

financing receivables.

COMMERCIAL

2010 2009

Over 30 days Over 90 days Over 30 days Over 90 days

December 31 past due past due past due past due

CLL

Americas 1.3 % 0.8 % 2.1 % 1.5 %

Europe 4.2 2.3 5.0 3.0

Asia 2.2 1.4 3.9 3.1

Other 0.7 0.3 1.5 0.8

Total CLL 2.1 1.3 3.1 2.0

Energy Financial Services 0.9 0.8 0.6 0.6

GECAS — — 1.2 1.2

Other 5.8 5.5 1.6 1.3

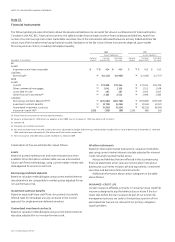

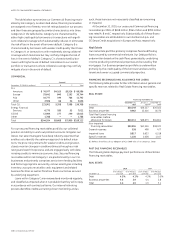

and factoring arrangements are secured by customer accounts

receivable, inventory, and/or machinery and equipment. The

portfolios in our Energy Financial Services and GECAS businesses

are primarily collateralized by energy generating assets and

commercial aircraft, respectively. Our senior secured position and

risk management expertise provide loss mitigation against bor-

rowers with weak credit characteristics.

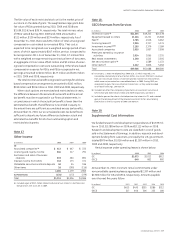

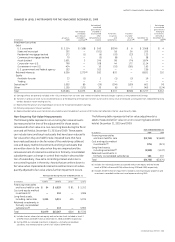

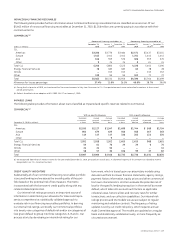

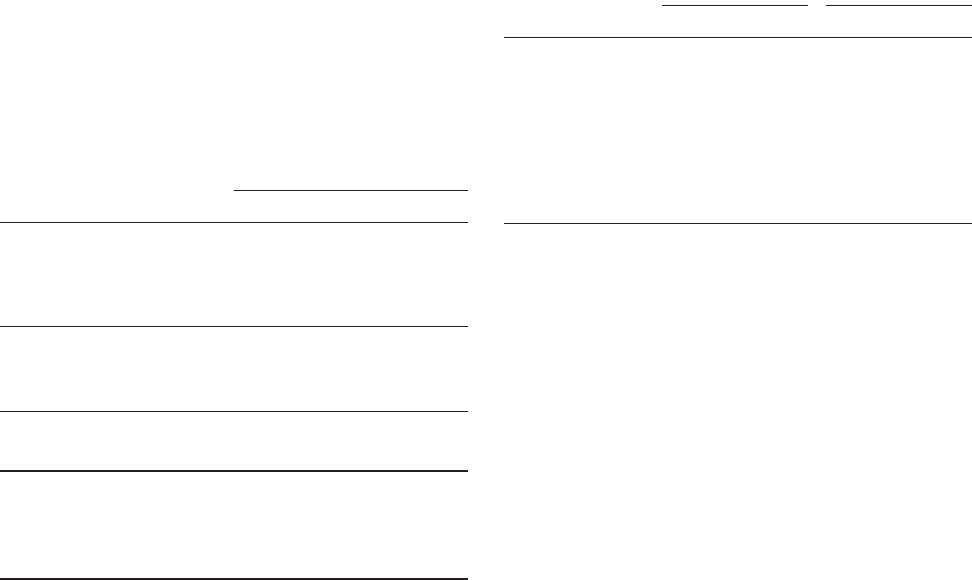

FINANCING RECEIVABLES AND ALLOWANCE FOR LOSSES

The following table provides further information about general

and specific reserves related to Commercial financing receivables.

COMMERCIAL

Financing receivables at

December 31, January 1, December 31,

(In millions) 2010 2010 (a) 2009

CLL (b)

Americas $ 86,596 $ 99,666 $ 87,496

Europe 37,498 43,403 41,455

Asia 11,943 13,159 13,202

Other 2,626 2,836 2,836

Total CLL 138,663 159,064 144,989

Energy Financial Services 7,011 7,790 7,790

GECAS (b) 12,615 13,254 13,254

Other

(c) 1,788 2,614 2,614

Total Commercial financing

receivables, before

allowance for losses $160,077 $182,722 $168,647

Non-impaired

financing receivables $154,257 $177,637 $163,661

General reserves 1,014 1,200 1,102

Impaired loans 5,820 5,085 4,986

Specific reserves 1,031 1,031 1,073

(a) Reflects the effects of our adoption of ASU 2009-16 & 17 on January 1, 2010.

(b) During the first quarter of 2010, we transferred the Transportation Financial

Services business from GECAS to CLL and the Consumer business in Italy from

Consumer to CLL. Prior-period amounts were reclassified to conform to the

current-period presentation.

(c) Primarily consisted of loans and financing leases in former consolidated,

liquidating securitization entities, which became wholly owned affiliates in

December 2010.