GE 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.management’s discussion and analsis

GE 2010 ANNUAL REPORT 35

composite effective interest rate was 3.1% in 2010, 3.5% in 2009

and 4.7% in 2008. In 2010, GECS average assets of $616.9 billion

were 3% lower than in 2009, which in turn were 4% lower than

in 2008. See the Liquidity and Borrowings section for a discus-

sion of liquidity, borrowings and interest rate risk management.

INCOME TAXES have a significant effect on our net earnings.

As a global commercial enterprise, our tax rates are affected by

many factors, including our global mix of earnings, the extent to

which those global earnings are indefinitely reinvested outside

the United States, legislation, acquisitions, dispositions and tax

characteristics of our income. Our tax returns are routinely

audited and settlements of issues raised in these audits some-

times affect our tax provisions.

GE and GECS file a consolidated U.S. federal income tax return.

This enables GE to use GECS tax deductions and credits to reduce

the tax that otherwise would have been payable by GE.

Our consolidated income tax rate is lower than the U.S. statu-

tory rate primarily because of benefits from lower-taxed global

operations, including the use of global funding structures, and our

2009 and 2008 decisions to indefinitely reinvest prior-year earn-

ings outside the U.S. There is a benefit from global operations as

non-U.S. income is subject to local country tax rates that are

significantly below the 35% U.S. statutory rate. These non-U.S.

earnings have been indefinitely reinvested outside the U.S. and

are not subject to current U.S. income tax. The rate of tax on our

indefinitely reinvested non-U.S. earnings is below the 35% U.S.

statutory rate because we have significant business operations

subject to tax in countries where the tax on that income is lower

than the U.S. statutory rate and because GE funds the majority of

its non-U.S. operations through foreign companies that are sub-

ject to low foreign taxes.

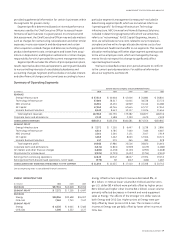

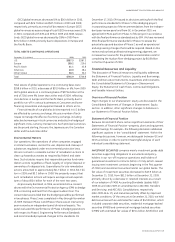

Income taxes (benefit) on consolidated earnings from continu-

ing operations were 7.4% in 2010 compared with (11.5)% in 2009

and 5.6% in 2008. We expect our consolidated effective tax rate to

increase in 2011 in part because we expect a high effective tax

rate on the pre-tax gain on the NBCU transaction with Comcast

(more than $3 billion) discussed in Note 2.

We expect our ability to benefit from non-U.S. income taxed at

less than the U.S. rate to continue, subject to changes of U.S. or

foreign law, including, as discussed in Note 14, the possible expi-

ration of the U.S. tax law provision deferring tax on active financial

services income. In addition, since this benefit depends on man-

agement’s intention to indefinitely reinvest amounts outside the

U.S., our tax provision will increase to the extent we no longer

indefinitely reinvest foreign earnings.

Our benefits from lower-taxed global operations declined to

$2.8 billion in 2010 from $4.0 billion in 2009 principally because of

lower earnings in our operations subject to tax in countries where

the tax on that income is lower than the U.S. statutory rate, and

from losses for which there was not a full tax benefit. These

decreases also reflected management’s decision in 2009 to indefi-

nitely reinvest prior year earnings outside the U.S. The benefit

from lower-taxed global operations increased in 2010 by $0.4 bil-

lion due to audit resolutions. To the extent global interest rates

and non-U.S. operating income increase we would expect tax

benefits to increase, subject to management’s intention to

indefinitely reinvest those earnings.

Our benefits from lower-taxed global operations included the

effect of the lower foreign tax rate on our indefinitely reinvested

non-U.S. earnings which provided a tax benefit of $2.0 billion in

2010 and $3.0 billion in 2009. The tax benefit from non-U.S.

income taxed at a local country rather than the U.S. statutory tax

rate is reported in the effective tax rate reconciliation in the line

“Tax on global earnings including exports.”

Our benefits from lower-taxed global operations declined to

$4.0 billion in 2009 from $5.1 billion in 2008 (including in each

year a benefit from the decision to indefinitely reinvest prior year

earnings outside the U.S.) principally because of lower earnings in

our operations subject to tax in countries where the tax on that

income is lower than the U.S. statutory rate. These decreases

were partially offset by management’s decision in 2009 to indefi-

nitely reinvest prior-year earnings outside the U.S. that was larger

than the 2008 decision to indefinitely reinvest prior-year earnings

outside the U.S.

Our consolidated income tax rate increased from 2009 to 2010

primarily because of an increase during 2010 of income in higher-

taxed jurisdictions. This decreased the relative effect of our tax

benefits from lower-taxed global operations. In addition, the

consolidated income tax rate increased from 2009 to 2010 due to

the decrease, discussed above, in the benefit from lower-taxed

global operations. These effects were partially offset by an increase

in the benefit from audit resolutions, primarily a decrease in the

balance of our unrecognized tax benefits from the completion of

our 2003–2005 audit with the IRS.

Cash income taxes paid in 2010 were $2.7 billion, reflecting the

effects of changes to temporary differences between the carrying

amount of assets and liabilities and their tax bases.

Our consolidated income tax rate decreased from 2008 to

2009 primarily because of a reduction during 2009 of income in

higher-taxed jurisdictions. This increased the relative effect of our

tax benefits from lower-taxed global operations, including the

decision, discussed below, to indefinitely reinvest prior-year

earnings outside the U.S. These effects were partially offset by

a decrease from 2008 to 2009 in the benefit from lower-taxed

earnings from global operations.

A more detailed analysis of differences between the U.S.

federal statutory rate and the consolidated rate, as well as other

information about our income tax provisions, is provided in

Note 14. The nature of business activities and associated income

taxes differ for GE and for GECS and a separate analysis of each is

presented in the paragraphs that follow.

Because GE tax expense does not include taxes on GECS

earnings, the GE effective tax rate is best analyzed in relation to

GE earnings excluding GECS. GE pre-tax earnings from continuing

operations, excluding GECS earnings from continuing operations,

were $12.0 billion, $12.6 billion and $14.2 billion for 2010, 2009 and

2008, respectively. On this basis, GE’s effective tax rate was 16.8%

in 2010, 21.8% in 2009 and 24.2% in 2008.