GE 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2010 ANNUAL REPORT 107

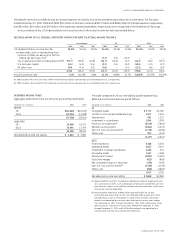

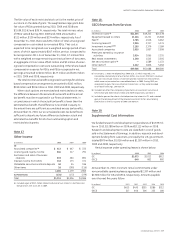

Note 18.

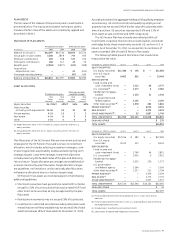

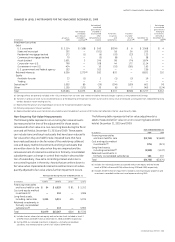

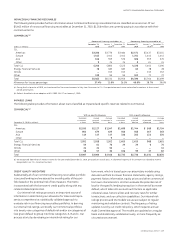

GECS Revenues from Services

(In millions) 2010 2009 2008

Interest on loans

(a) $21,344 $19,205 $26,378

Equipment leased to others 11,116 12,231 15,568

Fees (a) 4,785 4,516 6,062

Financing leases

(a) 2,805 3,317 4,374

Investment income

(a)(b) 2,185 3,379 2,189

Associated companies 2,035 1,007 2,058

Premiums earned by insurance

activities 2,014 2,065 2,255

Real estate investments 1,240 1,543 3,505

Net securitization gains

(a) — 1,589 1,133

Other items

(c) 2,442 2,836 5,058

Total $49,966 $51,688 $68,580

(a) On January 1, 2010, we adopted ASU 2009-16 & 17, which required us to

consolidate substantially all of our former QSPEs. As a result, 2010 GECS revenues

from services include interest, investment and fee income from these entities,

which were not presented on a consolidated basis in 2009. During 2010, we

recognized no gains from securitization transactions, as they were recorded

as on-book financings. See Note 24.

(b) Included net other-than-temporary impairments on investment securities of

$253 million and $581 million in 2010 and 2009, respectively. See Note 3.

(c) Included a gain on the sale of a limited partnership interest in PTL and a related

gain on the remeasurement of the retained investment to fair value totaling

$296 million in the first quarter of 2009. See Note 24.

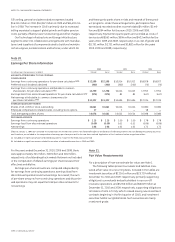

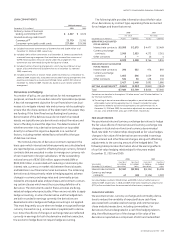

Note 19.

Supplemental Cost Information

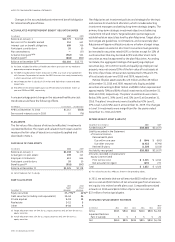

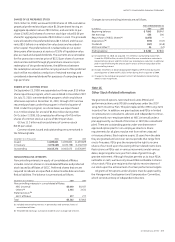

We funded research and development expenditures of $3,939 mil-

lion in 2010, $3,288 million in 2009 and $3,113 million in 2008.

Research and development costs are classified in cost of goods

sold in the Statement of Earnings. In addition, research and devel-

opment funding from customers, principally the U.S. government,

totaled $979 million, $1,050 million and $1,287 million in 2010,

2009 and 2008, respectively.

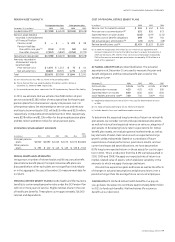

Rental expense under operating leases is shown below.

(In millions) 2010 2009 2008

GE $1,073 $1,012 $912

GECS 640 802 992

At December 31, 2010, minimum rental commitments under

noncancellable operating leases aggregated $2,397 million and

$2,380 million for GE and GECS, respectively. Amounts payable

over the next five years follow.

(In millions) 2011 2012 2013 2014 2015

GE $613 $470 $355 $286 $212

GEC S 517 4 66 30 6 223 18 0

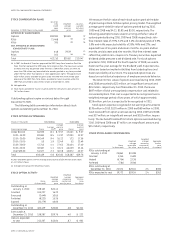

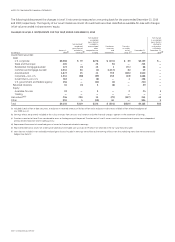

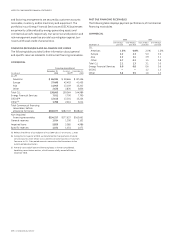

The fair value of each restricted stock unit is the market price of

our stock on the date of grant. The weighted average grant date

fair value of RSUs granted during 2010, 2009 and 2008 was

$15.89, $13.63 and $28.74, respectively. The total intrinsic value

of RSUs vested during 2010, 2009 and 2008 amounted to

$111 million, $139 million and $274 million, respectively. As of

December 31, 2010, there was $334 million of total unrecognized

compensation cost related to nonvested RSUs. That cost is

expected to be recognized over a weighted average period of two

years, of which approximately $147 million, pre tax, is expected to

be recognized in 2011. As of December 31, 2010, 0.7 million PSUs

with a weighted average remaining contractual term of two years,

an aggregate intrinsic value of $13 million and $2 million of unrec-

ognized compensation cost were outstanding. Other share-based

compensation expense for RSUs and PSUs recognized in net

earnings amounted to $116 million, $127 million and $155 million

in 2010, 2009 and 2008, respectively.

The total income tax benefit recognized in earnings for all share-

based compensation arrangements amounted to $143 million,

$118 million and $106 million in 2010, 2009 and 2008, respectively.

When stock options are exercised and restricted stock vests,

the difference between the assumed tax benefit and the actual

tax benefit must be recognized in our financial statements. In

circumstances in which the actual tax benefit is lower than the

estimated tax benefit, that difference is recorded in equity, to

the extent there are sufficient accumulated excess tax benefits.

At December 31, 2010, our accumulated excess tax benefits are

sufficient to absorb any future differences between actual and

estimated tax benefits for all of our outstanding option and

restricted stock grants.

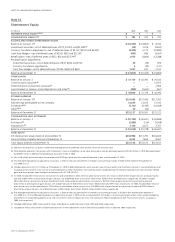

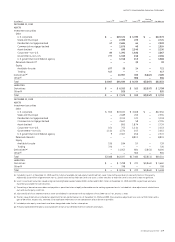

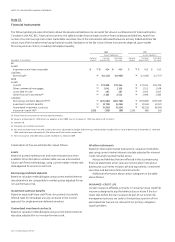

Note 17.

Other Income

(In millions) 2010 2009 2008

GE

Associated companies

(a) $ 413 $ 667 $ 332

Licensing and royalty income 364 217 291

Purchases and sales of business

interests 319 363 891

Interest income from GECS 133 173 371

Marketable securities and bank deposits 40 54 196

Other items 16 (295) (116)

1,285 1,179 1,965

ELIMINATIONS (134) (173) (379)

Total $1,151 $1,006 $1,586

(a) Included a gain of $552 million related to dilution of our interest in A&E Television

Network from 25% to 15.8% in 2009.