GE 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s discussion and analsis

GE 2010 ANNUAL REPORT 41

services orders of $11.7 billion scheduled for 2011 delivery.

Comparable December 31, 2009, total backlog was $37.9 billion,

of which $26.0 billion was for unfilled product orders and $11.9 bil-

lion, for product services orders. See Corporate Items and

Eliminations for a discussion of items not allocated to this segment.

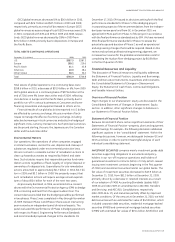

NBC UNIVERSAL revenues of $16.9 billion increased 9%, or

$1.5 billion, in 2010 as higher revenues in our broadcast televi-

sion business ($0.7 billion), lower impairments related to

associated companies and investment securities ($0.5 billion),

higher revenues in film ($0.3 billion), higher revenues in cable

($0.4 billion) and higher revenues in parks ($0.2 billion) were

partially offset by the lack of a current year counterpart to a

2009 gain related to A&E Television Network (AETN) ($0.6 billion).

The increase in broadcast revenues reflects the 2010 Olympic

broadcasts, partially offset by the absence of revenues from the

2009 Super Bowl broadcast. Segment profit of $2.3 billion was

unchanged from 2009, as lower gains related to associated

companies ($0.7 billion) and lower earnings in our broadcast

television business ($0.3 billion) were offset by lower impair-

ments related to associated companies and investment

securities ($0.5 billion), higher earnings in cable ($0.3 billion),

higher earnings in film ($0.2 billion) and higher earnings in parks

($0.1 billion). The decrease in broadcast television earnings

reflects losses from the Olympics broadcast, partially offset by

the lack of losses related to the 2009 Super Bowl broadcast.

NBC Universal revenues decreased 9%, or $1.5 billion, in 2009

as lower revenues in our broadcast television business ($1.1 bil-

lion), reflecting the lack of a current-year counterpart to the 2008

Olympics broadcasts and the effects of lower advertising rev-

enues, lower revenues in film ($0.8 billion) and lower earnings and

higher impairments related to associated companies and investment

securities ($0.4 billion) were partially offset by the gain relating

to AETN ($0.6 billion) and higher revenues in cable ($0.3 billion).

Segment profit of $2.3 billion decreased 28%, or $0.9 billion, as

lower earnings in film ($0.6 billion), lower earnings and higher

impairments related to associated companies and investment

securities ($0.4 billion), lack of a current-year counterpart to 2008

proceeds from insurance claims ($0.4 billion) and lower earnings

in our broadcast television business ($0.2 billion) were partially

offset by the gain related to AETN ($0.6 billion) and higher earnings

in cable ($0.2 billion). See Corporate Items and Eliminations for a

discussion of items not allocated to this segment.

On January 28, 2011, we transferred the assets of the NBCU

business and Comcast Corporation (Comcast) transferred certain

of its assets comprising cable networks, regional sports networks,

certain digital properties and certain unconsolidated investments

to a newly formed entity, NBC Universal LLC (NBCU LLC). In con-

nection with the transaction, we received cash from Comcast of

$6.2 billion and a 49% interest in NBCU LLC. Comcast holds the

remaining 51% interest in NBCU LLC. Our NBC Universal business

was classified as held for sale at December 31, 2010 and 2009. For

additional information, see Note 2.

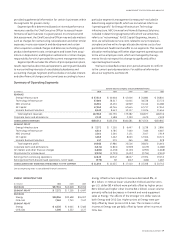

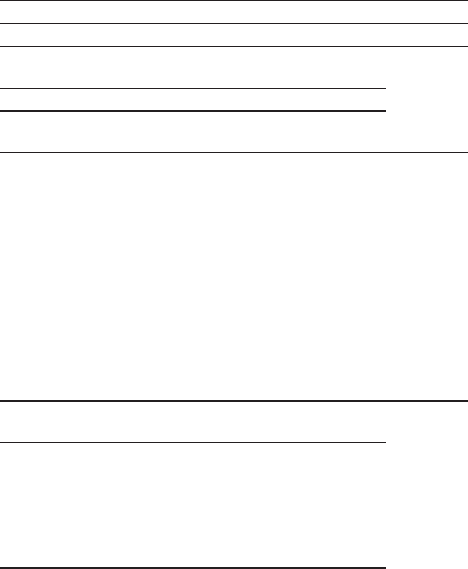

GE CAPITAL

(In millions) 2010 2009 2008

REVENUES $ 47,040 $ 49,746 $67,645

SEGMENT PROFIT $ 3,265 $ 1,462 $ 8,063

December 31 (In millions) 2010 2009

TOTAL ASSETS $575,908 $607,707

(In millions) 2010 2009 2008

REVENUES

CLL (a) $ 18,447 $ 20,762 $26,856

Consumer (a) 17,822 17,634 24,177

Real Estate 3,744 4,009 6,646

Energy Financial Services 1,957 2,117 3,707

GECAS (a) 5,127 4,594 4,688

SEGMENT PROFIT (LOSS)

CLL (a) $ 1,554 $ 963 $ 1,838

Consumer (a) 2,629 1,419 3,623

Real Estate (1,741) (1,541) 1,144

Energy Financial Services 367 212 825

GECAS (a) 1,195 1,016 1,140

December 31 (In millions) 2010 2009

TOTAL ASSETS

CLL (a) $202,650 $210,742

Consumer (a) 154,469 160,494

Real Estate 72,630 81,505

Energy Financial Services 19,549 22,616

GECAS (a) 49,106 48,178

(a) During the first quarter of 2010, we transferred the Transportation Financial

Services business from GECAS to CLL and the Consumer business in Italy from

Consumer to CLL. Prior-period amounts were reclassified to conform to the

current-period presentation.

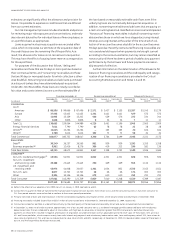

GE Capital revenues decreased 5% and net earnings increased

123% in 2010 as compared with 2009. Revenues for 2010 and

2009 included $0.2 billion and $0.1 billion of revenues from

acquisitions, respectively, and in 2010 were increased by

$0.1 billion and in 2009 were reduced by $2.3 billion as a result

of dispositions, including the effects of the 2010 deconsolidation

of Regency Energy Partners L.P. (Regency) and the 2009 decon-

solidation of Penske Truck Leasing Co., L.P. (PTL). The 2010

deconsolidation of Regency included a $0.1 billion gain on the

sale of our general partnership interest in Regency and remea-

surement of our retained investment (the Regency transaction).

Revenues for 2010 also decreased $0.7 billion compared with

2009 as a result of organic revenue declines primarily driven by

a lower asset base and a lower interest rate environment, par-

tially offset by the weaker U.S. dollar. Net earnings increased for

2010 compared with 2009, primarily due to lower provisions

for losses on financing receivables, lower selling, general and

administrative costs and the gain on the Regency transaction,

offset by higher marks and impairments, mainly at Real Estate,

the absence of the first quarter 2009 tax benefit from the deci-

sion to indefinitely reinvest prior-year earnings outside the U.S.,

and the absence of the first quarter 2009 gain related to the

PTL sale. GE Capital net earnings in 2010 also included restruc-

turing, rationalization and other charges of $0.2 billion and net

losses of $0.1 billion related to our Treasury operations.