GE 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

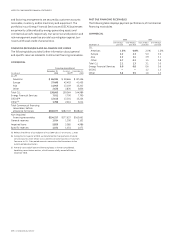

112 GE 2010 ANNUAL REPORT

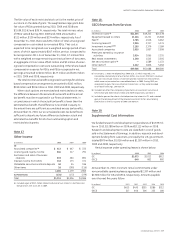

Note 22.

Financial Instruments

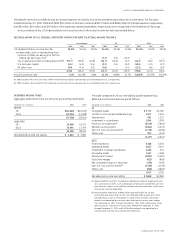

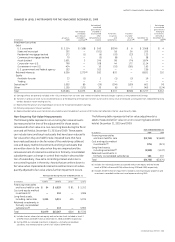

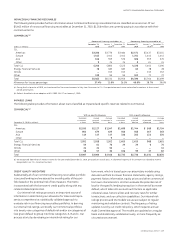

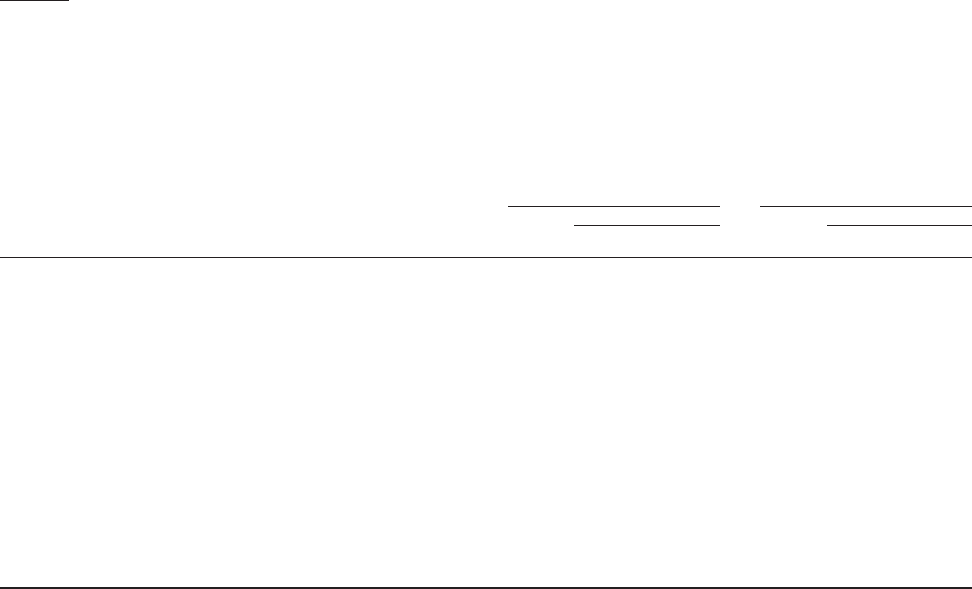

The following table provides information about the assets and liabilities not carried at fair value in our Statement of Financial Position.

Consistent with ASC 825, Financial Instruments, the table excludes finance leases and non-financial assets and liabilities. Apart from

certain of our borrowings and certain marketable securities, few of the instruments discussed below are actively traded and their fair

values must often be determined using financial models. Realization of the fair value of these instruments depends upon market

forces beyond our control, including marketplace liquidity.

2010 2009

Assets (liabilities) Assets (liabilities)

Notional Carrying Estimated Notional Carrying Estimated

December 31 (In millions) amount amount (net) fair value amount amount (net) fair value

GE

Assets

Investments and notes receivable $

(a) $ 414 $ 414 $

(a) $ 412 $ 412

Liabilities

Borrowings(c) (a) (10,112) (10,953) (a) (12,185) (12,757)

GECS

Assets

Loans(b) (a) 273,969 270,344 (a) 273,263 259,799

Other commercial mortgages (a) 1,041 1,103 (a) 1,151 1,198

Loans held for sale (a) 287 287 (a) 1,303 1,343

Other financial instruments(d) (a) 2,103 2,511 (a) 2,096 2,385

Liabilities

Borrowings and bank deposits(b)(c)(e) (a) (470,562) (482,765) (a) (493,585) (499,409)

Investment contract benefits (a) (3,726) (4,264) (a) (3,940) (4,397)

Guaranteed investment contracts (a) (5,502) (5,524) (a) (8,310) (8,394)

Insurance—credit life(f) 1,825 (103) (69) 1,595 (80) (53)

(a) These financial instruments do not have notional amounts.

(b) Amounts at December 31, 2010 reflect our adoption of ASU 2009-16 & 17 on January 1, 2010. See Notes 6, 10, 23 and 24.

(c) See Note 10.

(d) Principally cost method investments.

(e) Fair values exclude interest rate and currency derivatives designated as hedges of borrowings. Had they been included, the fair value of borrowings at December 31, 2010 and

2009 would have been reduced by $4,298 million and $2,856 million, respectively.

(f) Net of reinsurance of $2,800 million at both December 31, 2010 and 2009.

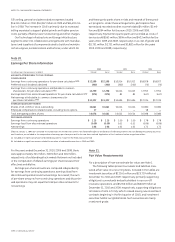

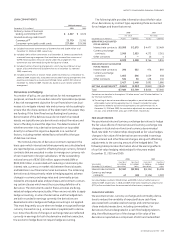

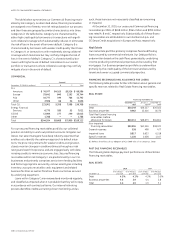

All other instruments

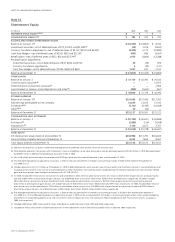

Based on observable market transactions, valuation methodolo-

gies using current market interest rate data adjusted for inherent

credit risk and/or quoted market prices.

Assets and liabilities that are reflected in the accompanying

financial statements at fair value are not included in the above

disclosures; such items include cash and equivalents, investment

securities and derivative financial instruments.

Additional information about certain categories in the table

above follows.

INSURANCE—CREDIT LIFE

Certain insurance affiliates, primarily in Consumer, issue credit life

insurance designed to pay the balance due on a loan if the bor-

rower dies before the loan is repaid. As part of our overall risk

management process, we cede to third parties a portion of this

associated risk, but are not relieved of our primary obligation

to policyholders.

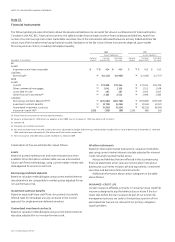

A description of how we estimate fair values follows.

Loans

Based on quoted market prices and recent transactions when

available. When this data is unobservable, we use a discounted

future cash flows methodology, using current market interest rate

data adjusted for inherent credit risk.

Borrowings and bank deposits

Based on valuation methodologies using current market interest

rate data which are comparable to market quotes adjusted for our

non-performance risk.

Investment contract benefits

Based on expected future cash flows, discounted at currently

offered rates for immediate annuity contracts or the income

approach for single premium deferred annuities.

Guaranteed investment contracts

Based on valuation methodologies using current market interest

rate data, adjusted for our non-performance risk.