EasyJet 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc

Annual report and accounts 2008

Business review

continued

OverviewDirectors’ reportReport on Directors’ remunerationFinancial informationOther information

07

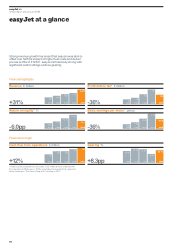

Focus on margins

easyJet remains focused on margin improvement and, in order to limit

further margin dilution over the winter, has withdrawn several lower

yielding flights in those hours of the day and days of the week where

consumer demand is weak thereby reducing aircraft utilisation

compared to last winter.

A key element of revenue enhancement is the continued development

of easyJet’s ancillary revenue stream. The checked bag charge, introduced

during the year, has quickly become a strong contributor to total revenue.

Speedy Boarding and Speedy Boarding Plus are recognised as valuable

customer offerings generating consistently good revenue. A significant

step in the development of inflight revenues was the transfer of the

service provision to Gate Gourmet at the end of last year. Subsequently,

revenues have improved and the next stage of development, the

introduction of electronic point of sale equipment onboard, will further

enhance the inflight revenue stream. Partner revenues continue to improve

and of particular note this year was the improvement in insurance

revenues following changes such as the introduction of annual, multi-trip,

and one-way policies and enhancement of the website presentation.

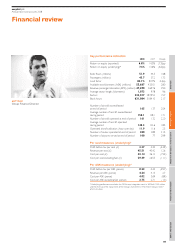

The cost environment continued to be challenging with above inflationary

increases in airport charges at Gatwick, Stansted, Paris and Amsterdam.

Despite this, easyJet has delivered an improvement in cost per available

seat kilometre excluding fuel and currency impacts. easyJet’s low cost

and efficient operation is a key competitive advantage and continued

aggressive cost management is vital to easyJet’s future success and thus

easyJet has put in place clear targets for further cost reduction over the

next three years in the areas of ownership, maintenance, crew and fuel

burn. These initiatives are expected to deliver more than £100 million

of savings by 2011. easyJet made 60 head office staff redundant in

September 2008, this and other overhead rationalisation will result

in annual savings of £6 million.

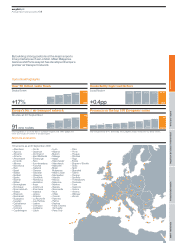

In the past year easyJet has further strengthened its network by the

integration of GB Airways which has given easyJet the leading position

at Gatwick with its large and affluent catchment area. easyJet now has

35 aircraft based at Gatwick.

easyJet’s expansion in mainland Europe in 2008 has been derived

from organic growth with capacity, measured by seats flown, in the year

increasing by 31% focusing on the key markets of France, Italy and Spain.

Network performance

easyJet continues to manage its network performance by optimising

routes, actively managing yields through its proprietary yield management

system and continuing to focus on a broad range of customer groups.

During the year, 24 underperforming routes were closed and it was

announced that Dortmund would be closed as a base in October.

In the UK, the summer performance was pleasing with particular strength

at Gatwick and Newcastle. Yields at Belfast remained challenging, however,

it is pleasing that customers continue to prefer easyJet with load factors

being significantly ahead of the competition on key overlapping routes.

Over the past year, easyJet continued the development of its business

in Italy. 11 aircraft are now based at Milan Malpensa covering a network

of 21 destinations including domestic routes such as Naples, Palermo

and Bari. easyJet has now displaced Alitalia to become the number

one short-haul airline at Malpensa.

In the year, two new bases were opened in France, one at Paris Charles

de Gaulle and one at Lyon. There are now 12 aircraft operating out of

the French bases, further developing market share and consolidating

easyJet’s position as France’s premier low fares carrier.

Performance of the Madrid base has been challenging but has improved

during the year as weaker competitors have started to consolidate

and withdraw capacity.

Switzerland continues to be an important market for easyJet where

it holds the leading position at Basel and Geneva.