EasyJet 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc

Annual report and accounts 2008

Notes to the

financial statements

continued

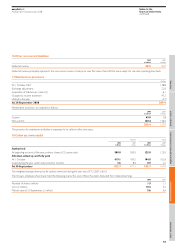

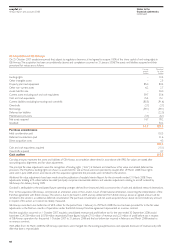

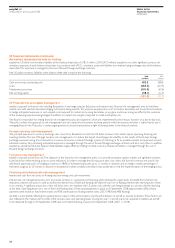

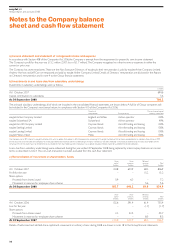

Derivatives designated as cash flow hedges

All derivatives to which hedge accounting is applied are designated as cash flow hedges, with only the intrinsic value being designated for option instruments.

Changes in fair value are recognised directly in shareholders’ funds, to the extent that they are effective, with the ineffective portion being recognised in the

income statement.

Where the hedged item results in a non-financial asset or liability, the accumulated gains and losses previously recognised in shareholders’ funds are included

in the carrying value of that asset or liability. Otherwise accumulated gains and losses are recognised in the income statement in the same period in which

the hedged items affects the income statement.

easyJet uses forward contracts and zero cost collars to hedge transaction currency risk, jet fuel price risk and surplus euro and Swiss franc monetary

balances. Transaction currency risk includes capital expenditure, lease payments, debt repayments and fuel payments. Where these hedges are assessed

as highly effective, gains and losses are deferred in shareholders’ funds and transferred to the income statement or cost of property, plant and equipment

when the related cash flow occurs.

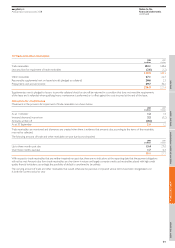

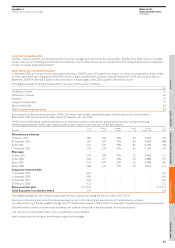

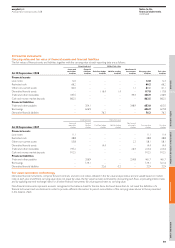

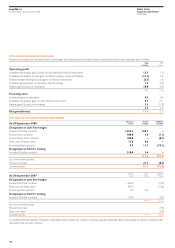

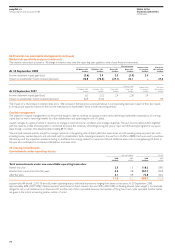

The cumulative net gains/(losses) deferred in shareholders’ funds and their expected maturities are as follows:

Within 1 year 1–2 years Total

At 30 September 2008 £million £million £million

Hedges of transaction currency risk 86.0 15.7 101.7

Hedges of jet fuel price risk (67.3) 3.8 (63.5)

18.7 19.5 38.2

Related deferred tax (10.6)

Net gains 27.6

Within 1 year 1–2 years Total

At 30 September 2007 £million £million £million

Hedges of transaction currency risk (25.8) (6.1) (31.9)

Hedges of jet fuel price risk 14.4 – 14.4

(11.4) (6.1) (17.5)

Related deferred tax 3.8

Net losses (13.7)

The amount deferred and recognised in shareholders’ funds during each financial year is disclosed in note 20.

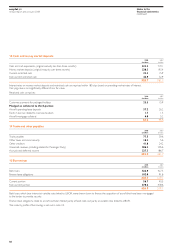

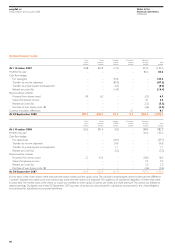

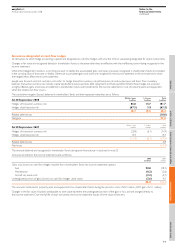

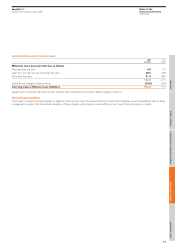

Amounts recorded in the income statement were as follows:

2008 2007

£million £million

Gains and (losses) on cash flow hedges recycled from shareholders’ funds into income statement captions:

Fuel 90.0 (29.3)

Maintenance (0.2) (0.6)

Aircraft dry lease costs (2.2) (4.7)

Undesignated portion of gains/(losses) on cash flow hedges (time value) (2.6) 4.5

85.0 (30.1)

The amount transferred to property, plant and equipment from shareholders’ funds during the period is a loss of £0.3 million (2007: gain of £1.1 million).

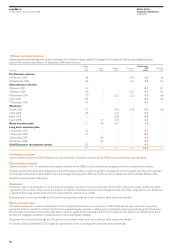

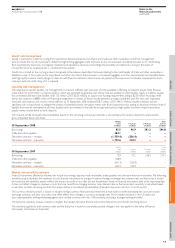

Changes in the fair value of options attributable to time value represent the undesignated portion of the gain or loss and are charged directly to

the income statement. Over the full life of each instrument, the income statement impact of time value will be zero.

71

OverviewDirectors’ reportReport on Directors’ remunerationFinancial informationOther information