EasyJet 2008 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

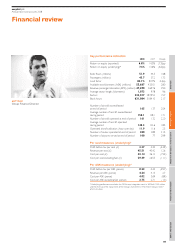

Profit before tax and return on equity

Reported profit before tax for 2008 was £110.2 million; after excluding

the one-off integration costs related to the acquisition of GB Airways,

underlying profit before tax was £123.1 million. This is a fall of

£68.2 million from the underlying profit before tax in 2007, despite

the fuel bill rising £283.2 million. With total revenue per seat increasing

by 12.6% and total cost per seat increasing by 19.4% profit margin

dropped by 5.4pp to 5.2%. The effective tax rate for the year was

broadly unchanged at 24.5% compared to 24.6% in 2007. For 2009

the effective tax rate is expected to be in line with the current year.

Reported return on equity for the year was 6.8%; excluding the one-off

integration costs in relation to GB Airways the underlying return was

7.6%. This is a fall of 6.0pp compared to the underlying return in 2007

of 13.6%. The Board has set return on equity as its key financial measure

as it best represents the return attributable to shareholders; the medium

term average target for this return is 15% and despite the drop in the

return this year and the prospect of challenging times ahead the Board

believes that this return continues to be the appropriate and achievable

medium term target.

Summary balance sheet

2008 2007 Change

£million £million £million

Property, plant and equipment 1,102.6 935.8 166.8

Other non-current assets 578.2 414.2 164.0

1,680.8 1,350.0 330.8

Net working capital (300.6) (326.9) 26.3

Cash and cash equivalents 632.2 719.1 (86.9)

Money market deposits 230.3 193.4 36.9

Borrowings (626.9) (519.1) (107.8)

Other non-current liabilities (337.6) (264.1) (73.5)

Net assets 1,278.2 1,152.4 125.8

Share capital and premium 745.9 738.7 7.2

Reserves 532.3 413.7 118.6

1,278.2 1,152.4 125.8

Net assets increased by £125.8 million to £1,278.2 million due to the

profit after tax and the increase in the fair value of cash flow hedges

net of deferred tax.

The net increase in property, plant and equipment in the year was

£166.8 million. Additions in respect of new aircraft delivered, the fair

value of GB Airways aircraft acquired, pre-delivery deposits for future

deliveries and non aircraft assets totalled £407.4 million, this was offset

by depreciation in the year of £44.4 million and a transfer to assets held

for sale of £195.8 million for the seven Airbus A321s and five Airbus

A319s put up for sale prior to year end. These assets held for sale are

included in net working capital above.

easyJet plc

Annual report and accounts 2008

Financial review

continued

Maintenance cost per seat at constant currency was up £0.57 or 25.9%

compared to 2007. This increase in costs reflects the increase in support

costs as the average age of components increases, annual contracted price

escalation, the inclusion of significantly higher GB Airways maintenance

costs, the insourcing of the maintenance planning function and, as mentioned

in last year’s annual report, the 2007 one-off adjustment to provisions

resulting from the ten year engine maintenance deal agreed with GE.

On an ongoing basis the GB Airways higher costs will reduce as those

aircraft exit the fleet over the next 18 months and the GE maintenance

deal and the insourcing of the planning function both deliver future

benefits. In addition, the move to a higher percentage owned fleet

will reduce cost per seat.

Merchant fees and commissions on a cost per seat basis, at

constant currency, increased by £0.16 or 35.1% compared to 2007.

This increase was driven by a change in the commercial terms on

which merchant fees were paid resulting in a corresponding increase

in interest receivable.

Ownership cost per seat at constant currency was up £0.32 or 13.3%

compared to 2007. After adjusting for the 2007 benefit of the leased

Boeing 737-300s being returned at less cost than previously expected

the 2008 ownership cost per seat remains flat compared to 2007.

The benefit of new lower cost Airbus A319s continues to reduce the

average cost of aircraft in the fleet; however, the impact this year of

the higher cost GB Airways aircraft, the reduction in interest receivable

due to the significant lowering of US dollar interest rates and the

increase in non-aircraft depreciation through investment in systems

have offset this benefit. In 2009 the GB Airways A321s are expected

to be sold, and are included in assets held for sale on the balance sheet

at 30 September 2008. In addition, four of the leased GB Airways A320s

will also be returned to lessors.

All of the 29 Boeing 737-700 leased aircraft are expected to have left

the fleet within the next three years being replaced by lower cost A320

family aircraft thereby realising more of the benefit, through lower

ownership costs, of the Airbus purchase deal.

Aircraft insurance and other costs improved in the year.

The improvement in insurance costs, achieved through better

negotiation and scale, delivered £0.10 per seat and the continued focus

on overhead costs delivered a year over year improvement of £0.50

per seat. During September 2008 easyJet completed a review of head

office activities and as part of its ongoing drive to improve cost efficiency

and to react to the changing external economic climate, made 60 people

redundant. The financial benefit of this will be seen in 2009.

12