EasyJet 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc

Annual report and accounts 2008

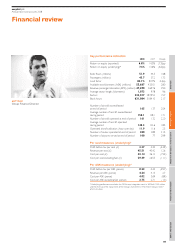

Financial review

continued

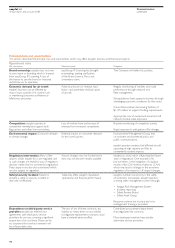

Principal risks and uncertainties

This section describes the principal risks and uncertainties which may affect easyJet’s business and financial prospects.

Operational risks

Risk description Potential impact Mitigation

Brand ownership: easyJet does not own easyGroup IP Licensing has brought The Company will defend its position.

its own name or branding which is licensed proceedings seeking clarification

from easyGroup IP Licensing. A loss of of the Brand Licence. This is not

the licence to use the brand or imposed a monetary claim.

restrictions on its operation.

Economic demand for air travel: Adverse pressure on revenue, load Regular monitoring of markets and route

easyJet’s business can be affected by factors and potentially residual values performance through network and

macro issues outside of its control such of aircraft. fleet management.

as weakening consumer confidence or

inflationary pressures. Strong balance sheet supports business through

challenging economic conditions for the sector.

Committed undrawn borrowing facilities of

$1,135 million to support funding requirements.

Appropriate mix of owned and leased aircraft

reduces residual value exposure.

Competition: easyJet operates in Loss of market share and erosion of Routine monitoring of competitor activity.

competitive marketplaces against both revenue from increased competition.

flag carriers and other low-cost airlines. Rapid response in anticipation of/to changes.

Environmental impact: Consumer attitude Potential impact on consumer demand Environmental Management Group that

to climate change. for the core business. co-ordinates environmental policy and

public communications.

easyJet operates modern, fuel-efficient aircraft

operating at high capacity and flies to

conveniently located airports.

Regulatory intervention: Many of the Airport charges may rise. Furthermore, easyJet has a key role in influencing the future

airports which easyJet fly to are regulated, and slots may not become readily available. state of regulations. One example of its

as such charges are levied by way of regulatory pro-activeness is the instigation of a judicial

decision rather than by commercial negotiation. review of the Civil Aviation Authority (CAA)

Many airports are also slot constrained which which may lead to changes in the economic

are also subject to regulation. regulation of increases to UK airport charges.

Safety/security incident: Failure to Adversely affect easyJet’s reputation, easyJet’s number one priority is the safety

prevent a safety or security incident or operational and financial performance. of customers and people. easyJet operates

deal with it effectively. a strong safety management system through:

• Fatigue Risk Management System

• Incident reporting

• Safety Review Board

• Safety Audit Group

Response systems are in place and crisis

management training is provided.

Dependence on third-party service The loss of any of these contracts, any Centralised procurement department

providers: easyJet has entered into inability to renew them or any inability that negotiates key contracts.

agreements with third-party service to negotiate replacement contracts could

providers for services covering a significant have a material adverse effect. Most developed markets have suitable

proportion of its cost base. There can be alternative service providers.

no assurance that contract renewals will

be at favourable rates.

14