EasyJet 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc

Annual report and accounts 2008

Business review

continued

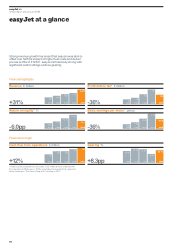

In the past year easyJet has continued to develop its business successfully

with passenger numbers increasing by 17.3% to 43.7 million and nearly

half of easyJet’s passengers now originate from outside the UK.

The average number of aircraft in the fleet in 2008 increased to

150 from 128 in 2007. easyJet has grown in the past 13 years through

capturing market share from charter and legacy carriers on primary

routes, as well as stimulating new markets to become the fourth largest

airline in European short-haul aviation, with a near 7% share measured

by seats flown. The market is highly fragmented with approximately 230

carriers in total of which the top 50 account for 90% of the capacity in

the market. European short-haul aviation has seen an average annual

increase in passenger traffic of around 4.5% over the past 20 years,

however the combination of higher fuel costs and the weakening

consumer environment is causing significant changes in the industry.

Strategy and business model

In the current environment it is companies such as easyJet with a

strong business model and balance sheet that will survive and ultimately

emerge stronger.

easyJet’s business model is centred around the following strengths:

• Low cost, financially strong and highly efficient;

• Europe’s number one air transport network;

• Strong customer proposition.

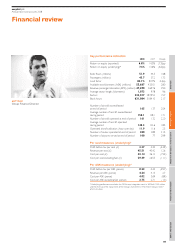

Through building on these strengths easyJet has improved its underlying

return on equity from 7.1% in 2005 to 13.6% in 2007, however in 2008

underlying return on equity has reduced to 7.6% mostly due to the

increase in fuel cost per seat of £4.08 equating to an increase in the

fuel bill of around £210 million. Encouragingly though, easyJet was able

to offset over half of this increase through revenue and cost initiatives

demonstrating the strength and resilience of the business model and

its appeal to customers. easyJet remains committed to achieving a

15% return on equity although the current difficult economic climate

and uncertainty over the future may make this a challenging target to

achieve over the medium term. In the current climate, the business will

take a prudent approach to cash conservation in order to emerge as

the winner in European short-haul aviation when the economic

conditions have improved.

Financial strength

easyJet is financially strong with £863 million of cash and money market

deposits on the balance sheet (excluding restricted cash of £66 million)

and low gearing at 29% as at the balance sheet date of 30 September

2008. In addition, financing at favourable rates (less than 100 basis points

above LIBOR) is already in place with a number of counterparties to

fund easyJet’s committed aircraft deliveries over the next 18 months.

In the next 18 months the capital expenditure outflow in respect of

aircraft deliveries amounts to $1.2 billion. This will be funded from the

current undrawn facilities of $1.1 billion. Beyond 18 months easyJet will

seek additional aircraft financing.

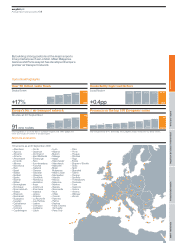

Network development

A key differentiator for easyJet is its network. Through its focus on

convenient airports and by building strong positions at the major

airports in key markets such as London, Milan, Geneva and Paris

easyJet has developed Europe’s premier air transport network when

measured both by consumer reach and presence on the top 100 routes.

The network ensures easyJet has a broad appeal across geographies

and customer types and thus a balanced revenue base.

06