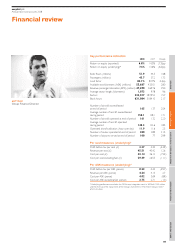

EasyJet 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Outlook

The economic outlook remains very difficult and highly uncertain.

Despite this easyJet’s forward bookings for the first quarter of the

financial year are currently slightly ahead of prior year.

In order to limit margin dilution over the winter from the impact of

higher fuel costs easyJet has withdrawn lower yielding flights, and as

a result aircraft utilisation this winter will fall to an average 9 hours

a day from 11.6 hours in the previous winter.

easyJet’s capacity for the winter, measured in seats flown, will be broadly

flat with last year but we expect competitor capacity on easyJet routes to

fall by 7% in the same period. There is also evidence of a “flight to value”

for both business and leisure passengers which means that easyJet’s total

revenue per seat flown for the first half of the year is expected to be

slightly ahead of last year on a constant currency basis.

Non fuel costs per seat for the winter are expected to increase mid to

high single digits at constant currency in the first half. The impact of higher

fuel costs will be felt most sharply in the first half of 2009 and thus

pre tax margins will decline in the first half compared to the prior year.

The outlook for summer 2009 is uncertain due to the difficult macro-

economic environment and yields will depend on the extent of the

fall in consumer expenditure in Europe and the level of competitor

capacity reduction in the market. We expect to see further downsizing

and consolidation of many weak competitors.

In the second half, easyJet expects to make progress on costs through

negotiations with suppliers, reductions in overheads and improved crew

efficiency which means that in total non fuel unit costs per seat for the

full year are expected to increase by low single digits before the impact

of currency. For the full year at current fuel and exchange rates easyJet

expects to be profitable.

To reduce our short-term earnings volatility easyJet has put the following

fuel and currency hedging positions in place:

• 66% fuel requirement hedged at $1,146 per metric tonne;

• 66% of anticipated 2009 US$ requirement is hedged at $1.96/£,

an additional 5% of requirement are hedged with collars with

average floors of $1.73/£;

• 56% of 2009 capital expenditure relating to aircraft deliveries

hedged at $1.97/£;

• 81% of anticipated 2009 euro surplus hedged at €1.24/£.

easyJet is financially strong and the Board, despite caution about

the current consumer environment, remains confident in easyJet’s

future prospects.

Fleet

easyJet benefits from its young fuel efficient fleet and the low ownership

costs negotiated as part of the ongoing relationship with Airbus. In the

year, easyJet took delivery of 13 A319 aircraft under the terms of the easyJet

agreement and acquired 15 A320 family aircraft through the GB Airways

acquisition. Subsequently, easyJet has taken delivery of three further

A321 GB Airways configured aircraft with two returned to lessors during

the period. In addition, easyJet reached an agreement with Airbus to

convert 25 Airbus A319 orders to those for A320 aircraft with 180 seats.

These aircraft will be deployed on some of the longer sector routes

acquired with GB Airways, on some of the traditional easyJet routes

to pick up extra revenue at peak times and at slot constrained airports.

easyJet has 45 aircraft in its Boeing and GB Airways sub-fleet and the

intention is to exit all of these aircraft from the fleet by 2011

to realise ownership cost savings of £40 million per annum.

The sale of the seven A321 aircraft from the GB Airways sub-fleet and

five A319 aircraft continues to progress albeit in the current market

potential purchasers are finding financing more difficult to arrange.

In light of the current economic environment, the Board will adopt

a cautious approach to growth and will focus on maintaining a strong

balance sheet. The Board will continue to monitor capital expenditure

plans and fleet planning decisions quarterly. The Airbus contract allows

easyJet, with 18 months notice, to defer up to half of the future deliveries

for up to two years. In the light of the slow sale of surplus aircraft and

the likelihood of a prolonged recession the Board has decided in

September 2008 to defer four aircraft scheduled for delivery in 2010

and will keep the rest of the committed orders under review given the

current uncertain economic climate.

Future

deliveries

(including Un-

Under Under Changes exercised exercised

operating finance in options) options

Owned lease lease Total year (notes 1,3) (note 2)

easyJet

A320

family 68 46 6 120 13 107 88

Boeing

737-700 – 29 – 29 (1) – –

GB Airways

A320 family 7 9 – 16 16 2 –

75 84 6 165 28 109 88

Note 1: easyJet has the ability to defer 50% of its committed orders with Airbus

for up to two years by giving 18 months’ notice.

Note 2: Options may be taken as any A320 family aircraft and are valid until 2015.

Note 3: The 109 future deliveries are anticipated to be delivered over the next four financial

years, 36 in 2009, 30 in 2010, 24 in 2011 and 19 in 2012.

The total fleet plan over the period to 30 September 2011 is as follows:

GB

easyJet Boeing Airways

A320 737- A320 Total

family 700 family aircraft

At 30 September 2007 107 30 – 137

At 30 September 2008 120 29 16 165

At 30 September 2009 150 17 5 172*

At 30 September 2010 179 8 – 187

At 30 September 2011 197 – – 197

*Assumes assets held for sale are sold in financial year 2009.

easyJet plc

Annual report and accounts 2008

Business review

continued

08