EasyJet 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

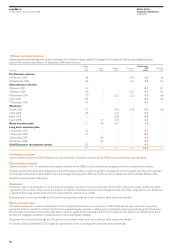

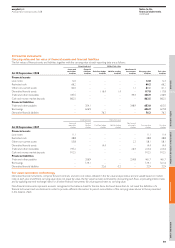

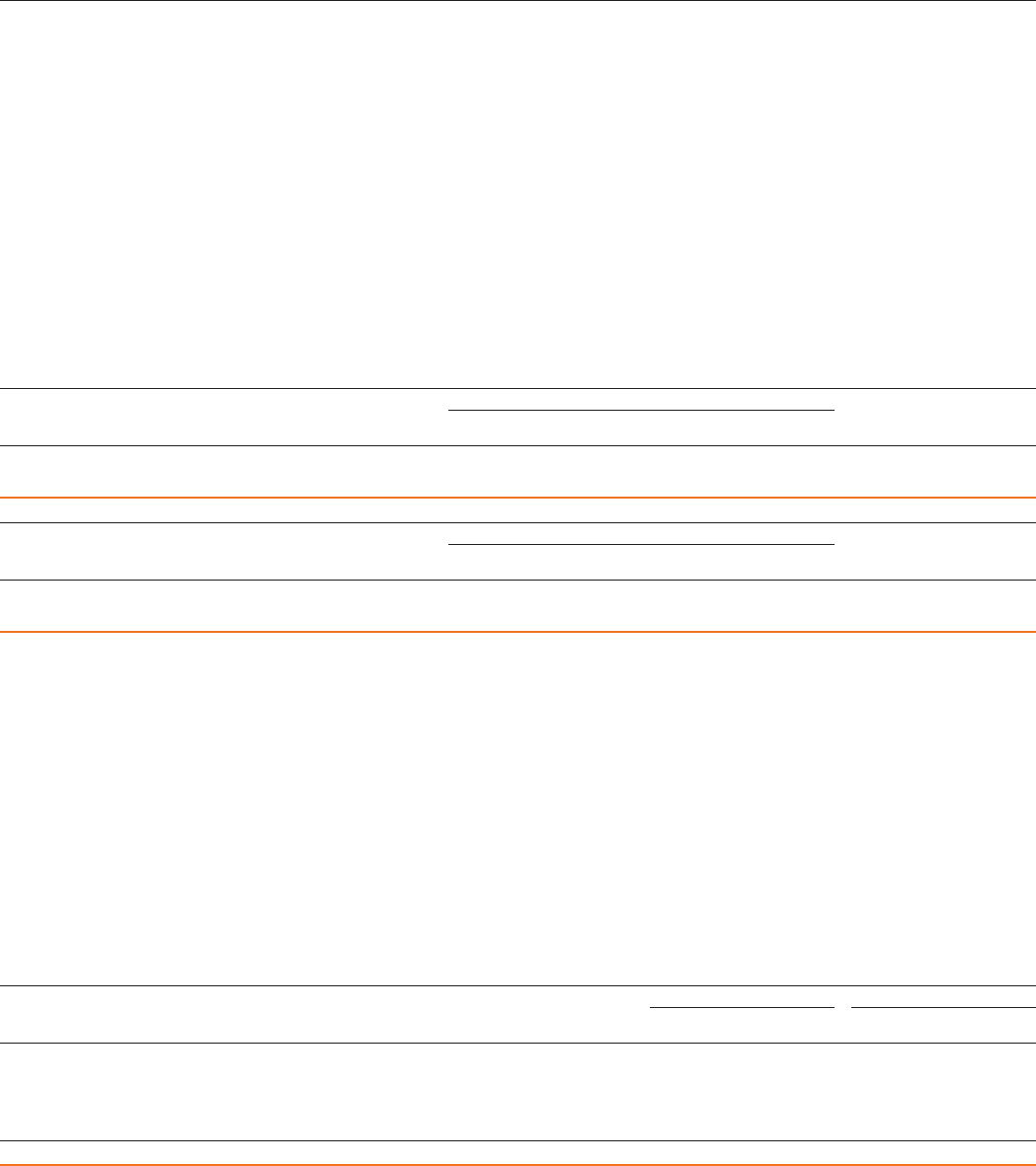

24 Financial risk and capital management (continued)

Market risk sensitivity analysis (continued)

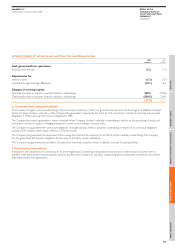

The interest rate analysis assumes a 1% change in interest rates over the reporting year applied to end of year financial instruments.

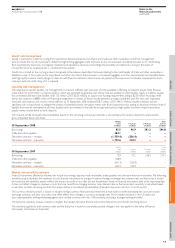

Currency rates Interest rates Fuel price

US dollar +10% US dollar –10% Euro +10% Euro –10% 1% increase 10% increase

At 30 September 2008 £million £million £million £million £million £million

Income statement impact: gain/(loss) (3.6) 2.9 2.3 (1.9) 2.4 –

Impact on shareholders’ funds: increase/(decrease) 86.8 (70.5) (27.1) 22.1 – 27.6

Currency rates Interest rates Fuel price

US dollar +10% US dollar –10% Euro +10% Euro –10% 1% increase 10% increase

At 30 September 2007 £million £million £million £million £million £million

Income statement impact: gain/(loss) 6.3 (5.2) 2.4 (2.4) 3.4 –

Impact on shareholders’ funds: increase/(decrease) 62.9 (54.0) – – – 9.4

The impact of a 1% increase in interest rates and a 10% increase in the fuel price is disclosed above. A corresponding decrease in each of the rates results

in an equal and opposite impact on the income statement and shareholders’ funds in both reporting periods.

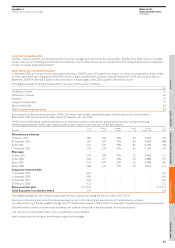

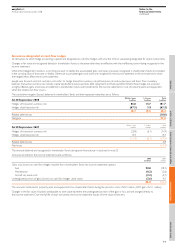

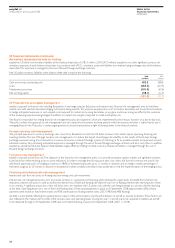

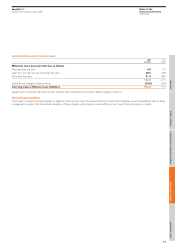

Capital management

The objective of capital management is to ensure that easyJet is able to continue as a going concern whilst delivering shareholder expectations of a strong

capital base as well as returning benefits for other stakeholders and optimising the cost of capital.

easyJet manages its capital structure in response to changes in both economic conditions and strategic objectives. The cash and net debt position together

with the maturity profile of existing debt is monitored to ensure the continuity of funding. During the year, a major aircraft financing programme was put in

place though a number of bi-lateral facilities totalling $937 million.

The principal measure used by easyJet to manage capital risk is the gearing ratio of debt (debt plus seven times aircraft operating lease payments less cash,

including money market deposits and restricted cash) to shareholders’ funds. Gearing increased in the year from 20.4% to 28.8%. Cash was used to purchase

GB Airways and the acquisition resulted in taking on additional borrowings related to owned aircraft and additional lease costs. A strengthening US dollar in

the year also contributed to increased indebtedness and lease costs.

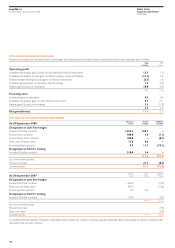

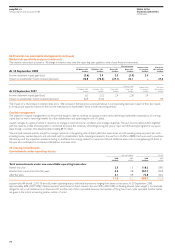

25 Leasing commitments

Commitments under operating leases

Land and buildings Aircraft

2008 2007 2008 2007

£million £million £million £million

Total commitments under non-cancellable operating leases due:

Within one year 2.5 1.5 118.2 109.3

Greater than one and less than five years 4.4 3.8 267.7 305.9

After five years 4.1 4.9 72.8 100.7

11.0 10.2 458.7 515.9

easyJet holds 84 aircraft (2007: 76 aircraft) under operating leases, with initial lease terms ranging from seven to ten years. At 30 September 2008,

approximately 60% (2007: 54%) of lease payments were based on fixed interest rates and 40% (2007: 46%) on floating interest rates. easyJet is contractually

obliged to carry out maintenance on these aircraft, and the cost of this is provided based on the number of flying hours and cycles operated. Further details

are given in the critical accounting policies section of note 1.

easyJet plc

Annual report and accounts 2008

Notes to the

financial statements

continued

74