EasyJet 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

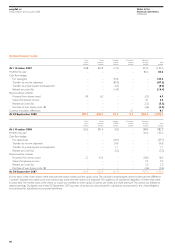

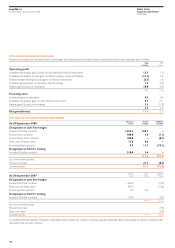

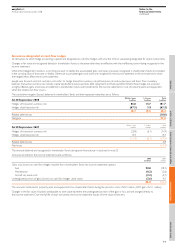

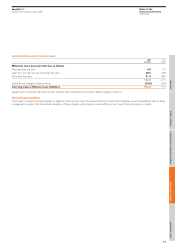

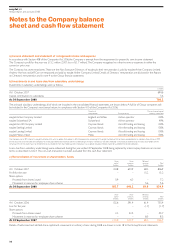

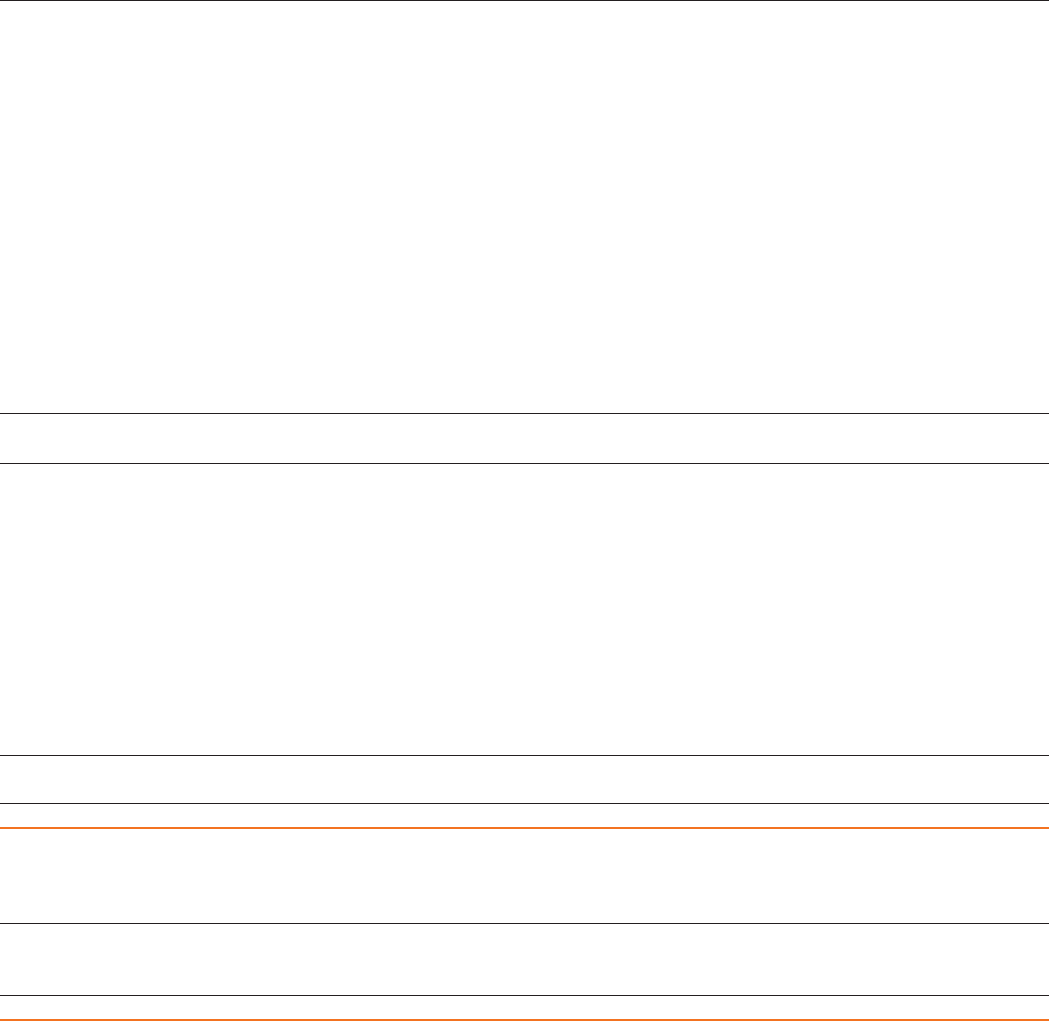

22 Acquisition of GB Airways

On 25 October 2007, easyJet announced that, subject to regulatory clearance, it had agreed to acquire 100% of the share capital of and voting rights in

GB Airways. The acquisition has been unconditionally cleared and completion occurred on 31 January 2008. The assets and liabilities acquired and their

provisional fair values are as follows:

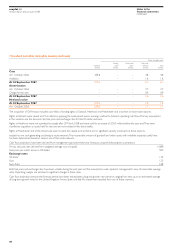

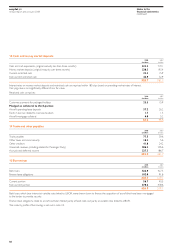

Carrying Provisional

amount fair value

£million £million

Landing rights – 72.4

Other intangible assets – 2.5

Property, plant and equipment 85.0 83.4

Other non-current assets 6.2 2.7

Assets held for sale – 30.0

Current assets excluding cash and cash equivalents 59.7 55.6

Cash and cash equivalents 15.4 15.1

Current liabilities, excluding borrowings and overdrafts (85.5) (91.6)

Overdrafts (3.7) (3.7)

Borrowings (59.1) (59.1)

Deferred tax liabilities – (22.0)

Maintenance provisions (3.3) (6.1)

Net assets acquired 14.7 79.2

Goodwill – 50.2

14.7 129.4

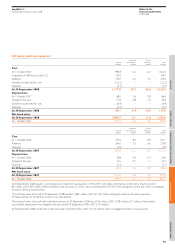

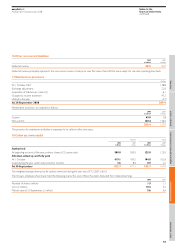

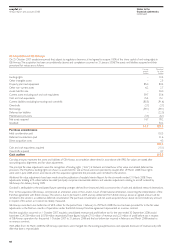

Purchase consideration

Initial consideration paid 103.5

Deferred consideration paid 21.6

Direct acquisition costs 4.3

129.4

Cash and cash equivalents acquired (15.1)

Overdrafts acquired 3.7

Cash outflow 118.0

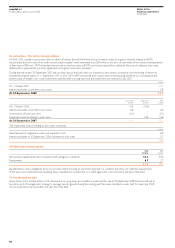

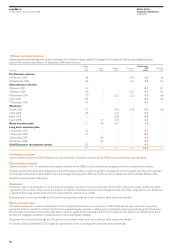

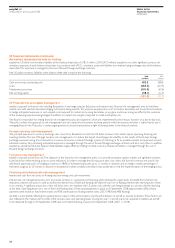

Carrying amounts represent the assets and liabilities of GB Airways at completion determined in accordance with IFRS. Fair values are stated after

accounting policy alignments and fair value adjustments.

The principal fair value adjustments were the recognition of landing rights (“slots”) at Gatwick and Heathrow at fair value, and related deferred tax

provisions. The Heathrow landing rights are shown as assets held for sale as these were not operated by easyJet after 29 March 2008. These rights

were sold in June 2008, and, in accordance with the acquisition agreement, the proceeds were remitted to the vendors.

Additional fair value adjustments have been made since the publication of easyJet’s Interim Report for the six months ended 31 March 2008. These

adjustments, totalling £7.5 million before tax relief, principally comprise irrecoverable debtors and valuation adjustments relating to aircraft ordered by

GB Airways for delivery during 2009.

Goodwill is attributable to the anticipated future operating synergies derived from improved yield, cost economies of scale and additional network destinations.

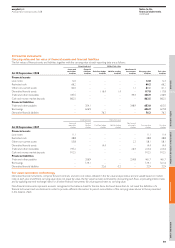

Prior to the acquisition, GB Airways commenced an arbitration action in the London Court of International Arbitration, concerning the interpretation of the

franchise agreement with British Airways. This action is due to be heard in 2009, and any settlement from British Airways above an agreed amount will be

remitted to the vendors as additional deferred consideration. The purchase consideration and net assets acquired shown above do not include any amount

in respect of this action as it cannot be reliably measured.

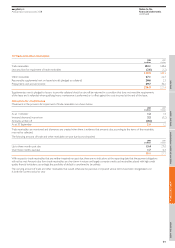

GB Airways recorded a loss before tax of £4.9 million for the period from 1 February to 29 March 2008; this loss has been provided for in the fair value

adjustments as the final two months of operations under the British Airways franchise agreement represented an onerous contract.

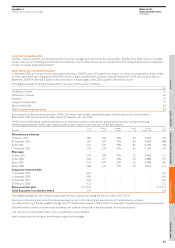

Had the acquisition occurred on 1 October 2007, easyJet’s consolidated revenue and profit before tax for the year ended 30 September 2008 would

have been £2,433.8 million and £107.8 million respectively. These figures include £71.0 million of revenue and £2.5 million of profit before tax in respect

of GB Airways operations for the period 1 October 2007 to 31 January 2008 and the loss before tax incurred in February and March 2008 treated as

an onerous contract.

With effect from 30 March 2008 the GB Airways operations were merged into the existing easyJet business, and separate disclosure of revenue and profit

after that date is impracticable.

easyJet plc

Annual report and accounts 2008

Notes to the

financial statements

continued

68